Pound / Dollar Rate Finds Feet but Risks Remain, Some Analysts Say

- Written by: James Skinner

- GBP/USD looks to regain 1.36 after reversing losses

- But lingering Russia-Ukraine risks could limit upside

- BoE testimonies up next, with implications uncertain

Image © Adobe Images

The Pound to Dollar exchange rate recovered sharply from earlier lows to trade back near the 1.36 handle early in the midweek session but some analysts are sceptical of the rally in light of lingering risks associated with developments in Ukraine.

Pound Sterling had traded as low as 1.3539 against the Dollar on Tuesday as financial markets digested Russia’s official recognition of two breakaway Ukrainian provinces as independent republics and the possible implications of the international response.

But GBP/USD rallied strongly from the North American open and was attempting to regain the 1.36 handle at the European open on Wednesday, although some analysts say there’s likely little, if any, scope for it to rise further in the short-term.

"The British pound has reclaimed $1.36 against the US dollar and €1.20 against the euro," says analyst George Vessey of Western Union Business Solutions, "both levels of resistance that have proven tough to hold above recently."

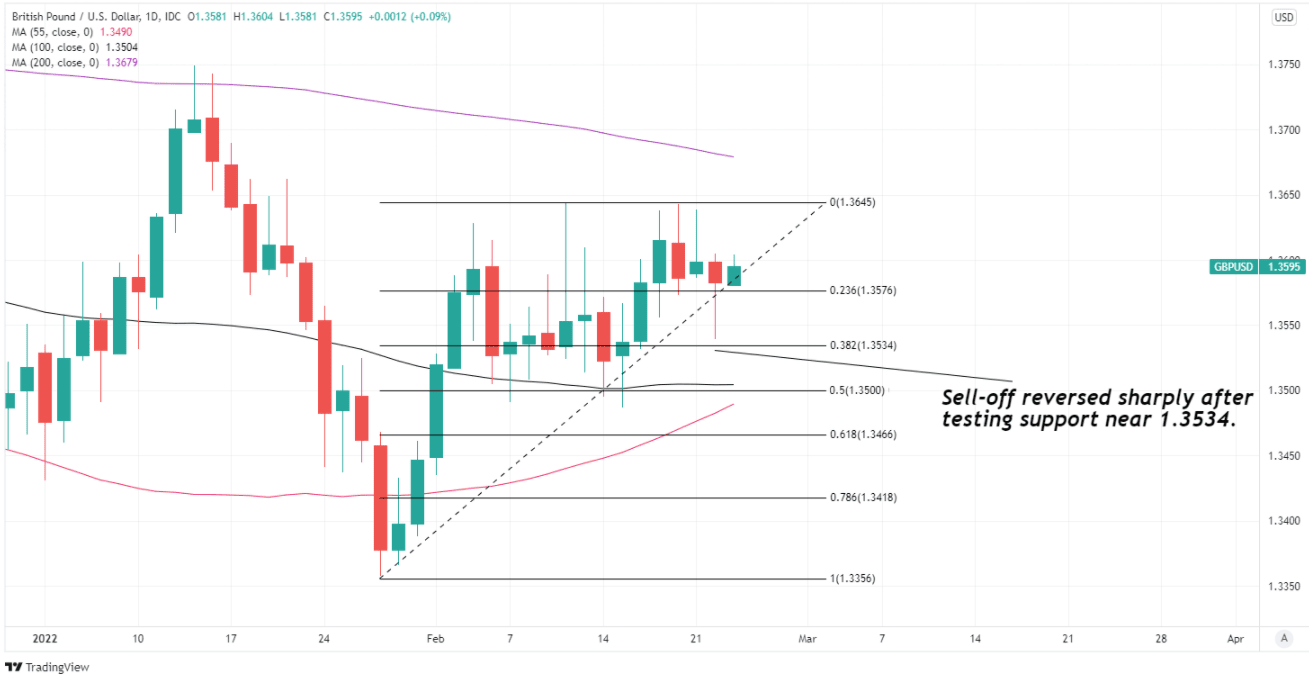

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of late January rally indicating likely areas of technical support for Sterling. Selected moving-averages denote possible technical supports and resistances for GBP/USD.

- GBP/USD reference rates at publication:

Spot: 1.3592 - High street bank rates (indicative band): 1.3216-1.3311

- Payment specialist rates (indicative band): 1.3470-1.3524

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

"With GBPUSD now closing NY trade between 1.3550-70s support and 1.3590-1.3610s resistance, we think the market will adopt a more neutral tone," said Erik Bregar, author of the FX Beat newsletter.

Moscow’s formal recognition of the breakaway provinces and authorisation of military deployments within their borders unnerved markets and drew a volley of sanctions from the UK, European Union members and the United States.

Sterling and other major reserve currencies were sold through much of the prior session as international markets stabilised in the wake of losses sustained following Monday evening’s announcements from Moscow.

“Western sanctions were, with the surprising exception of Germany pausing NordStream 2, milquetoast. They will see Russian oligarchs move yachts around, and cash, but they will not stop a Russian war machine rolling. They don’t hit SWIFT, or key Russian banks, or energy, grains, fertilizer, or metals – so most Russian exports. And they hit very few things on the import side,” says Michael Every, a global macro strategist at Rabobank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

European Union countries were hard on the heels of London with a sanctions response while Washington followed overnight, although the measures announced by each so far are on the mild side of what could yet be seen.

There was no shortage of possible pretexts for a hostile stance toward Ukraine in President Vladimir Putin’s Monday speech, which included an allegation that the country could be contemplating a nuclear rearmament.

“GBP/USD reversed earlier losses and is trading near 1.3585. The risk remains that GBP falls towards its 1.3419 support level if Russia‑Ukraine tensions escalate,” says Kim Mundy, a senior economist and currency strategist at Commonwealth Bank of Australia.

The CBA team has been sceptical of the Pound-Dollar rebound but said late on Tuesday that Sterling could potentially find itself better supported following parliamentary testimonies from Bank of England (BoE) Governor Andrew Bailey and Monetary Policy Committee colleagues at 09:30.

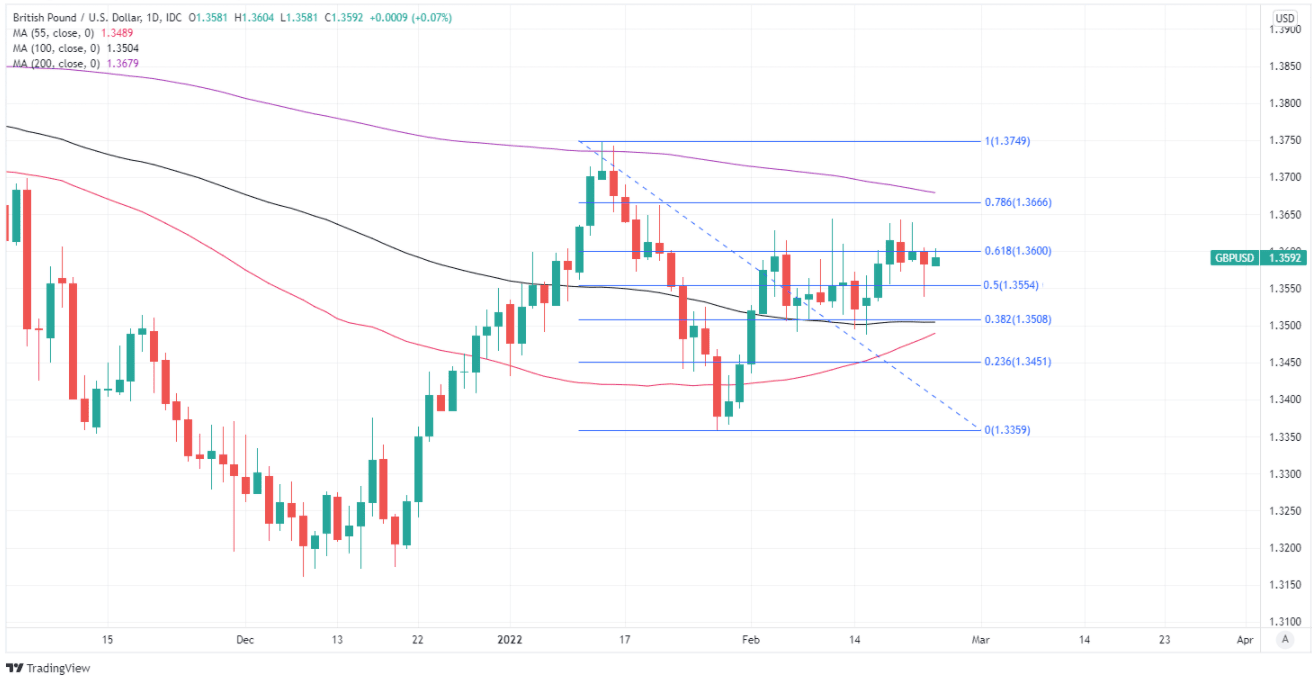

Above: Pound to Dollar rate shown at daily intervals with Fibonacci retracements of early January fall indicating likely areas of technical resistance for Sterling. Selected moving-averages denote possible technical supports and resistances for GBP/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

A large minority on the nine seat Monetary Policy Committee voted to lift the Bank Rate by 0.50% to 0.75% at the February meeting and forecasts contained in the BoE’s Monetary Policy Report indicated that the benchmark could rise as far as 1.5% over the next year or so in response to the sharp and ongoing increase in inflation.

“Interest rate markets had nearly fully priced a 50bp hike after the BoE’s February meeting (when 4/5 policy members voted to raise the bank rate by 50bp). Since then, market pricing for a 50bp hike has eased. Hawkish comments can reignite expectations for a larger move and support GBP,” Mundy and the CBA team said on Tuesday.

Inflation rose from 5.4% to 5.5% in January and although this was the smallest increase since April 2021, the ongoing developments in Ukraine have lifted international energy prices and could stoke price pressures further in the weeks and months ahead.

Much potentially depends for the Pound-Dollar rate this Wednesday on any remarks from BoE policymakers about the way in which a further energy price shock would be likely to influence the BoE’s stance of monetary policy.

Sterling would be most responsive to any indications of whether such developments would strengthen the case for higher interest rates or undermine it in light of the risks it could pose to the economy.