Euro / Dollar Headwinds Grow with CEE Losses but ECB Poses Upside Risk

- Written by: James Skinner

- EUR/USD closes in on major support near 1.1002

- Amid steepest losses since 2021’s Fed policy shift

- Conflict, oil price, ECB outlook weigh on EUR/USD

- But CEE FX weakness also a significant headwind

- After steep losses elicit central bank interventions

Image © Adobe Images

The Euro to Dollar rate slipped further toward a notable support level on the charts in the midweek session as other regional currencies sustained further crushing losses that are likely exacerbating EUR/USD’s declines, although next Thursday's European Central Bank (ECB) decision could yet put a floor beneath the single currency.

Europe’s single currency slipped beneath 1.11 and appeared on course for 1.1002 and the 78.6% Fibonacci retracement of its 2020 recovery trend on Wednesday even after Eurostat figures showed Eurozone inflation rates jumping further in February.

Eurozone inflation rose from 5.1% to 5.8% last month, taking it above even the 5.4% seen in the UK, while the more important core measure of inflation increased from 2.3% to 2.7% in another sign that price pressures continued to build early in the new year.

But with the market uncertain about whether it will draw a response from the ECB, the data did little to help the Euro, which remained under almost relentless pressure alongside Central and Eastern European (CEE) currencies.

“We prefer an explanation of CE3 currencies as part of a correlated risk-off move affecting the euro complex. Poland's central bank officially announced that it had intervened in the FX market,” says Tatha Ghose, an FX and emerging market analyst at Commerzbank.

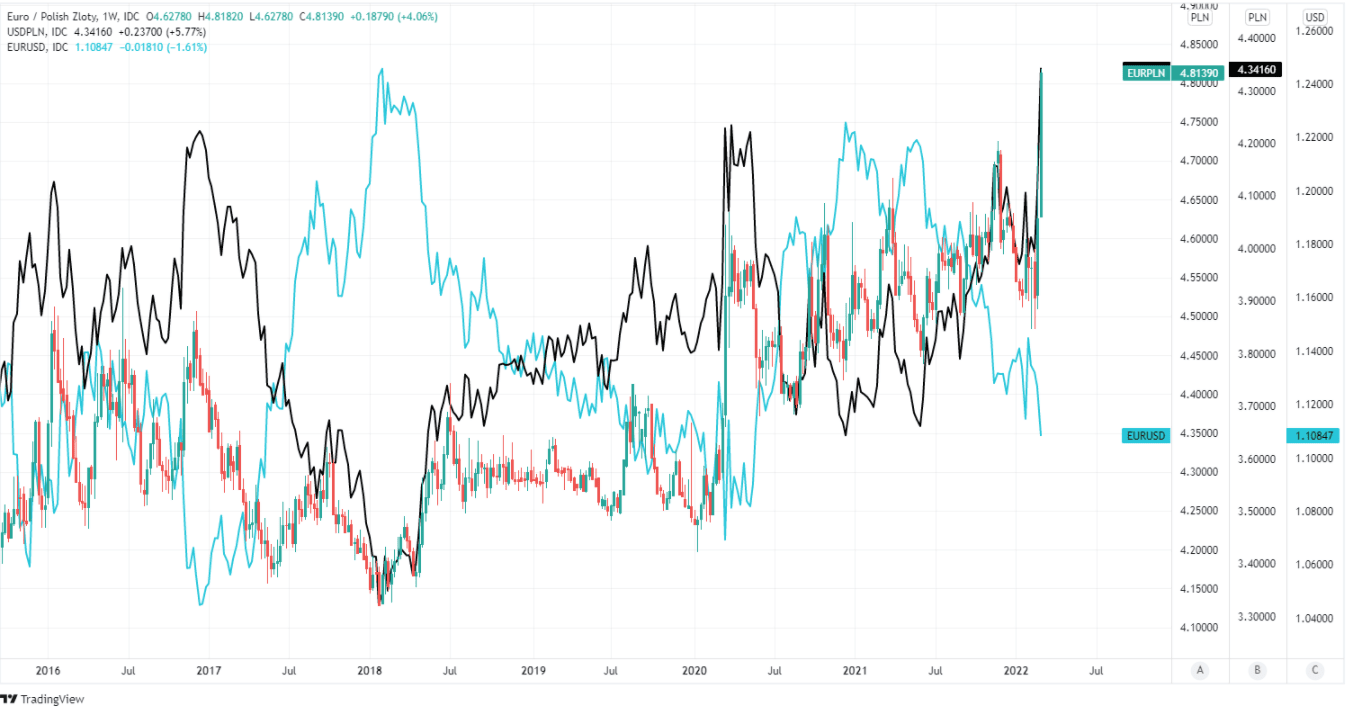

Above: Euro to Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery trend and shown alongside PLN/USD.

- EUR/USD reference rates at publication:

Spot: 1.1097 - High street bank rates (indicative band): 1.0709-1.0786

- Payment specialist rates (indicative band): 1.1000-1.1045

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

Poland’s Zloty fell more than two percent during European trading on Wednesday, taking its one week loss to almost seven percent as European currencies continued to be penalized for their close proximity to the conflict in Ukraine; and most notably those in the CEE region.

“The depreciation of the zloty observed in recent days is not consistent with the foundations of the Polish economy, nor with the direction of the NBP's monetary policy. The NBP has an adequate level of foreign exchange reserves,” the National Bank of Poland (NBP) said on Tuesday.

“The NBP is ready to react at any time to excessive fluctuations in the zloty exchange rate, which could disrupt the smooth functioning of the currency and financial markets or adversely affect the financial stability or the effectiveness of the monetary policy implemented by the NBP,” it added.

The potential, if not likely rub for the Euro is that Tuesday’s intervention may have led the NBP to sell Euros in exchange for Dollars and then Dollars in exchange for Zloty as this would have been the most efficient way for it to combat the inflationary impact of declines in Polish exchange rates.

Above: EUR/USD and PLN/USD (black), HUF/USD (green) and CZK/USD (yellow).

Poland’s central bank holds both Euros and Dollars within its roughly $161bn foreign exchange reserve basket, although the bulk of goods imported into Poland come from Euro denominated economies and so it’s likely the case that the NBP sought to push the EUR/PLN exchange rate lower on Tuesday.

“Looking at yesterday's intraday range, NBP might have defended the 4.80 level,” Commerzbank’s Ghose says.

These transactions would, however, be merely an incremental headwind out of many for the European single currency, which has also been burdened by a range of side effects from the conflict in Ukraine including surging oil prices and dented ECB confidence in the Eurozone economic outlook.

“The economy is experiencing a series of imported supply shocks that are pushing up inflation and depressing demand,” says Fabio Panetta, a member of the ECB’s executive board, in a Tuesday online seminar organised by the Robert Schuman Centre for Advanced Studies and Florence School of Banking and Finance at the European University Institute.

Above: EUR/PLN shown at weekly intervals alongside USD/PLN and EUR/USD.

“The dramatic conflict in Ukraine is now weighing negatively on both supply and demand conditions, making uncertainty more acute and exacerbating risks to the medium-term inflation outlook on both sides. In this environment, it would be unwise to pre-commit on future policy steps until the fallout from the current crisis becomes clearer,” Panetta also said in other remarks.

Previous to last Thursday’s Russian military incursion into Ukraine the Euro-Dollar outlook had turned for the better after ECB President Christine Lagarde said Eurozone inflation risks are rising, before declining to reiterate an earlier opinion that ECB interest rates would be unlikely to rise this year.

That led financial markets to become more confident in betting that an end of the negative interest rate era could be near, although Ukraine conflict and its potential to upend economic recoveries across Europe has thrown a fresh curveball at ECB policymakers.

Financial markets have since marked down their expectations for Eurozone interest rates this year, although it’s far from assured that the ECB would be willing to abandon its December plan to steadily phase out the bulk of its regular quantitative easing purchases or be blown off any other course.

This could make wagering against the Euro-Dollar rate from Wednesday’s levels a high risk prospect ahead of next Thursday’s ECB policy meeting.