NZ Dollar: Charts Flashing Weakness ahead of Central Bank Meeting

Images © Rafael Ben-Ari, Adobe Stock

- EUR/NZD and USD/NZD are showing potentially bullish charts ahead of RBNZ meeting on Wednesday

- Market consensus supports chart outlook with expectation of dovish delivery

- Overstretched downside positioning, in NZD, however, suggests bears may be exhausted and hints at caution

A combination of bearish price charts and a growing market consensus that the Reserve Bank of New Zealand (RBNZ) is likely to strike a dovish tone at its meeting on Wednesday, is creating the perfect conditions for a possible broad decline in the new Zealand Dollar.

At its policy meeting on Wednesday, the RBNZ is expected to keep interest rates (OCR) unchanged at 1.75% but strike a neutral or dovish tone - dovish meaning in favour of lower interest rates for a longer period of time - which could act as a drag on the Kiwi.

Lower interest rates weaken a currency by reducing foreign capital inflows due to the lower returns on offer.

The charts are backing up the overall negative outlook expected from the central bank.

USD/NZD, for example, has broken out above its triangle pattern and looks poised to extend gains up to a potential target of 1.5065.

The pair has also formed a bullish three-bar continuation pattern which further supports the possibility of more upside. Today's pullback could be explained as a temporary throwback to support at just-breached upper border of the triangle before the uptrend resumes.

The chances of a breakout higher are enhanced by the fact the pair was in a strong uptrend prior to the formation of the triangle pattern.

Confirmation is required however - and a break above the 1.4875 highs would be a necessary prerequisite before expecting higher prices.

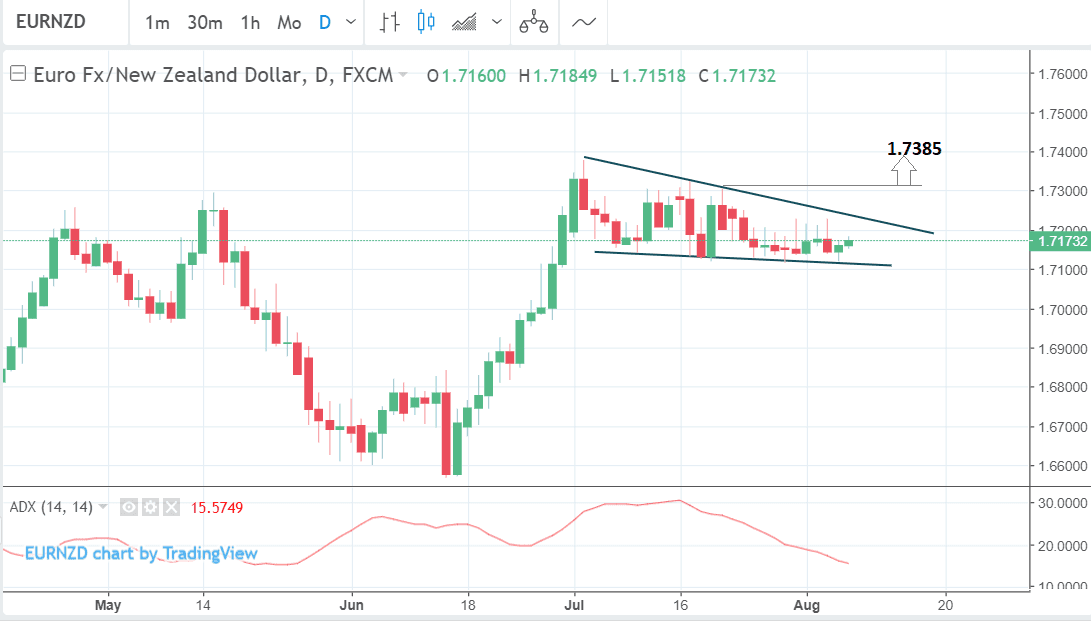

And it is not just USD/NZD which is showing bullish signs - a similar analysis can be applied to EUR/NZD, which has also formed a triangle-like consolidation pattern and looks poised to breakout to the upside.

In the case of EUR/NZD the pair has formed a triangle after a strong uptrend. The pattern looks like a pause after a strong bull-run. The expectation is for the market to go higher eventually.

Once again confirmation would be a necessary pre-requisite for a bullish continuation, with a break above the July 20 1.7306 highs providing the necessary green light; and a minimum upside target of 1.7385.

GBP/NZD: Kiwi More Resillient

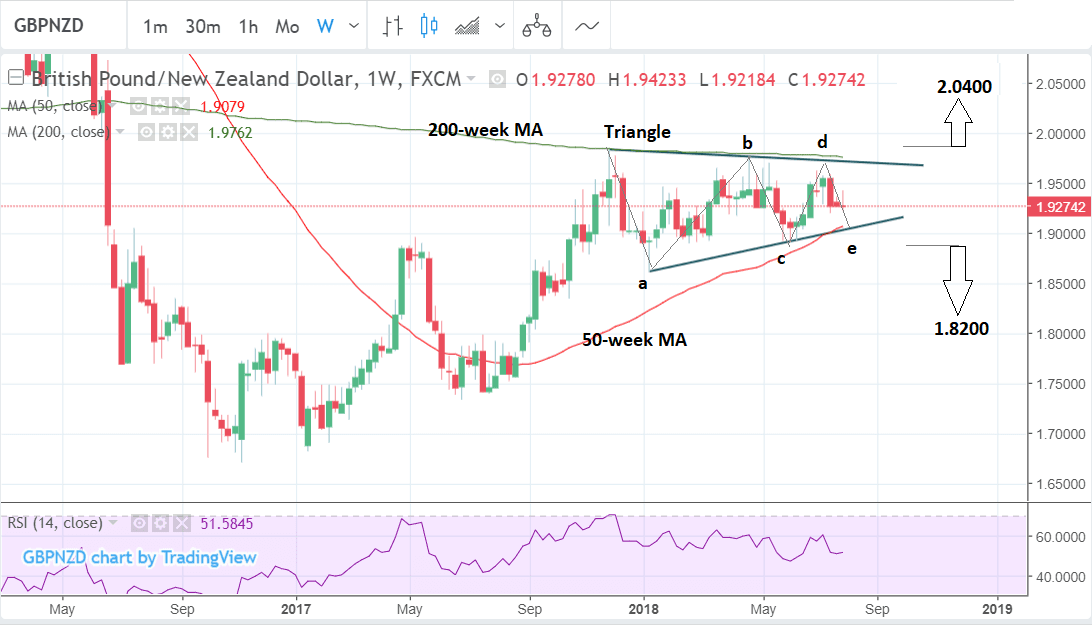

Our week-ahead technical studies of the Pound vs. New Zealand Dollar exchange rate meanwhile identify the pair as being more range-bound, but we do eye an eventual breakout.

the trapped nature of the Pound-to-New Zealand Dollar market which remains stuck in a very tight range in the 1.92-93s. Beyond that it is also trading within a wider range which it has been in since the autumn of 2017.

The highs and lows of this wider range have tapered into what looks like a triangle pattern, as illustrated in the chart below.

The triangle is likely to breakout but it is not clear yet in which direction.

The fact that the prior trend was bullish suggests a bias to an upside breakout.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

But Beware, the Market Might be Guilty of Being too Pessimistic on NZD

Recent data out of New Zealand has been mixed: inflation rose to 1.5% in Q2 from 1.1% in Q1, but it still remains below of the RBNZ's 2.0% target; and it has bobbed up and down inside a zone between 1-2% since the start of 2017.

Services and Manufacturing PMI Surveys, however, showed a dip in recent months which suggests an economic growth slowdown is on the horizon.

Unemployment has fallen to historic lows but failed to generate much upside in wages.

The threat of trade wars over-spilling into New Zealand's backyard is a further headwind.

Rising tariffs will hurt New Zealand more than other less export-orientated economies, and China is a major importer of NZ softs' so a slowdown there caused by trade problems would hurt demand for NZ commodities.

"We expect RBNZ to maintain OCR on hold at 1.75% at its upcoming meeting (9th Aug) amid cautious inflation outlook (but we expect an eventual move higher to 2% in early 2019), signs of moderation in global activity and ongoing trade war concerns between US and China," says Saktiandi Supaat, an analyst at Maybank.

"We were initially expecting RBNZ to possibly tighten rates as early as in 2H 2018 but given the recent comments from RBNZ Governor Orr (in May and Jun), those comments seemed to suggest that easy monetary conditions could stay on for longer," adds Supaat.

The analysts highlights the release of the RBNZ's quarterly Monetary Policy Statement (9 Aug) which he says will also be keenly watched.

"In particular we will be watching for potential wordings change in the MPS in relation to “above-trend pace of growth” and if RBNZ Governor Orr acknowledges the recent decline in Kiwi and if he flags the possibility of higher price pressures amid higher energy prices – the latter could be supportive for the Kiwi," says the analyst.

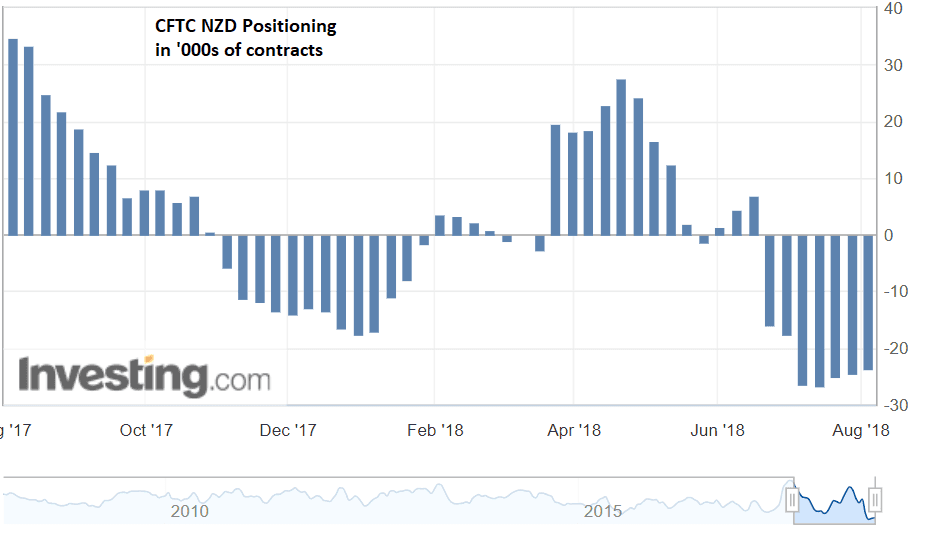

If there is a spoiler to our weak Kiwi view then it is the overstretched nature of Kiwi short trades in speculative FX markets, which suggests a rising probability of a snap-back higher.

the "unwinding of stretched NZD shorts could force a sharp rebound in the NZD," says the analyst.

The latest CFTC data, which tracks large fund positions in currency futures markets, showed net NZD was -23.7k contracts short on Aug 03, which suggest NZD short-positions remain dangerously extended and may be indicating the risk of a recovery in NZD.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here