U.S. Dollar's Rally against Pound and Euro Accelerates in Wake of U.S. Retail Sales Plunge

- Written by: Gary Howes

- USD marches higher

- Despite softer-than-expected U.S. data

- USD benefiting from safe-haven demand

- But USD being set up for a fall says one analyst

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1720 | GBP/USD: 1.3764

- Bank transfer rates: 1.1490 | 1.3479

- Specialist transfer rates: 1.1640 | 1.3668

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

When the U.S. Dollar is not benefiting from strong U.S. data it is benefiting from safe haven demand when market sentiment sours, creating something of a win-win environment for the global reserve currency.

The Dollar's multi-faceted strengths were on display Tuesday August 17 following the release of U.S. retail sales data that underwhelmed against consensus estimates.

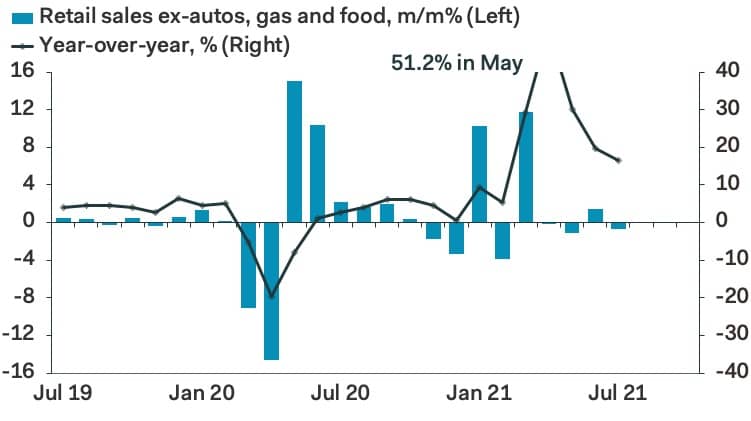

Retail sales fell 1.1% Month-on-Month in July, a sizeable miss on the -0.3% figure the market was looking for, reinforcing evidence of something of a slowdown in the U.S. economic growth story.

"It’s impossible to separate the impact of the fading stimulus boost from the possible hit due to the Delta variant, which began to hit real-time indicators like restaurant diner and airline passenger numbers in late July. The Delta hit likely will be bigger in August, so we have to scale back our hopes for Q3 consumption quite sharply," says Ian Shepherdson, Chief Economist, Pantheon Macroeconomics.

Above: Retail sales, image courtesy of Pantheon Macroeconomics.

Typically such a data release would be consistent with growing expectations for a delay to the point at which the Federal Reserve plans to withdraw monetary stimulus; the timing of which is one of the central obsession for financial markets at present.

The market is expecting the Fed will begin the process at its September policy meeting by announcing a 'taper' to its quantitative easing programme, but such a move is conditional on unequivocal improvements in U.S. data.

Therefore this soft retail sales report would be considered to be consistent with a delay, and therefore Dollar weakness, as opposed to the strength we are in fact seeing.

The U.S. data came on a day that markets were already under pressure, eyeing a growth slowdown in Asia linked to the imposition of covid restrictions across various countries in the region as the Delta variant spreads.

The decline in stock markets and commodity prices points to an overarching demand for 'safe haven' assets, of which the Yen, Franc, Dollar and Euro are all considered.

"The dollar in general is well bid. Its performance even improved after the poor retail sales," says Mathias Van der Jeugt, an analyst with KBC Markets.

"Sterling on the other hand is suffering from the risk context. This morning’s labour market report wasn’t bad at all and even justified the BoE’s hawkish turn earlier this month," adds Van der Jeugt.

The Pound-to-Dollar exchange rate (GBP/USD) slipped by 0.5% to reach 1.3763 while the Euro-to-Dollar exchange rate slipped a third of a percent to reach 1.1736.

"The buck continues to draw support from risks to global growth stemming the uncertain outlooks for China’s economy and the geopolitical crisis in Afghanistan, and rising cases of Covid-19," says Joe Manimbo, Senior Market Analyst at Western Union.

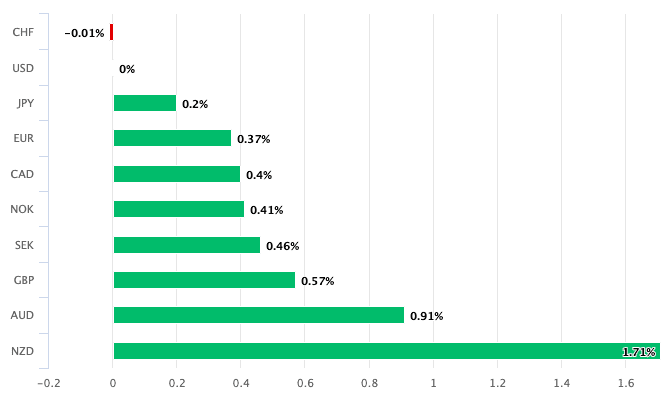

In fact, the Dollar is the second-best performer on the day and given that it is going toe-to-toe with the 'ultra safe' Franc for the accolade of best performer suggests this is a market that is one being dictated to by the binary risk-on/risk-off trade:

Above: USD dominance on Aug 17.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Analysts at HSBC say they see the conditions for a trend of appreciation in the U.S. Dollar to extend for a number of months.

"The peaking of global growth, sequentially, would mark the end of the USD’s broad cyclical decline. Second, the Fed’s path towards policy normalisation should support the USD gradually, especially when tapering actually starts," says Paul Mackel, Head of FX Research at HSBC.

HSBC had expected the Dollar supportive trends to begin later in 2021, but note their timing was wrong.

"Instead of these two forces slowly supporting the USD later this year and into 2022, this is happening earlier. As a result, we have pulled forward our timing for the USD to strengthen and expect this to continue through 2022," says Mackel.

Jeremy Boulton, a Reuters market analyst, is not convinced the Dollar's all-weather advance can continue indefinitely over coming weeks.

He says that falling markets and commodity prices could in fact lessen the need for the Federal Reserve to announce it will begin reducing the scale of its quantitative easing programme at the September policy meeting.

"Waning risk appetite has boosted demand for dollars ahead of September's Federal Reserve meeting where the chance of a change in monetary policy that could have led to significant dollar gains is diminishing as fast as risk aversion is rising. The dollar is being set up to fall," says Boulton.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The market has also become heavily invested in bet for the continuation of further Dollar gains, a development that can often prove to be a headwind for an appreciating currency.

Data from the CFTC shows significant Dollar buying in the past two months with the net speculative position turning from $19.2BN staked on dollar dropping to $3.1BN on its rise.

Any unwind in this position could prompt a reversal in the U.S. currency.

"Risk-averse market activity has driven down commodities with oil quickly losing one-tenth of its value, cooling inflation fears and lessening the need to change monetary policy. This all exposes the dollar to a sell-off should the Fed stand pat in September," says Boulton.