Pound-Dollar Week Ahead Forecast: Downside Risk Dominate as USD Keeps Lid on GBP

- Written by: James Skinner

- GBP/USD sees slippage as far as major average at 1.3757

- While upward momentum ebbs between 1.3940 & 1.3991

- With U.S. economy, Fed outlook aiding USD & capping GBP

- After U.S. data puts Sept QE taper & 2022 rate rise on table

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3870

- Bank transfers (indicative guide): 1.3485-1.3582

- Money transfer specialist rates (indicative): 1.3742-1.3773

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar exchange rate has suffered a series of setbacks that have curbed its upward momentum and could see it slipping lower over the coming days, potentially as far as its 200-day average around 1.3757, as a buoyant Dollar keeps downside risks dominant for Sterling.

Pound Sterling has been one of the more resilient currencies within the G10 contingent of majors amid the latest rebound by the Dollar and could potentially remain so now the Bank of England (BoE) has formally acknowledged that “modest monetary tightening” of the kind envisaged by financial markets in early August could be necessary to return UK inflation back to the bank’s 2% target over the coming years.

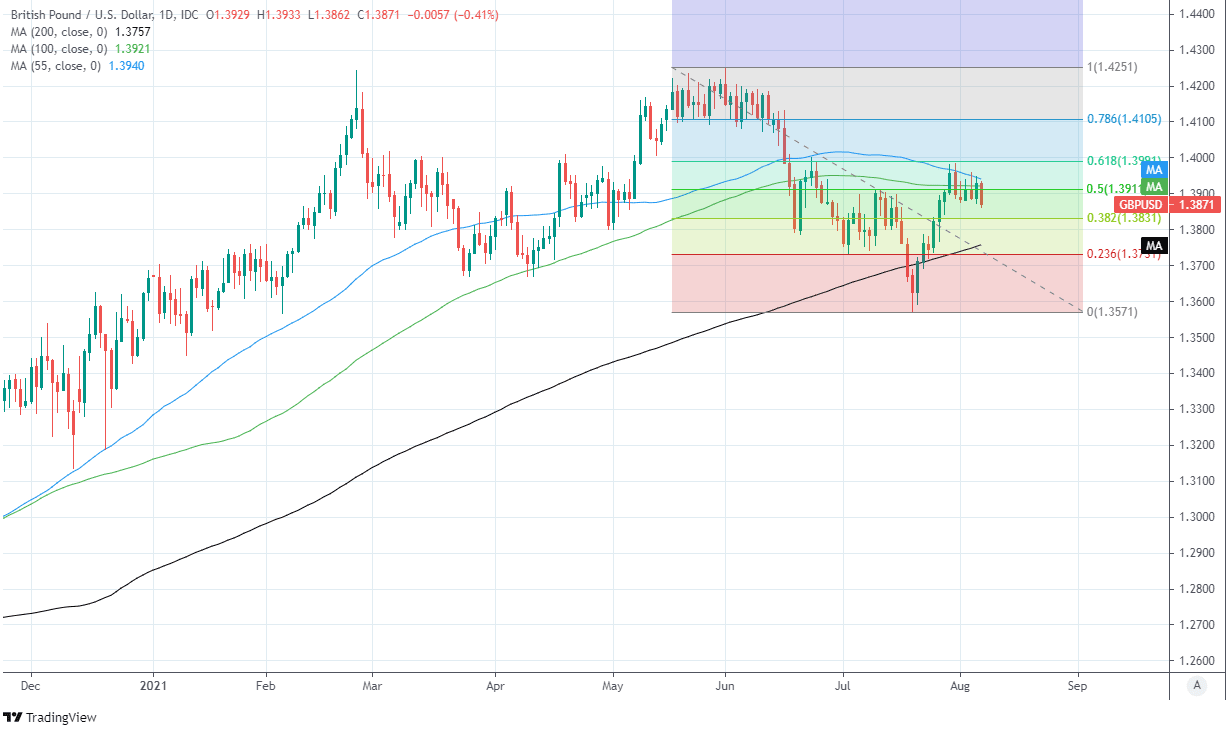

But the Pound-to-Dollar rate is still at risk of further declines over the coming days having been dealt a series of curveballs in the last week, although there’s a multitude of lesser support levels that could potentially break GBP/USD’s fall ahead of the 200-day moving-average around 1.3757.

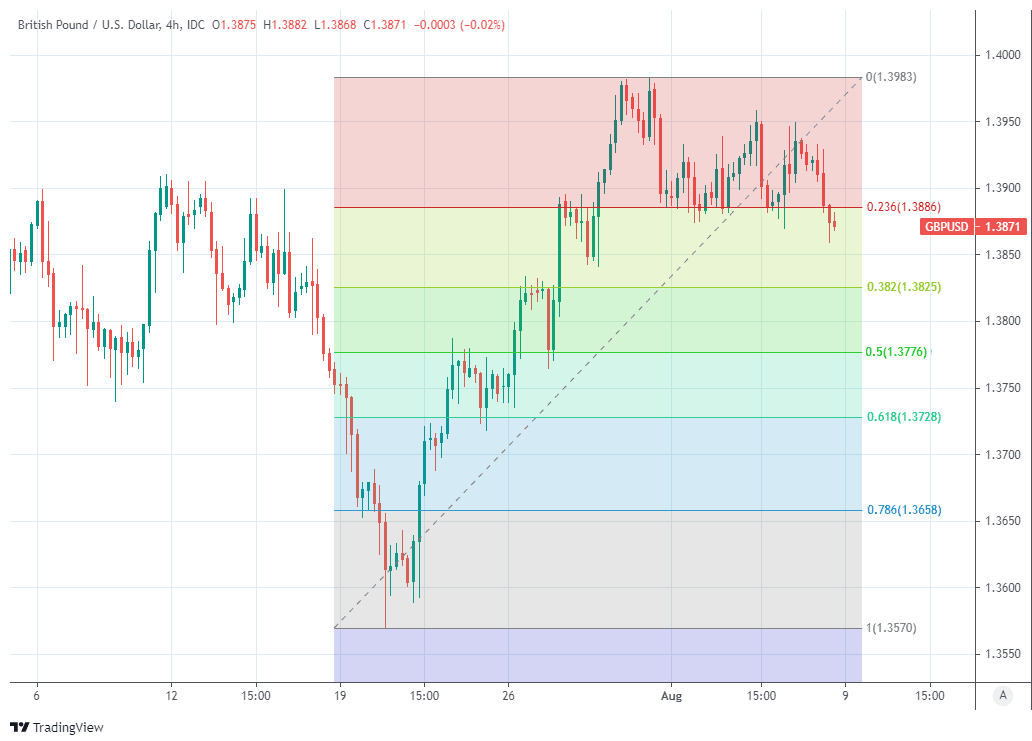

“GBP/USD continues to consolidate below the 61.8% Fibonacci retracement at 1.3990. We look for the market to remain capped by the 1.4018 pivot and we would allow for failure (we have warning signals on intraday charts). Intraday dips lower are likely to be supported around 1.3800,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Jones and the Commerzbank team are sellers of the Pound-Dollar rate from around 1.3875 and have flagged the 1.3786 area, which is GBP/USD’s 21st June low, and 1.3735 levels around which any renewed declines could potentially begin to run out of steam.

Above: Pound-to-Dollar rate shown at 4-hour intervals with Fibonacci retracements of late July recovery indicating possible further areas of support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Sterling previously appeared on course for a retest of 1.40 but only made it as far as 1.3950 before being pulled lower last Wednesday when a new record high for the Institute for Supply Management services PMI came shortly ahead of a ‘hawkish’ address from Vice Chairman of the Federal Reserve (Fed) Richard Clarida, who signalled that interest rates could rise from late 2022 if economy conforms to expectations in the interim.

“Governor Waller told CNBC on Monday that the QE taper timeline should be speedy enough “to make sure we’re in position to raise rates in 2022 if we have to”. While neither represents the full committee view (and Vice Chair Clarida’s term ends in January 2022), markets may need to price an “early hike” risk premium,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

“We do not see a case for sustained Dollar appreciation: the global economy will benefit from vaccination tailwinds over coming quarters, the US economy should slow as the fiscal impulse turns negative, and falling inflation should allow the Fed to remain on hold for a lengthy period (our economists expect an unchanged funds rate until Q3 2023),” Pandl writes in a note last Friday.

Pandl and the Goldman Sachs team cite a deteriorating coronavirus situation in Asia, recent U.S. data surprises and more palpable risks of changes in Fed policy that could come earlier than they’ve anticipated and the Fed has so far guided for thinking the Dollar could remain elevated in the short-term.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Last week’s ISM PMI together with Friday’s blockbuster nonfarm payrolls report has signalled that a renewed acceleration may have gotten underway in the U.S. economy last month, with all of this together helping to accentuate the risk that Federal Open Market Committee members agree in September on announcing a plan to end the Fed’s $120BN per month quantitative easing programme.

That’s not the only U.S. policy risk however, as a renewed acceleration of the economy could potentially foster a recovery of the recently retreating market-implied probability that an interest rate rise is announced around the end of next year or soon after, which would be further supportive of the Dollar and an additional burden for GBP/USD to carry in the weeks ahead.

“After the jobs report, attention will shift to inflation in the upcoming week,” says Kevin Cummins, chief U.S. economist at Natwest Markets. “On a year/year basis, we forecast the headline inflation rate to inch down to 5.3% (versus 5.4% in June) though base effects will push the core inflation rate down from 4.5% in June to 4.2% in July.”

The week ahead will see the Pound-Dollar rate’s attention remain on U.S. and UK economic data, with Wednesday’s U.S. inflation figures the first potential pitfall for Sterling ahead of Thursday’s second quarter UK GDP report, which poses two-way risks for GBP/USD.

Above: Pound-to-Dollar rate shown at daily intervals with Fibonacci retracements of June fall indicating possible areas of resistance alongside 55 & 100-day averages while the 200-day moving-average lurks below the market at 1.3757.

Consensus sees U.S. inflation ebbing only slightly from June highs above five percent at 13:30 on Wednesday, although the Dollar could be sensitive to any upward surprises as such an outcome might be seen by some in the market as keeping alive the risk of a 2022/23 interest rate rise from the Fed.

For Sterling Thursday’s GDP data will be crucial given that the Bank of England’s supportive monetary policy stance is contingent on a bullish outlook for the UK economy being borne out by data, beginning with what the Monetary Policy Committee expects will be a 5% second quarter growth figure.

Consensus among economists favours only a 4.8% increase when last quarter’s GDP data is released at 07:00 on Thursday although the economy would likely have to overshoot the BoE’s more upbeat expectation for the Pound-to-Dollar rate to derive a meaningful lift from it.

“We think the BoE will begin hiking rates in late-2022, which would be roughly around the same time as the Fed and thus GBPUSD may not be greatly impacted (although the Fed’s neutral rate is higher). But the EURGBP will remain under pressure over the forecast horizon as the ECB waits at least one more year before it increases its own policy rates,” says Shaun Osborne, chief FX strategist at Scotiabank.

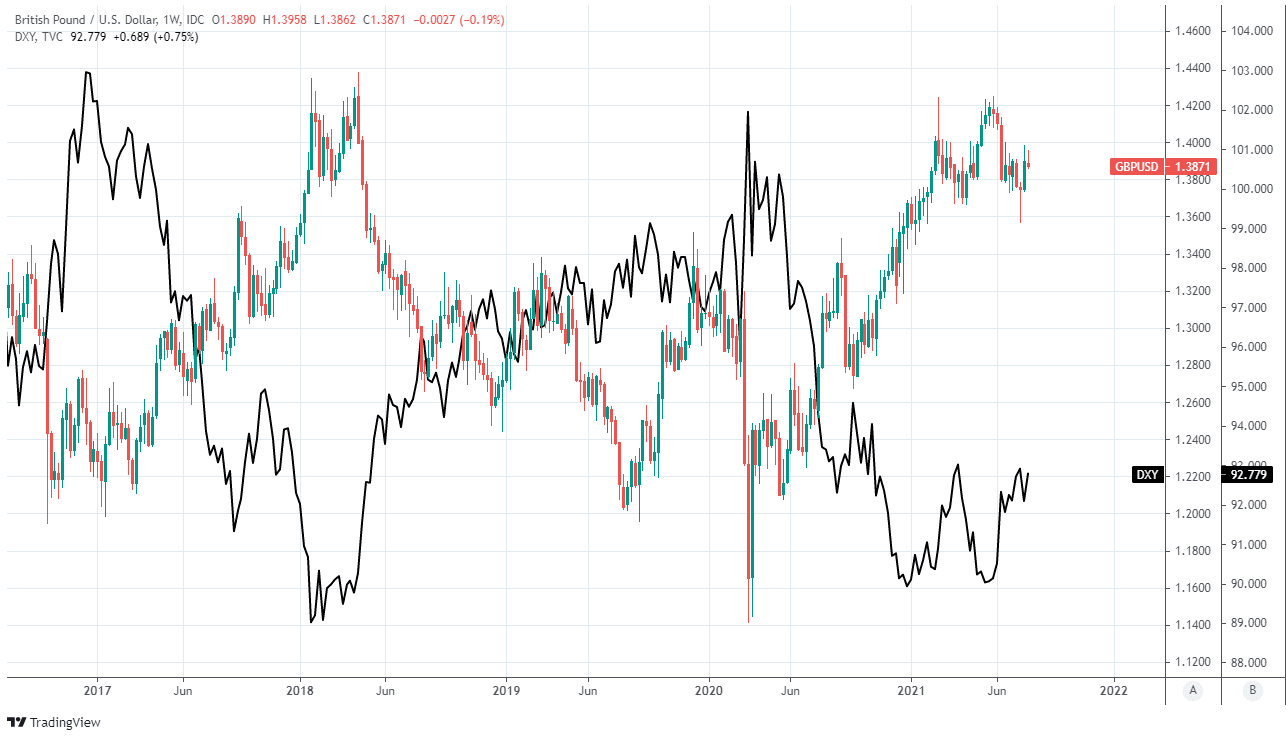

“Sterling remains in a narrow trading channel between the upper 1.38s and the mid/upper 1.39s with limited hints that it will break out of the range in either direction,” Osborne writes, in a Friday note.

Above: Pound-to-Dollar rate shown at weekly intervals alongside U.S. Dollar Index.