Dollar Strengthens against Pound and Euro as Investors Bet on a Strengthening U.S. Jobs Marke

- Written by: Gary Howes

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.4112

- Bank transfers (indicative guide): 1.3724-1.3823

- Money transfer specialist rates (indicative): 1.3990-1.4019

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Dollar rose against the Pound, Euro and other major rivals as foreign exchange market participants looked to front-run a strong labour market report due out on Friday.

The key announcement of the week, indeed of the month, will be Friday's U.S. non-farm payroll report that will cast a light on how the world's number one economy labour market is recovering.

A strong reading is expected to be supportive of the Dollar as it will imply the market is expecting the U.S. Federal Reserve to start seriously considering 'tapering' its quantitative easing programme in coming months, which would pave the way to an interest rate rise in 2022.

"The U.S. dollar firmed ahead of influential American jobs data over the balance of the week. The buck rose against the euro and kept above multiyear lows against rivals from the UK and Canada. A run of strong U.S. data has helped to slow the anti-dollar trade that has gained traction this quarter," says Joe Manimbo, Senior Market Analyst at Western Union Business Solutions.

The market is expecting a strong reading on Friday given the two separate reports detailing labour market trends out Thursday easily beat expectations and suggested the jobs market was improving.

Weekly Initial Jobless Claims came in at 385K, which is below the 390K analysts had forecast.

The ADP Nonfarm Employment reading for May came in at 978K, ahead of the 650K market was expecting and making a substantive improvement on the April reading of 654K.

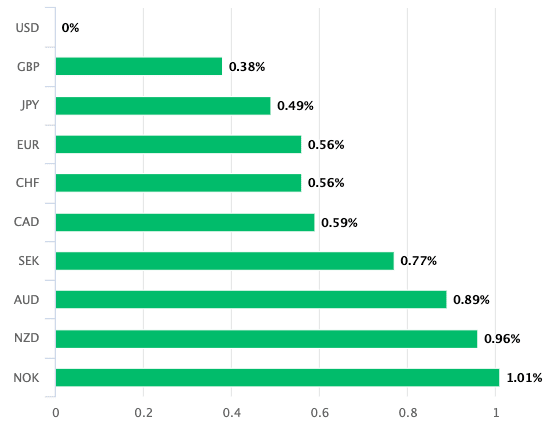

The Dollar advanced against all its major peers in the wake of the data:

The Pound-to-Dollar exchange rate (GBP/USD) fell back to 1.4110 in the wake of the numbers while the Euro-to-Dollar exchange rate fell a hefty two-thirds of a percent to trade at 1.2142.

"Claims continue to fall at a rapid, steady pace. With firms unable to find staff, the risks of prematurely letting people go is rising; if business conditions improve, employers might not be able to rehire," says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

The economist said the below chart shows that the trend in jobless claims is sharply downwards, "with no end in sight".

Image courtesy of Pantheon Macroeconomics.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"Claims remain elevated by normals standards, but the downward trend has been relentless in recent months, and a return to the pre-Covid level, in the low 200s, over the summer seems a decent bet," says Shepherdson.

The U.S. Federal Reserve now operates a policy of supporting the labour market as well as managing inflation, meaning they will only consider raising interest rates should the labour market look to be on the mend.

The data is telling us that their concerns for jobs might soon start easing and their guidance become more 'hawkish' as a result.

This would be supportive of the Dollar.

"The robust USD selling momentum during April and May, which reversed the Q1 gains, has now petered out," says Daragh Maher Head of Research, Americas, at HSBC. "Currencies such as the EUR, GBP and CAD seem unable to break into new bullish territory."

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |