U.S. Dollar's Reserve Status: The Impact of Sanctions on Russia

- Written by: James Skinner

- CBR asset freeze prompts questions over USD’s future

- Doubts about status misunderstand sanctions package

- Given UK, Europe & Japan also participate in sanctions

- Yet it may accelerate efforts to subvert current system

Image © Adobe Images

One of the most aggressive sanctions packages in modern history has this week prompted questions about the sustainability of the U.S. Dollar’s reserve status, although these questions misunderstand the package itself and overlook that such sanctions could be most likely to accelerate sovereign state efforts to subvert the entire present day monetary system.

G7 countries and the European Union announced on Monday that they would demand the eviction of many Russian commercial banks from The Society for Worldwide Interbank Financial Telecommunication (SWIFT) international payment system, and seek to freeze as far as possible the official reserve assets held by the Central Bank of Russia (CBR).

“This action is taken in concert with the US and the European Union, to prevent the CBR from deploying its foreign reserves in ways that undermine the impact of sanctions imposed by us and our allies, and to undercut its ability to engage in foreign exchange transactions to support the Russian rouble,” HM Treasury said in a joint announcement with the Governor of the Bank of England.

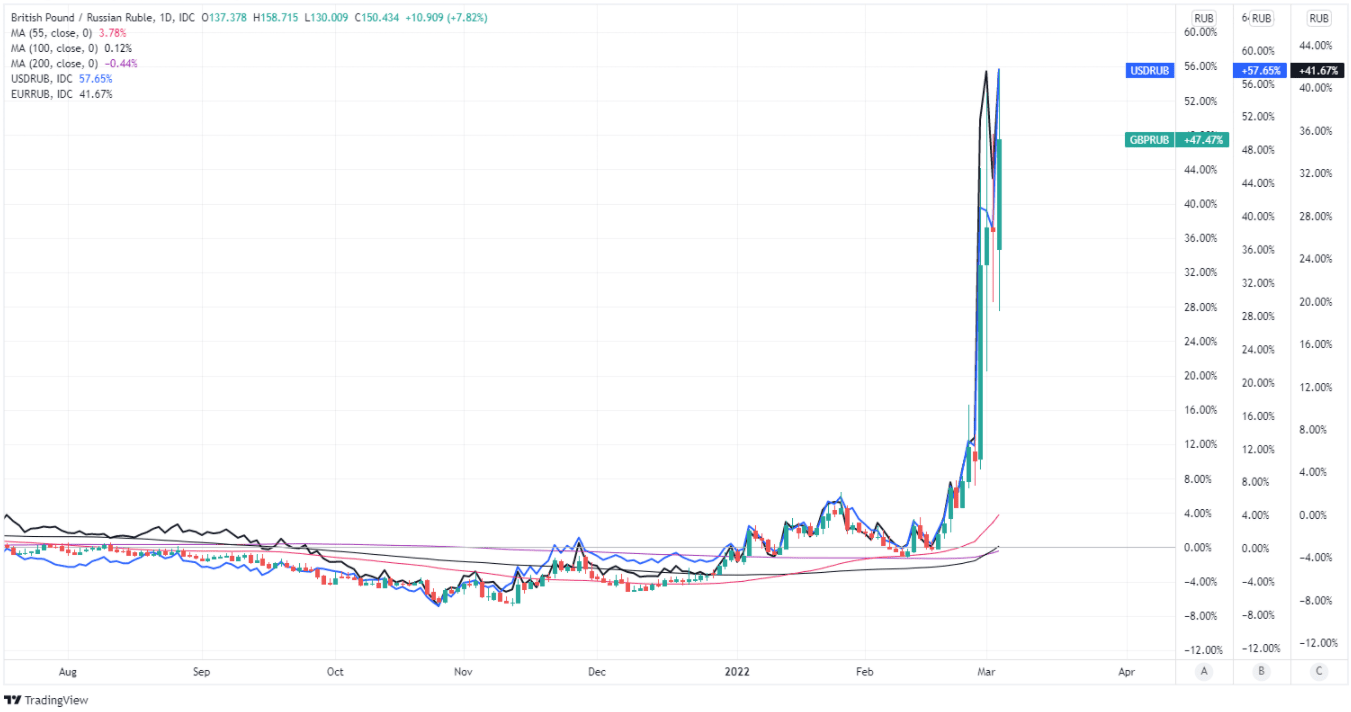

Those were just two of the sanctions announced, which have thus far exacerbated a collapse of the Rouble in an outcome that will raise inflation and promote financial distress across the Russian economy; all the while limiting the Russian state institutions’ ability to mitigate the damage.

Above: GBP/RUB, USD/RUB and EUR/RUB shown at daily intervals. Click image for a closer inspection.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

However, all sanctions have side effects and in this instance they have led some corporations to ask what will become of the Dollar’s status as the dominant global reserve currency, which is an integral underpinning of its value and confers upon Washington a range of political and financial benefits.

“The widespread use of the Dollar in international markets, for instance, allows the United States to affect foreign policy goals through financial market channels (“hard power”) and may also confer certain reputational benefits (“soft power”). However, overuse of these powers could compel other actors to try to replace Dollar transactions, as Russia already did to some extent,” explains Michael Cahill, a G10 FX strategist at Goldman Sachs.

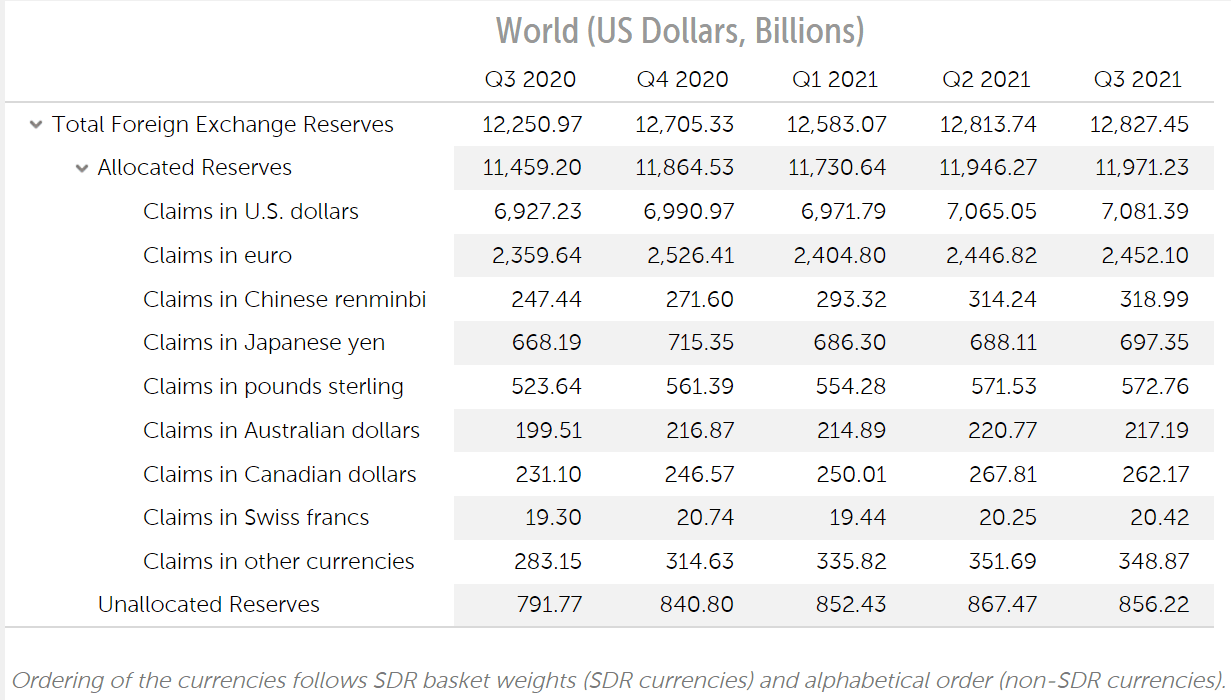

“In this regard, the coordination across the G-7 is particularly important. Already, global reserve managers had relatively limited options for shifting reserves out of Dollars given limited supply of strong investment grade assets in the Euro area and limited capital market depth elsewhere. This is especially true for the large reserve managers, like China,” Cahill and colleagues said in a Monday questions and answers session with clients.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Countries build and retain foreign exchange reserves by selling their own currencies, and one of the chief reasons they do this is to purchase and hold an insurance policy that would typically be used to protect their own exchange rates from crisis-induced declines whenever and wherever they occur, as such declines can also do significant damage to economies.

Governments have generally done this on the assumption that reserves either could not or would not be taken from them, or at least that’s been the case so far, while the latest sanctions have deprived the Russian state of these resources at a time when it needs them most and so may in turn lead other countries to worry the same could happen to them; hence questions from companies about what may become of the Dollar.

“One of the more pervasive ‘hot takes’ out there is that the overuse of sanctions will cause the US dollar to be unseated as the global reserve currency. Guys, it’s not that simple. Why? Because there is NO CREDIBLE ALTERNATIVE to the US dollar as a reserve currency right now, and there won’t be one for a long time,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Above: Currency composition of official foreign exchange reserves. Source: International Monetary Fund

“For those that like analogies – if the world of [reserve] currencies were search engines, the US dollar would be Google,” Rai said on Thursday.

Europe’s single currency, China’s Renminbi and the Japanese Yen have at various times been mooted as possible substitutes for the U.S. Dollar in its role as the lynchpin of the global financial system.

But CIBC’s Rai and Goldman Sachs’ Cahill each set out reasons this week for why neither would be adequate as a replacement.

“Overall, while these actions could ultimately compel a change in reserve accumulation behavior, and support additional inflows to CNY, there is not really a viable alternative available at the moment for large reserve holders, especially when Europe is also participating in the sanctions,” Goldman Sachs’ Cahill said on Monday.

Both Europe and Japan are also part of the concert imposing the sanctions, which means concerns soley about the U.S. Dollar’s position as a reserve currency could reflect a misunderstanding of the package announced and partially illustrates why if such sanctions are to be truly undermined in the future, it wouldn’t be without the present day financial system and currency market having been subverted in its entirety first.