Turkish Lira Forecasts Envisage Recovery at ABN Amro as Others See Slide into Arms of IMF

- Written by: James Skinner

Image © Adobe Stock

- GBP/TRY spot rate at time of writing: 10.85

- Bank transfer rate (indicative guide): 10.47-10.55

- FX specialist providers (indicative guide): 10.69-10.76

- More information on FX specialist rates here

The Lira tumbled again Friday as the Dollar sought a fifth consecutive advance, although the outlook is murky with forecasts from ABN Amro suggesting a 2021 unravelling of the greenback could throw the Turkish currency a lifeline, while others still look for an International Monetary Fund (IMF) intervention.

Turkey's troubled Lira slipped to new lows against the Dollar and Euro Friday, even as the single currency slipped lower against all major developed world counterparts and emerging market currencies recovered more generally, demonstrating the extent to which investors remain out of love with the Lira.

Losses built initially this week when a war of words between French and Turkish leaders grew louder, although inflation forecasts from the Turkish central bank and the institution's lack a credible plan for reigning in price pressures added to the Lira's woes from Wednesday.

Not even European Central Bank-induced Euro wounds could stem the bleeding, despite EUR/USD having a significant influence on EUR/TRY.

"When capital outflows lessened in many other EMs, they persisted beyond the initial COVID-19 selloff in Turkey. This was not visible in the lira exchange rate in June and July, as the central bank intervened heavily to support the lira. Since the start of August it appears to have abandoned the attempt," says Georgette Boele, a senior FX strategist at ABN Amro.

Above: EUR/USD at hourly intervals alongside USD/TRY (orange line, left axis) and EUR/TRY (black line, left axis).

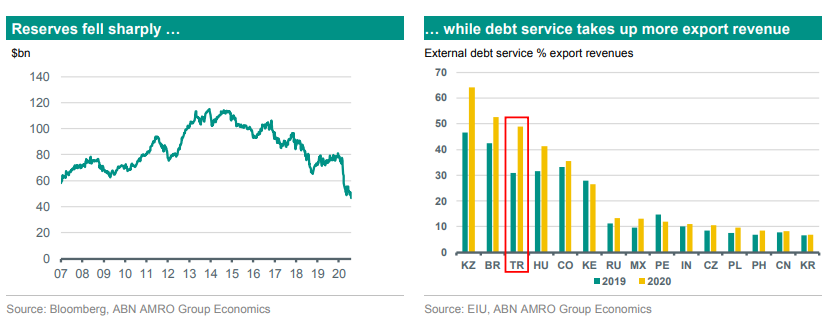

Boele and the ABN Amro team cite steep reductions in Turkey's main interest rate for the Lira's post-2018 falls, which have continued throughout the coronavirus pandemic and drained the country's foreign currency reserves, taking them back toward financial crisis era levels.

"The policy interest rate has been falling since July 2019 from a high of 24%, to 12% at the end of 2019 and 8.25% since May of this year. Inflation did not come down at the same pace, however. As a result, the real interest rate has decreased from highs of around 8% in the summer of 2019, to around -3% currently. These rates make the currency less attractive to investors," says Anke Martens, a senior economist at ABN.

Lira woes have been compounded by the pandemic-related loss of tourism revenues, which have led exports to fall faster than imports and helped to turn the balance of payments from a profitable and sometimes currency supportive surplus, into a deficit.

That now acts as an additional drag on a Lira that has been sunk steadily in recent years as a result of the unorthodox policy of Central Bank of the Republic of Turkey, which at times has appeared to buy President Recep Tayip Erdogan's idea that lower interest rates can be used to reduce inflation.

"As long as the central bank does not take stronger action and political uncertainty remains, the currency will weaken further," Boele says.

Above: ABN Amro graphs showing declines in Turkish currency reserves and cost of foreign debt.

The rub for the CBRT is that its interest rate cuts have reduced the inflation adjusted returns earned by investors who buy Turkish debt, leading them to sell both Turkish bonds and the currency, with devaluation increasingly offsetting any reduced price pressures that have resulted from reduced borrowing costs.

"We expect more weakness in the near-term, followed by a recovery in the course of 2021. This recovery will also be the result of general dollar weakness in 2021. We adjusted our year-end forecast in USD/TRY from 7.6 to 8.0 to reflect these dynamics. Our new forecast for end 2021 for USD/TRY is 7.5 (was 7.0)," Boele says.

Despite the Lira's troubles and no sign yet that the CBRT intends to follow its surprise September interest rate hike with another tightening of policy conditions, Boele and the ABN team see scope for depreciation pressures to eventually ease toward year-end and in 2021.

The bank looks for the Dollar to uravel further in response increasingly negative inflation adjusted bond yields in the U.S., where an economic recovery is expected to lift inflation while Federal Reserve (Fed) monetary policy further crushes American bond yields.

But others see the Lira depreciating further before year-end, in the New Year and for as long as the CBRT remains averse to higher interest rates.

Above: EUR/USD at daily intervals alongside USD/TRY (orange line, left axis) and EUR/TRY (black line, left axis).

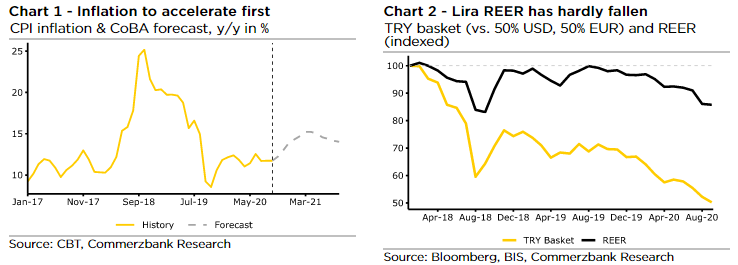

"We assume that a major policy regime change, for example an IMF deal, would be invoked when the lira has depreciated sufficiently to make external debt servicing impossible. Such a deal would then restore credibility by establishing central bank independence," says Tatha Ghose, an analyst at Commerzbank. "Only thereafter do we assume that the lira could stabilise at around 8.00."

Ghose and the Commerzbank team look for the Lira to remain under pressure and warned earlier in October that USD/TRY could overshoot their year-end forecast of 8.20 and temporarily rise to 8.50 or beyond.

They assume the Lira will go on depreciating until the central bank sustains a change of policy, which is also assumed not to happen until currency depreciation forces the Turkish government into the hands of the IMF.

This however, shouldn't be expected any time soon they argue, not least of all because the political cost to government of going cap in hand to an IMF that's dominated by American and European creditors would be high.

“How much further can the lira fall?” This frequently asked question does not really have a scientific answer," Ghose says in a research note this week. "In our humble view, an attempt to guesstimate a level at which USD-TRY overshooting will stay capped is nonsensical. There is no reason why USD-TRY could not overshoot to, say, 9.00 in coming weeks or months. We still think that a large emergency rate hike by the central bank might be the only policy response we get in the first round."

Above: Commerzbank forecasts for Turkish inflation and TRY exchange rate Vs TRY's 'real equilibrium exchange rate'.

Ghose and the Commerzbank team poured cold water on claims contained in the inflation report released by the CBRT this week, which included the suggetion that the Turkish currency is undervalued as well as usual and obligatory pretence of a sincere expectation that consumer price inflation will fall to the 5% target in the next two years.

"Their projected disinflation is the same as what has always been predicted in mid-term plans, but never materialised. There is no mechanism to produce the disinflation," Ghose writes in a research note. "The comparison between the TRY basket (50% USD, 50% EUR) and the TRY REER over the period of the 2018 lira crisis until present. While the nominal exchange rate has indeed nearly halved, the REER has weakened by much less."

Commerzbank says that while USD/TRY and EUR/TRY doubled since early 2018 the real-equilibrium-exchange-rate (REER), which is a trade-weighted measure of multiple exchange rates after adjustments for inflation changes are made, has barely moved in that time. This means that currency depreciation, rather than offering a boost to exporting Turkish companies, has offered no benefit to the economy. It's only imposed costs on businesses and households.

"For the real economy to benefit – for example, via current-account improvement – the REER has to get sustainably cheaper. If this did not happen, only the nominal exchange rate got cheaper, the only result is a much larger external debt (or, FX liability) burden as percentage of GDP," Ghose says. "In other words, there is no automatic stabiliser effect from nominal exchange rate depreciation alone, quite the contrary."

Above: EUR/USD at daily monthly alongside USD/TRY (orange line, left axis) and EUR/TRY (black line, left axis).