Sterling Staring Down the Barrel of Bank of England Interest Rate Cuts

- Written by: James Skinner

© IRStone, Adobe Stock

- BoE to cut rates within months says Capital Economics

- One cut seen as Brexit and global risks rise, growth slows.

- GDP forecasts slashed due to ONS revisions, global worries.

- October 31 Brexit deal tipped as only way to avoid a BoE cut.

- GBP forecasts eye limited upside, plenty of downside scope.

The Pound could fall further from historically low levels if the latest forecasts from Capital Economics are anything to go by, because Bank of England (BoE) interest rate cuts are now seen adding to the British currency's Brexit woes unless a deal is agreed with the EU before the end of October.

Capital Economics has scrapped some of its earlier forecasts in response to new information from the Office for National Statistics (ONS) and the latest developments in the global economy. It now projects the BoE will cut its interest rate within months, even if the UK's departure from the EU is delayed beyond October 31. And the influential London-based consultancy also says there's little upside for Sterling in the years ahead, whatever happens at the end of October, and lots of downside potential.

The economy is now struggling under the weight of uncertainty thrown up by the Brexit process, which comes on top of icy winds blowing in from overseas. Methodology changes saw the ONS make sweeping revisions to earlier growth estimates last week, with the upshot being that GDP growth was 0.1% higher at 1.5% for 2018 but that household spending growth was lower than statisticians previously thought in seven out of the last ten quarters.

Paul Dales, chief UK economist at Capital Economics, says this suggests households have been more sensitive to Brexit uncertainty than was previously thought to be the case. And with the global economy now going down the pan at the same time, he says the Bank of England is likely to take action before long.

Above: Capital Economics graph showing expectations for Bank Rate and average forecast.

"So if Brexit uncertainty lasts longer, then consumption growth would probably remain soft," Dales says. "Rather than rise above the Bank of England’s 2% target, we now think that CPI inflation will stay below 2% for the next two years. In response, we have taken out the two 0.25% hikes in interest rates we had previously expected and added in one 0.25% rate cut instead, from 0.75% to 0.50%...It is possible that it could cut rates before 3t1s January if Brexit is delayed on 31st October."

Changes in interest rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency while rising rates have the opposite effect.

With growth slowing, inflation pressures are diminishing and leaving the BoE struggling to sustain its claim that rates will need to rise over the coming years in order to keep inflation in check. It acknowledged last month that a degree of "slack" has opened up in the economy, although it's been hesitant to respond in case a Brexit deal is struck and an anticipated increase of investment and demand leads to a recovery of price pressures.

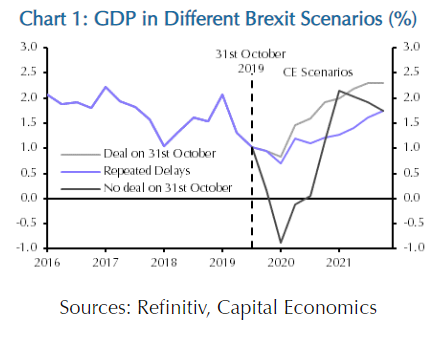

Above: Capital Economics growth forecasts for different Brexit scenarios.

"We still believe there is only one scenario in which the UK economy falls into a recession, and that’s a relatively shallow and short recession after a no deal Brexit. (See But we think there are now two scenarios in which interest rates are cut – after a no deal and after one or two more delays to Brexit. Another way of putting it is the only way in which rate cuts are avoided is if there’s a Brexit deal," Dales writes, in a recent briefing to clients.

A July speech from the BoE's chief economist, Andy Haldane, suggested the bank is increasingly worried about the economic impact of Brexit uncertainty. UK GDP growth was 0.3% in July, up from 0% previously and marking a strong start to the third quarter for an economy that shrank by 0.2% in the earlier period. The contraction stoked fears of a technical recession, which is defined as two consecutive quarters of contraction, although the probability of that happening is now tipped as low.

Growth was 0.5% in the second quarter, meaning the economy is up 0.6% for the year mid-way in the third quarter, although Dales forecasts an expansion of 1.3% for the year overall. The economy is tipped to grow only 1% in 2020 if Brexit is delayed a third time at the end of the month, whereas an exit with a deal is seen driving a 1.5% increase next year.

Above: Capital Economics graph showing GBP correlation with election odds.

"With the chances of a Brexit deal in the next few weeks now looking remote, another delay to the UK’s departure from the EU, followed by a UK general election, seems more likely than the UK leaving on 31st October without a deal at all. Investors may favour a hung parliament and coalition government to a Conservative or Labour majority. But even in those cases, it is hard to make a strong case for the pound to rise," says Oliver Allen, a colleague of Dales.

Capital Economics forecasts the Pound-to-Dollar rate will end the year at 1.25 unless there is a 'no deal' Brexit in which case the exchange rate, which was quoted around 1.22 Thursday, is tipped to fall to 1.15. The British currency doesn't get above 1.25 at all within the forecast horizon, which runs to the end of 2021, unless there is a Brexit deal before the end of October. If there is a deal, Capital Economics tips an increase to 1.35 next year and 1.40 in 2020.

"It’s hard to decipher how our forecasts compare to the consensus when the consensus is based on a variety of different assumptions for Brexit. But as far as we can tell, we are more optimistic on the outlook for the economy if there’s a Brexit deal, a bit more downbeat if there are many more delays and not as pessimistic if there’s a no deal," Dales says.

Above: Pound-to-Dollar rate shown at weekly intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement