Pound-to-Dollar Rate Week Ahead Forecast: Trend Turns and Starts Rising

Image © RCP, Adobe Stock

- Short-term trend reverses and starts to rise

- Major trendline main obstacle left for bulls

- Pound to take cue from Brexit talks; Dollar from CPI

The Pound / Dollar rate is trading at 1.3118 at the start of the new week, down from the multi-week high at 1.3177 achieved on the previous Friday.

Compared to this point last Monday the exchange rate is however one-and-a-half percent higher, suggesting near-term momentum lies firm with Sterling.

The GBP/USD pair was driven higher by speculation Britain's two major parties might try harder to agree a cross-party Brexit deal with the crushing losses inflicted on the Conservatives by an electorate frustrated over the progress of Brexit in the local elections suggesting more compromises will be forthcoming.

Analysts interpreted the results as giving Theresa May license to shift her stance away from the harder Brexit leaning elements in her party and closer to Labour’s softer stance.

But it was on Friday when Sterling really surged higher, boosted by comments from Jeremy Corbyn, the Labour party leader, who said the results from the local elections suggested lawmakers needed to “get a deal done” as soon as possible. His comments were interpreted as heralding a greater willingness to make compromises, which could bring bipartisan negotiations closer to a shared vision.

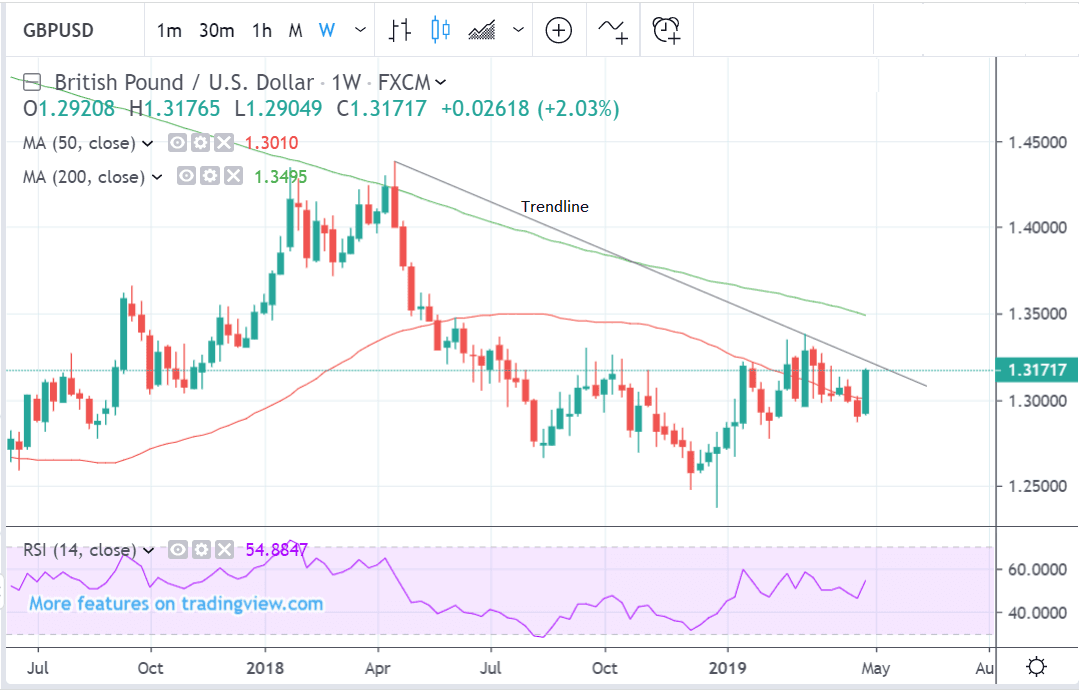

From a technical perspective, the downtrend has reversed on a dime and Sterling started rising very strongly in the short-term.

It is now possible the pair has begun a new short-term uptrend.

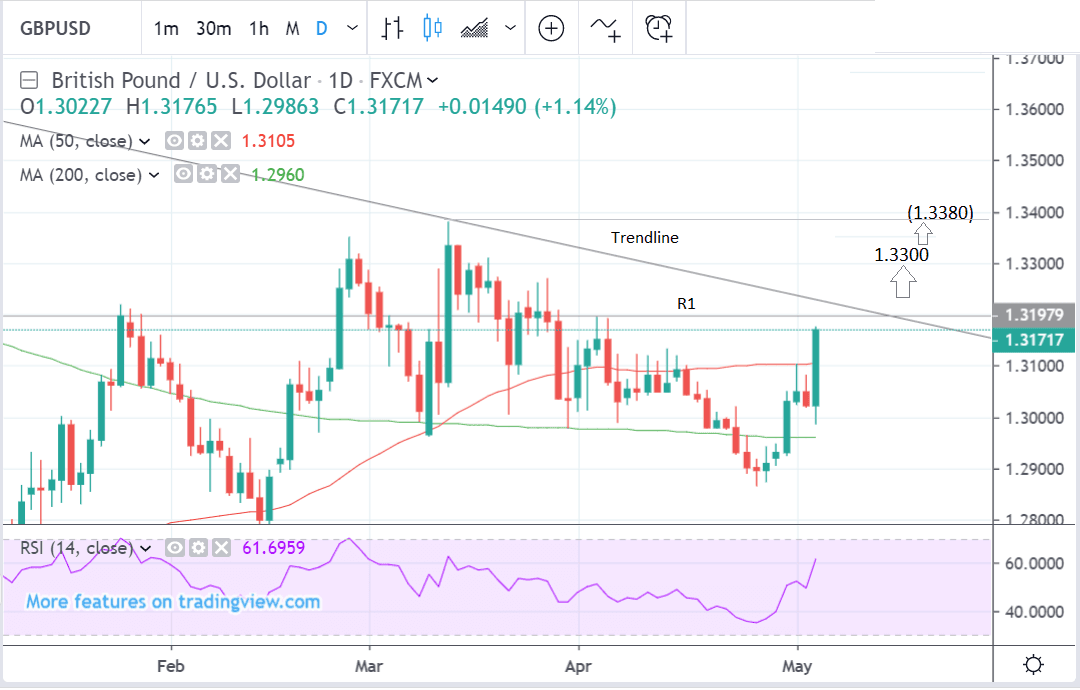

The next major resistance level which could cap gains, however, is the major trendline drawn from the March 2018 highs situated at circa 1.3200.

The trendline is likely to present an obstacle to the budding uptrend which needs to be overcome to continue signalling more upside. A break higher, on the other hand, would be a strongly bullish sign.

Another resistance level which must be overcome for bulls to extend the new uptrend is the the R1 monthly pivot at 1.3198.

Pivots, as the name suggests, are levels where reversals often happen. They were once used by pit traders as rough and ready guide to overbought and oversold levels.

A clear break above the pivot, confirmed by a break above

1.3225 would probably give the green-light to an extension higher, to a target at 1.3300. A clear move above that might then provide further confirmation of a rise to 1.3380.

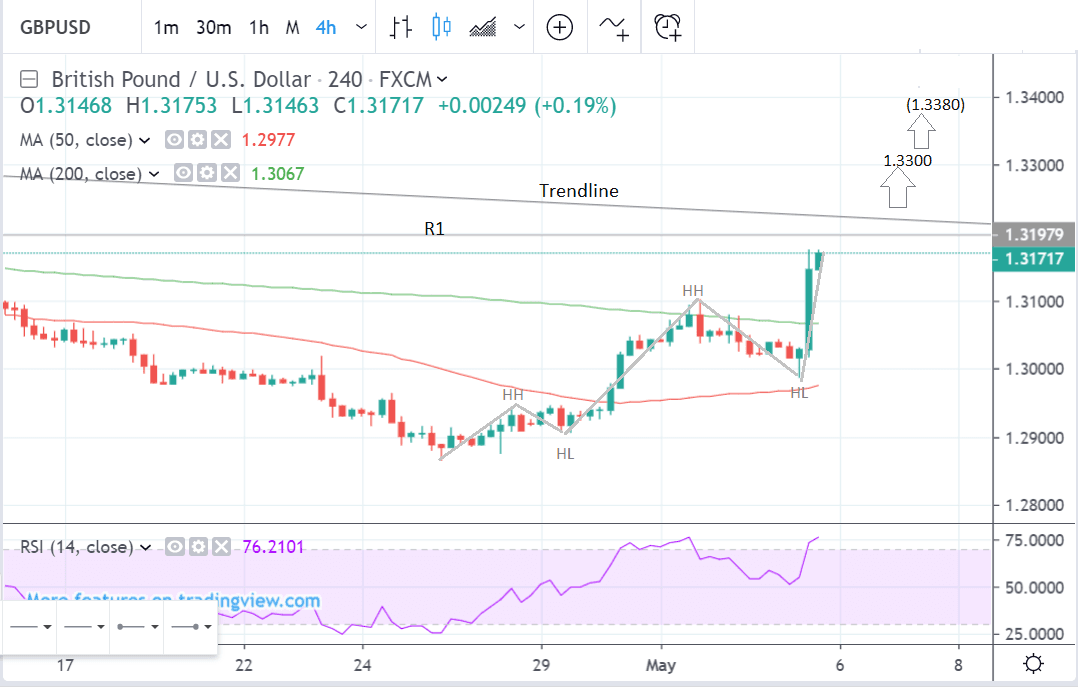

The 4hr chart - which gives a near-term perspective - is showing further evidence a short-term bullish trend is forming.

The pair has formed more than two sets of higher highs (HH) and higher lows (HL) - one of the signs analysts use to evidence the start of a new trend.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Dollar: What to Watch this week

The main release for the U.S. Dollar in the week ahead is inflation data out on Friday, and to a lesser extend producer price - or factory gate inflation (PPI) as it is also known - out on Thursday. Both will be used as gauges against which to measure Federal Reserve chairman Powell’s comments about subdued inflation being only ‘transitory’ at last week’s Fed policy meeting.

The Dollar has been rising over recent weeks thanks to an ongoing outperformance of the American economy, which has lead markets to believe the Fed could, in the future, start raising interest rates once more. As a rule of thumb, expectations for rate rises are supportive of a currency.

While expectations for such a rise are still relatively subdued, they nevertheless mark a shift away from expectations for an interest rate cut.

Stronger inflation data out this week would reinforce the trend.

Both the core and broader headline CPI, out at 13.30 BST, are forecast to rise by a faster 2.1% rate in April compared to a year ago; this compares to 2.0% and 1.9% respectively in March.

On a monthly basis core is expected to rise at a faster 0.2% (up from 0.1%) and broad by 0.4% (same as previously).

If the data beats expectations we could well see the Dollar rise.

“Although the Fed pays more attention to the core PCE price index, which has been trending lower, any modest increase in the CPI rate would ease worries of a sustained downtrend in PCE inflation, hence supporting Chairman Powell’s remarks that the current weakness is transitory,” says Raffi Boyadijian an economist at broker XM.com.

PPI is expected to rise by 2.3% in April from 2.2% previously and by a slower 0.2% from 0.6% previously on a monthly basis.

Another key release for the U.S. Dollar is the trade balance which is forecast to show a deepening of the trade deficit to -$51.1bn from -$49.4bn previously.

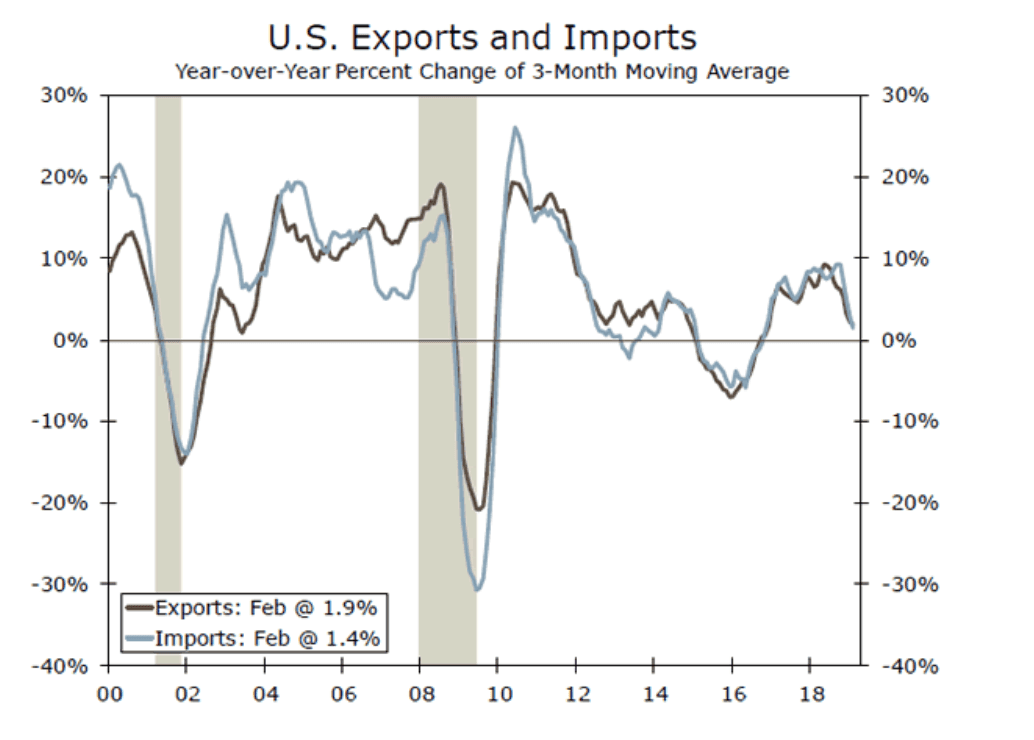

Trade is a key component of GDP which influences the Dollar. An increasing deficit, however, tends to be a sign of reduced growth and shows increased supply of Dollars by importers, which also weighs on the greenback.

“As the nearby chart shows, both import and export growth have been slowing on trend since the expansion of trade tariffs went into effect late last year. This has occurred alongside a drying up in global trade that has pulled global export volume growth into negative territory, a key factor identified by the IMF in its most dour forecast for global GDP growth since the global recession,” say Wells Fargo in a client note addressing the matter.

The Pound this Week: May's Concessions to Corbyn, GDP

We expect Brexit to remain the major mover of the Pound over coming days as this week has been set as the deadline by Prime Minister Theresa May for a deal between Labour and the Conservatives to be agreed.

Reports over the weekend suggest May is prepared to offer Labour fresh concessions to allow the two sides to come together.

According to Tim Shipman, political editor at The Sunday Times, "Theresa May will take a final desperate gamble to deliver Brexit this week by offering Jeremy Corbyn three major concessions in a bid to force MPs to back a new deal."

On Tuesday, May is being tipped to make a “big, bold” offer to Labour.

This could well be the point at which we find out whether a cross-party compromise is possible.

However, there are fears the PM's offer "could split the Conservative Party down the middle," says Shipman.

Labour are demanding the UK enters into a customs union with the EU following Brexit, which would mean the country is unable to strike independent trade deals which has been a key test of Brexit for many in the Conservative Party.

Labour and the Conservatives might well strike a deal but both parties are deeply divided over the issue and therefore even a deal does not necessarily a majority in the House of Commons can be secured.

So while the news pulse has turned positive for Sterling over recent days, there are clear limits as the risk that no deal is done and the Prime Minister resigns remains substantial we believe.

The main economic release for the Pound is preliminary GDP data for the first quarter, out at 9.30 BST on Friday, May 10.

This is expected to show a 0.5% rise compared to 0.2% of Q4 which would suggest the economy remains robust in the face of the ongoing Brexit saga. On an annualised basis i.e extrapolated to provide a yearly estimate, GDP is expected to have rise 1.8% compared to the 1.4% previously.

Other key releases out at the same time are the trade balance for March, manufacturing production for March, industrial production for March and business investment (Q1).

Business investment is expected to remain especially subdued as it is one of the facets of the economy hardest hit by Brexit.

Another important release is Halifax house prices out at 8.30 on Wednesday, and speeches from the Bank of England's Cunliffe and Haldane on Tuesday evening.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement