Pound-to-New Zealand Dollar Rate Week Ahead Forecast: End of the Uptrend?

Image © Naru Edom, Adobe Stock

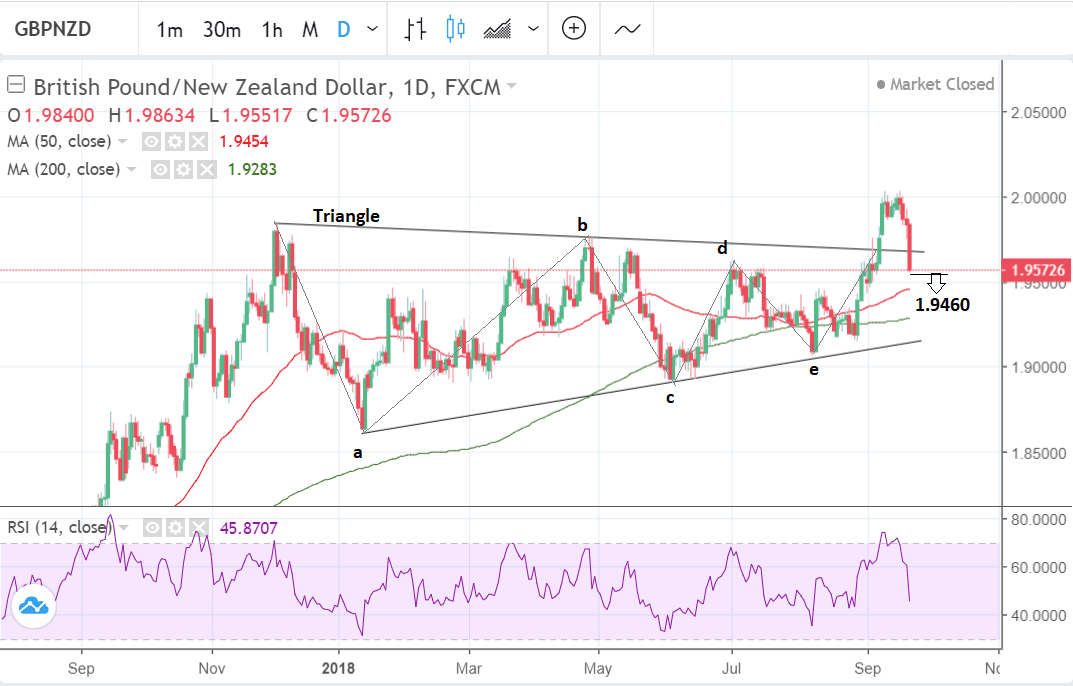

- GBP/NZD in spectacular reversal last week

- Pair could fall to 50-day MA at 1.9460

- RBNZ key event risk for NZD this week.

The Pound-to-New Zealand Dollar exchange rate has executed a potential u-turn in trend after it slumped at the end of last week on news that the E.U. and U.K. have reached an impasse in Brexit negotiations.

The Pound's rout occurred on Friday afternoon when Theresa May made a speech in which she said the E.U. would have to adopt a more constructive and proactive approach to negotiations in order for them to succeed.

May further reiterated her commitment to the referendum result and her view that 'no-deal' was better than a 'bad deal'. This frightened investors who saw the chances of the UK leaving the EU without a free-trade deal rise again and the Pound sold-off as a consequence.

The GBP/NZD pair had been rallying after breaking out of a long-term consolidation range or triangle pattern at the beginning of September.

We had expected the pair to rise to a target at 2.04 in line with the usual method of using the height of the triangle at its widest point and extrapolating it higher by 61.8%, however, it has failed to reach its objective and has now fallen back inside the pattern invalidating the breakout completely.

Of course, markets tend to throw curve balls at times ensuring even the best laid plans fail.

We now see the downtrend as dominant following last Friday's game-changing sell-off, and this biases the outlook to expecting lower prices and a further sell-off to a target just above the 50-day moving average (MA) at 1.9460.

Confirmation could be supplied by a break below the 1.9550 level.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The New Zealand Dollar: What to Watch

Global factors remain largely in charge of the New Zealand Dollar - when markets are trading with optimism we tend to find the currency benefits, and the the opposite is true when issues such as global trade war fears become elevated.

With this in mind, the new week starts on a poor footing following weekend reports that China has withdrawn for tentatively-scheduled trade talks with the U.S.

The decision to withdraw comes after the U.S. last week announced a fresh round of tariffs on Chinese imports. Markets fear the issue might not be resolved for a good period of time.

Domestically, data remains robust.

GDP statistics for the second quarter were released last week and numbers beat expectation by showing the New Zealand economy grew by 1.0% quarter-on-quarter and 2.8% annualised.

This could lead to increased expectations that the Reserve Bank of New Zealand (RBNZ) may change its tone at the next meeting on Wednesday at 22.00 B.S.T.

RBNZ governor Adrian Orr said at the last meeting in August that the next move in rates could be either up or down and that, in any case, rates may not rise from current levels until well into 2020.

This led to speculation that the RBNZ might even reduce rates.

"The Reserve Bank of New Zealand has a monetary announcement. When it last met, it sent NZD/USD tumbling to its lowest level in 2.5 years by pushing out its forecast for a rate hike from Q3 of 2019 to Q3 of 2020," says Kathy Lien, Managing Director at BK Asset Management.

"Since then, we’ve seen quite a bit of improvement in New Zealand’s economy, especially in consumer spending, GDP and inflation. In the second quarter, the economy expanded at its fastest pace in 2 years," she continues.

"Although weakness elsewhere keeps the central bank neutral, these latest reports reduce the chance of easing by the RBNZ and increases the odds of a slightly brighter outlook by the central bank," says Lien.

Another major release for the New Zealand Dollar is the release of trade balance data, which is forecast to show a -930m deficit in August, compared to -143m in July.

The data is due out at 23:45 B.S.T. on Tuesday. Any improvement in New Zealand's export-import balance could well support NZD temporarily.

A deeper deficit is likely to weaken rather than strengthen the Kiwi as it suggests greater selling of the currency to purchase imports than buying by foreigners to purchase exports.

ANZ business confidence data in September is out at 02.00 B.S.T on Wednesday and could be another driver of the exchange rate.

The Pound: What to Watch this Week

Currency markets are likely to continue to be affected by the shockwaves from the Brexit bombshell dropped by May at the end of last week and we will be looking for any new proposals from both the U.K. and E.U. aimed at unlocking the stalled process.

This week, further matters to consider on the political front include whether or not the Labour Party will back a second referendum on Brexit; something that is likely considering polling of Labour Party members suggests well over 80% are in favour of such an outcome. Reports suggest Labour leader Jeremy Corbyn will accept the will of his party on the matter.

Also of note is a report in the Sunday Times that Theresa May might be left with little choice but to call another general election in order to both shore up her own position and to deliver her desired Brexit plan.

Reports suggest her aides are suggesting an election might be called in November: We believe if this were to happen it will inject a significant amount of downside into Sterling which detests uncertainty.

Political developments are likely to dwarf the few economic data releases on the calendar, including industrial trends data from the Consortium of British Industry (CBI) (Monday 11.00 B.S.T), the Nationwide house price index (HPI) (Friday 7.00), business investment (Friday 9.30), current account data (ditto), Q2 GDP revisions (ditto) and gross mortgage approvals (Wednesday 9.30).

None of the above are major market moving releases unless they deviate hugely from their expected results.

Possibly of more importance for the Pound could be what Bank of England (BOE) officials say in their speeches in the week ahead about the current state of Brexit negotiations and associated risks - if they decide to comment, which they probably will.

BOE Monetary Policy Committee (MPC) member Gert Vlieghe speaks on Tuesday at 9.40, MPC member and BOE chief economist Andy Haldane at 11.45 on Thursday, and MPC member Sir Dave Ramsden speaks at 14.20 on Friday.

In addition, the week ahead also sees the release of the BOE's Financial Stability Report, at 4.30 on Monday, which will contain clues of the BOE's thinking on the outlook for the economy, although their assumptions about the outcome of Brexit may already be out-of-date following Friday's shock breakdown in negotiations.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here