'Blue Wave': The Senate Battles that will Determine the U.S. Dollar's Path Forward

- USD vulnerable to Democrat sweep of Senate and Presidency in Nov.

- Just 8 senate seats tossups

- Saxo see only 40% chance of a 'blue wave'

Photo by Adam Schultz / Biden for President

- GBP/USD spot rate at time of writing: 1.2943

- Bank transfer rate (indicative guide): 1.2590-1.2680

- FX specialist providers (indicative guide): 1.2860-1.2880

- More information on FX specialist rates here

There are 35 senate seats up for grabs in the November vote, whether or not the Democrats can snatch enough from the Republicans to take control of the Houses of Congress could well dictate how the U.S. Dollar and equity markets end 2020.

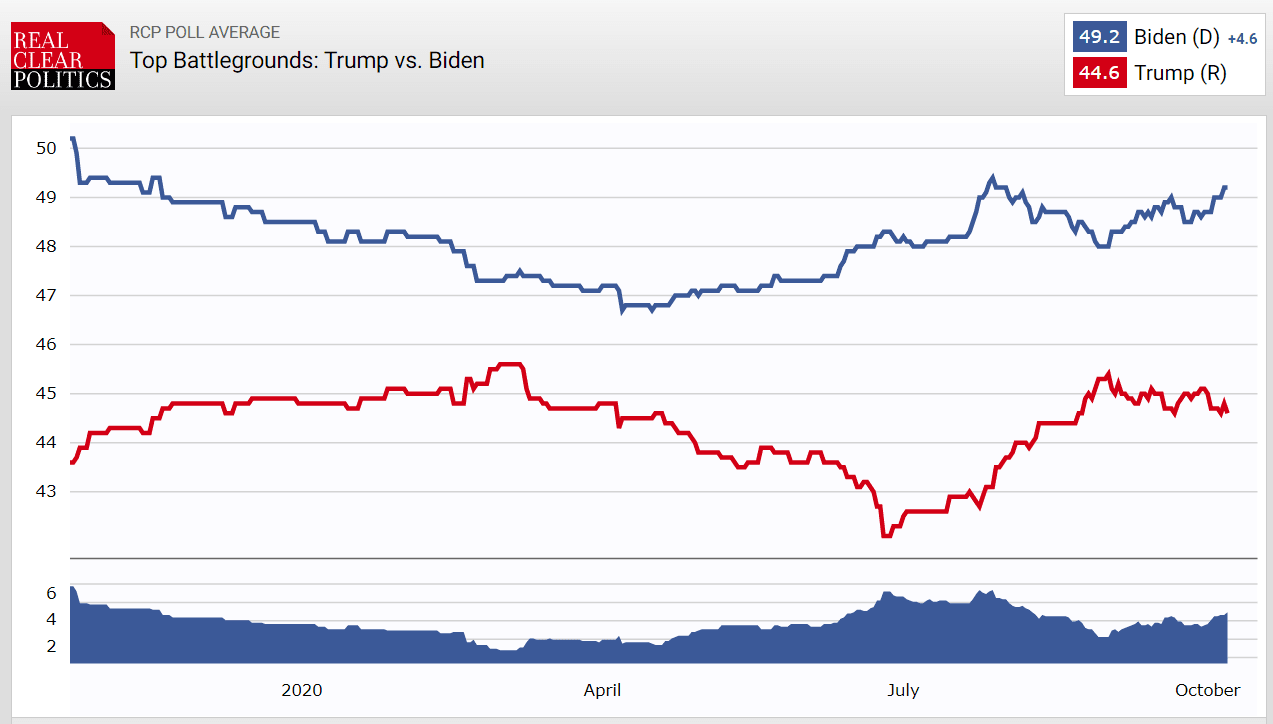

Markets are increasingly pricing for a sweep in both the presidential and senate votes by the Democrat Party according to analysts, such an outcome would see the passing of a significant stimulus in early 2021 which would prove beneficial to equity market prices, while weighing on the U.S. Dollar.

"We think that FX markets and to some extent equity markets, are looking past the election with an expectation that a blue wave is inevitable. Betting markets seem to think so. While we generally agree that a blue wave will be highly reflationary, we think expectations for a fiscal stimulus before the election is rather ambitious - it may not be until early 2021 that sees a package actually delivered," says Mazen Issa, Senior FX Strategist at TD Securities.

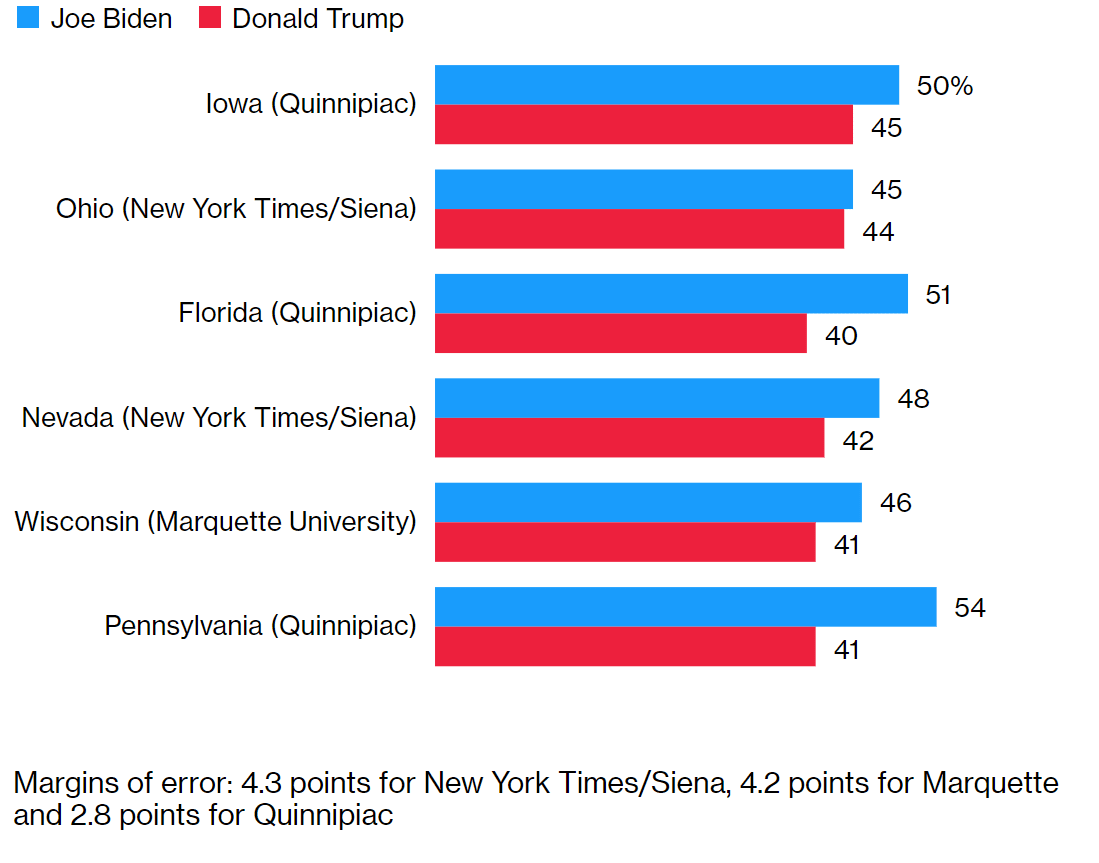

Polling is in favour of Biden in key states that he must win to take the presidency according to the FT's tracker. In Pennsylvania and Wisconsin, where Mr Trump won by razor thin margins in 2016, Biden leads by 5 and 6 points, respectively.

The race is even closer in Arizona, a state only one Democratic presidential candidate has won in the past 70 years, and Ohio, where Trump beat Hillary Clinton by 8 points in 2016.

"One of the plausible narratives out there on why risk remains buoyant, is that markets are expecting a 'blue wave' in the upcoming election. A 'blue wave' would likely mean easier path for additional stimulus – and if you’ve been attention this year, that means higher equities, lower USD and a steeper UST curve," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

While much focus in financial circles is on the odds of Biden winning the White House, there is somewhat scant analysis on the dynamics involved in the Democrats flipping the Senate.

For a 'blue wave' to materialise a number of key states must go the way of the Democrats, thanks to the unique characteristics of the

U.S. electoral system which places emphasis on electoral colleges. Furthermore, when it comes to the Democrats taking hold of the senate, they will need to flip a few Republican seats.

"As part of that wave, the Democrats need to flip the Senate – which means that they’ll need to convert three or four seats (depending on who the VP will be after the election). Now, there’s confusion as to what to follow in order to gain a sense of the Senate races," says Rai.

CIBC Capital Markets have produced this useful pointer to understanding how the Senate race will need to unfold in order for a 'blue wave' to unfold:

- There are 35 senate seats (out of 100) that are being contested this year

- 12 of those seats are currently controlled by Democrats. Of the 12, 10 seats are listed as ‘safe’, one is competitive (but the Dems hold an advantage) while the last is a seat they’ll likely lose (Doug Jones in Alabama)

- 23 seats are currently controlled by the Republicans. Of those 23, 13 are either 'safe' or 'likely' to be retained by the Republicans, and 2 are competitive (with the Republicans still favoured to win).

The final 8 seats are either tossups, or expected to be flipped into Democrat seats.

If you net out the Alabama seat that the Democrats are expected to lose, the ‘blue wave’ scenario requires the Dems to flip 4 out of the remaining 7.

Rai says the races to watch include:

- Maine: Collins (R) vs Gideon (D)

- Iowa: Ernst (R) vs Greenfield (D)

- North Carolina: Tillis (R) vs Cunningham (D)

- Montana: Daines (R) vs Bullock (D)

- Georgia: Perdue (R) vs Ossoff (D)

- South Carolina: Graham (R) vs Harrison (D)

- Colorado: Gardner (R) vs Hickenlooper (D)

- Arizona: McSally (R) vs. Kelly (D)

"Again – all of the above races have the Republican as the incumbent. Of the above, 538 assigns the highest odds of a change in the Arizona, Colorado, North Carolina and Maine races," says Rai. "As for the House? There’s almost no chance it’ll flip to Republican control this year."

(If you have USD requirements and would like to book a rate now for future use, thereby protecting your FX budget, please learn how this can be achieved here).

While the narrative of a 'blue wave' is certainly starting to take hold, the foreign exchange market is yet to convince that this expectation is widely shared by investors.

"We remind markets that even though the polls have moved the way that they have, that there is still ample time for the dynamics of the race to change and for more "October" surprises to surface. We have a hard time seeing risk premia dissipate," says Issa.

The inability of the Dollar to find a clear trend of late could be betraying a market at odds with what the pollsters are saying, and economists at Saxo Bank have told clients that there is in fact only a 40% chance of a "blue wave" outcome.

The odds of either a Trump win or a contested Democrat win amount to 60% according to Saxobank, which would be interpreted as being bullish for the U.S. Dollar which has benefited from Trump's policies and would do so again during another presidency; it would also benefit from the safe haven demand that a contested outcome would yield.

"Our probabilities are at odds with both polls and bookmakers. The Biden-Harris ticket is odds-on to win the White House, and potentially even get a clean sweep by winning both the Senate and Congress. The math is seriously stacked against President Trump, even more so than it was in 2016, but when talking to investors around the world we get the feeling that a large majority continues to ‘feel’ and think President Trump will come from behind once again," says Steen Jakobsen, Chief Economist and CIO at Saxobank.

Saxo Bank sees three distinct paths and probabilities between now and the Inauguration day on January 20 2021:

1) A contested election – probability 40%

Results:

• Spike in volatility

• Sell off in equities due to uncertainty

• Weaker US Dollar

• Strong Gold

2) A clean sweep by Biden – probability 40%

Results:

• Sell off in equities, particularly in technology (tax increases, focus on monopolies)

• Rally in green stocks

• Higher interest rates as ‘power of the purse’ in controlling both houses of Congress creates fiscal bonanza

3) A win by Trump – probability 20%

Results:

• Volatility increases – four more years of disruption to global order

• Increased China vs. U.S. tension

• Relief rally

• Two houses most likely split, which will mean little fiscal stimulus ability

"We fear that the U.S. election is the biggest political risk we have seen in several decades, as the end of the economic cycle meets inequality, social unrest and a market feeding frenzy driven by the policy response to this deep economic crisis: zero interest rates, infinite government and central bank support. The massive official backstop, with guarantees for demand and jobs in a world of State Capitalism, means that markets and individual freedom have never been more under attack," says Jakobsen.