The Pound-to-Dollar Rate Has Further to Fall says BMO Capital Markets

- Written by: James Skinner

© IRStone, Adobe Stock

- GBP to decline by 5% before March says BMO Capital Markets

- Regardless of what parliament does about PM May's Brexit deal.

- As all roads lead to further losses for the GBP in the short-term.

The Pound-to-Dollar rate still has a lot further to fall before it will find stability, according to analysts at BMO Capital Markets, who say all roads lead toward further losses for the British currency over the short-term.

Pound traders have for weeks focused solely on the ebb and flow of the parliamentary Brexit process rather than traditional drivers such as economic data and what it might mean for Bank of England (BoE) interest rate policy.

This is because the parliamentary outcome will determine economic constraints that bind the BoE's hands for years to come, with a so-called no deal Brexit likely to mean lower-for-longer interest rates that weigh heavily on the Pound.

"We will enter 2019 with the most important aspects of the Brexit situation still unresolved. December was an enormously bad month for Theresa May," says Stephen Gallo, European head of FX strategy at BMO. "To the detriment of the GBP, the remaining Brexit permutations appear to be declining in number."

Prime Minister Theresa May survived a leadership challenge this month but she still lacks enough support in parliament for her Brexit Withdrawal Agreement to make it onto the statute book.

With parliament's vote on the bill delayed until mid-January, fears of an exit from the EU on World Trade Organization (WTO) terms have been growing by the day and weighing on the Pound.

The UK government was reported Tuesday, more than two years after the vote to leave the EU, to have begun planning in earnest for a no deal Brexit.

It's not yet clear whether those are to be genuine preparations for such an outcome, or whether they just mark the beginning of another effort by the government to strong-arm MPs into supporting the Withdrawal Agreement.

"The first permutation is a “hard Brexit” in which the UK legally exits the EU on March 29th without a deal, forcing the country to revert to WTO rules. We would assign a 45% probability to that outcome at this stage and assume a level of $1.20 in GBPUSD if that comes to pass," Gallo writes, in a note to clients.

Analysts and traders have been readying themselves for a seemingly inevitable defeat of the government when the House of Commons gets its "meaningful vote" on the Withdrawal Agreement in January.

Lawmakers on all sides of the House have pledged to vote against the proposals for a variety of reasons and the PM is currently expected to lose the ballot in the Commons.

Approval before March 29, 2019 is key if the UK is to avoid leaving the EU without any preferable arrangements in March 2019 and defaulting to trading with the bloc on WTO terms.

Above: Pound-to-Dollar rate shown at 4-hour intervals.

The Pound-to-Dollar rate was quoted 0.24% higher at 1.2647 Tuesday but has declined by -1.4% in the last month and -3.9% over the last three months. It is down by -6.3% for the 2018 year-to-date.

Above: Pound-to-Dollar rate shown at daily intervals.

Opposition and some government lawmakers are pushing for PM May to further water down the extent to which the UK separates itself from the EU.

Meanwhile, a key Brexit-supporting contingent of Conservative MPs have criticised the existing proposals for being a 'betrayal' of voters who backed leaving the bloc.

This leaves parliament quite apparently deadlocked ahead of the Christmas break, with no obvious way out of the mire for the New Year, which has led many analysts to anticipate further losses for the Pound over coming months.

"The second permutation is an extension of Article-50 leading to new elections and possibly a new Brexit referendum, depending on which party is able to form a government. We would currently assign this outcome a 55% probability and we assume a similarly low level for GBPUSD in that case, largely because of the risk of a far-left-leaning, Labour government," warns Gallo.

It's still possible that the government is able to persuade some opposition lawmakers to support PM May's deal in order to reduce scope for the UK to stage a complete break with the EU.

Such a development could materialise in February or March next year, but Gallo and the BMO team say the most likely outcome of all is that PM May fails to get her deal through parliament.

That could also easily lead to seismic implications for the Pound because it would amount to a failure of the government to make good on what is in reality its sole policy deliverable for the current parliament.

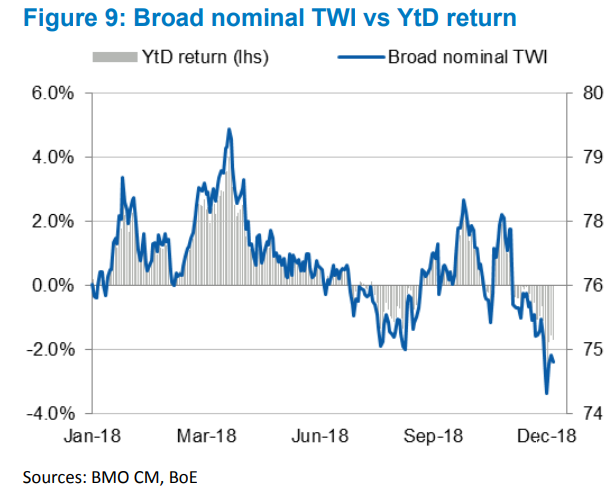

Above: Pound Sterling Trade-weighted Index. Source: BMO Capital Markets.

"The path to that vote will continue to embed a sizeable risk premium in the GBP. This is already reflected in the broad TWI, which currently trades very close to its lowest point for the year," says Gallo.

An extension of the Article 50 countdown period would be an admission of failure that Gallo says will lead to another general election.

That itself would be problematic for Sterling as it could mean a government headed by the Labour Party becomes all but inevitable.

Labour leader Jeremy Corbyn has previously stoked controversy with proposals to remove the Bank of England's independence, to spur investment through "people's QE" that would see money created to pay directly for some £500 billion of infrastructure spending and to make university education "free".

This is not to mention Corbyn's criticisms of capitalism and murmerings of policies that call into question his commitment to private property rights.

Gallo says that if the market gets a whiff of a Corbyn government being in the pipeline then the Pound would fall just as far as it could in the event of a so-called no-deal Brexit taking place.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here