Dollar Outlook Bolstered by U.S. Inflation Escalation

- Written by: James Skinner

“The inflation data will be even worse by the time asset purchases end in March.”

Image © Adobe Images.

The Dollar outlook was bolstered on Friday when official figures confirmed U.S. inflation rose to a new multi-decade high last month, which likely keeps the Federal Reserve (Fed) on course to accelerate its monetary policy normalisation next week and thereafter.

Dollar exchange rates wavered briefly ahead of the weekend as the market Bureau of Labor Statistics figures revealed that a 0.8% November increase in inflation lifted the annualised pace of U.S. price growth to 6.8% last month.

Meanwhile, inflation rose from 4.6% to 4.9% for November, its highest level since the year ending in June 1991, even after changes in volatile food and energy costs were excluded from the numbers following a 0.5% November increase in the core inflation rate.

Gasoline, shelter, food, used cars and trucks, and new vehicles were among the largest contributors to November’s price increases, all goods for which supplies have recently been interrupted by coronavirus containment efforts, leading prices to rise sharply over the last year.

“While December will see some relief from lower energy prices on omicron, causing total inflation to decelerate, there is scope for supply chain issues to prop up core goods prices again as omicron spreads globally and disrupts production,” says Katherine Judge, an economist at CIBC Capital Markets.

“With inflation at a lofty pace, the Fed is set to accelerate its QE tapering timeline at the December meeting, to finish in the early spring, and to allow for a rate hike in Q2 2022, when the winter wave of Covid could be behind us,” Judge wrote in a note to clients following Friday’s release.

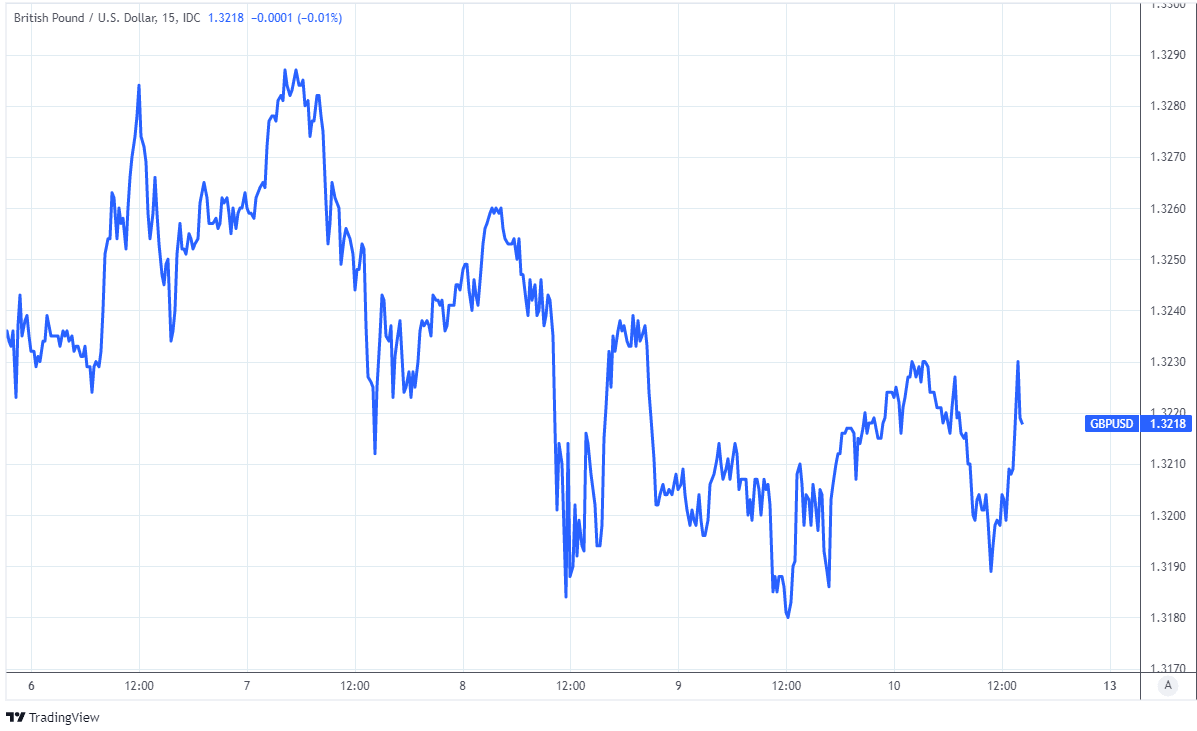

Above: Pound-Dollar rate shown at 15-minute intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Inflation has risen sharply across the globe this year due to goods and labour shortages as well as other factors, although price increases have been strongest in the U.S. where publicly funded financial support for households was much larger than elsewhere at the height of the pandemic.

November was the second month running in which the main consumer price index has risen by more than six percent, which is far above the Fed’s 2% average inflation target and likely to keep the bank on track to accelerate the normalisation of its monetary policy settings.

The strength and persistence of recent increases in inflation has led Fed policymakers to rethink earlier expectations that price pressures would be quick to dissipate of their own accord and has all but sealed the deal for a decision next week to speed up the tapering of the bank’s bond buying programme.

“While several FOMC participants reiterated their belief that the recent rise in inflation will prove temporary, some participants—including Chair Powell— signaled that they have become less certain about the timeline for normalization,” says Jan Hatzius, chief economist at Goldman Sachs.

“Most participants stressed that there are upside risks to inflation outcomes relative to their baseline expectations, and a few participants noted that the Omicron variant could result in further inflationary pressure,” Hatzius and colleagues said in summary of recent remarks by Fed officials this week.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Ten out of the twelve voting members of the Federal Open Market Committee have indicated publicly over the course of the last month that they could support a decision to taper off the Fed’s monthly bond purchases at a faster pace than that agreed upon in November.

Many economists now expect the Fed to end its bond purchases in March as opposed to June 2022, which would create room for the bank to begin lifting its main interest rate as soon as the second quarter of next year if inflation pressures remain sufficiently elevated in the interim.

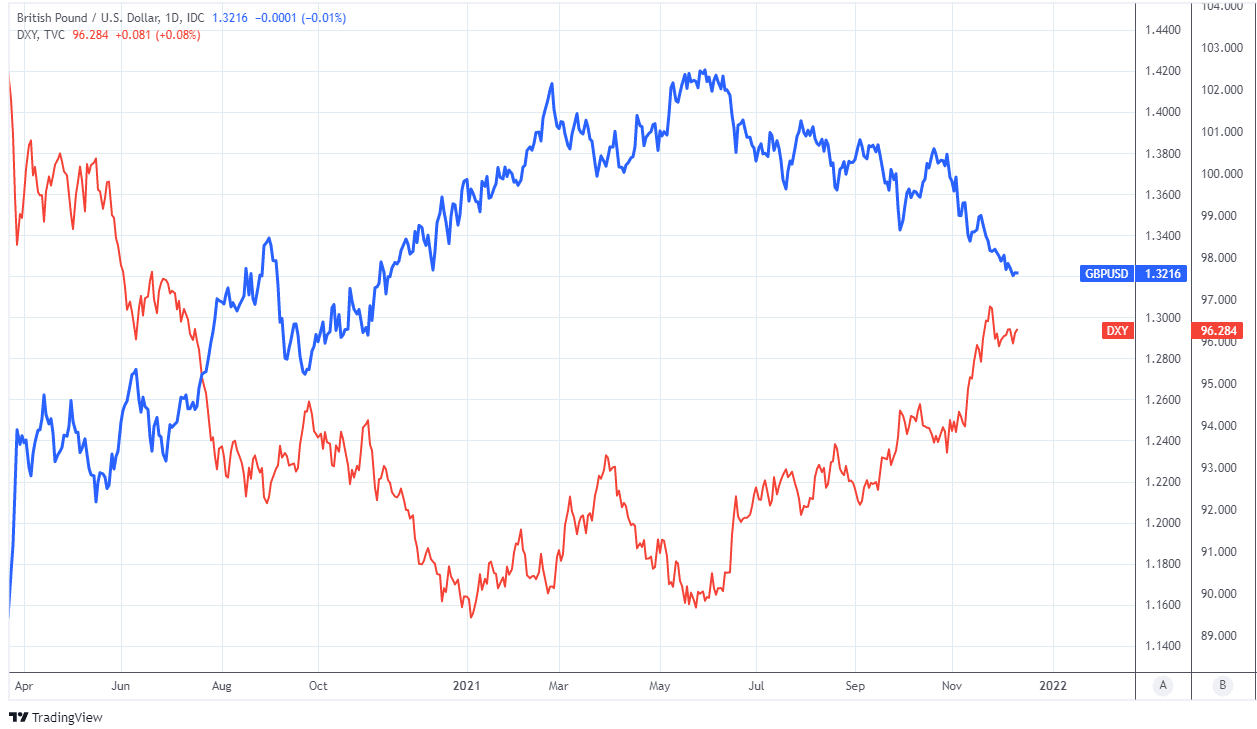

This has proven a boon for the greenback already and a burden for the Pound-Dollar rate, although the Fed’s shifting stance could weigh heavier on Sterling still in the months ahead if the market comes to expect the bank’s interest rate to rise sooner rather than later once into 2022.

“The surge in core inflation, and the near-certainty of further increases ahead, explain the Fed’s hawkish pivot in recent weeks,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

“The inflation data will be even worse by the time asset purchases end in March, and we expect the Fed to hike in May, even if they stick to their view that the inflation outlook for end-22/early 23 is much better,” Shepherdson warned in a note to clients on Friday.

Above: Pound-Dollar rate shown at daily intervals alongside U.S. Dollar Index.