Pound-to-New Zealand Dollar Rate Week Ahead: In a Range Within Range but RBNZ meeting Beckons

Image © Adobe Stock

- GBP/NZD is oscillating within a narrow range in a week when there is plenty of potential for volatility

- The pair has formed a compelling triangle pattern which will probably breakout soon

- The main release for the Pound is Q2 GDP data - for the NZD it is the RBNZ rate meeting

One Pound buys 1.9274 New Zealand Dollars on the interbank market at the time of writing, a purchasing power that is more-or-less unchanged on the previous week's close.

The lack of change in the exchange rate is symptomatic of the trapped nature of the Pound-to-New Zealand Dollar market which remains stuck in a very tight range in the 1.92-93s. Beyond that it is also trading within a wider range which it has been in since the autumn of 2017.

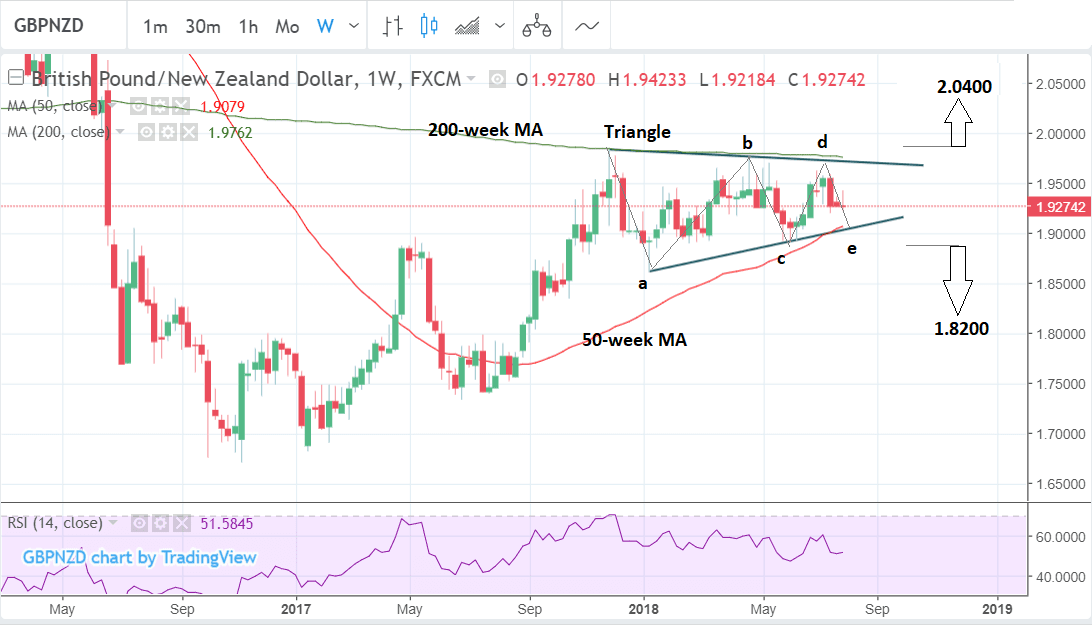

The highs and lows of this wider range have tapered into what looks like a triangle pattern, as illustrated in the chart below.

The triangle is likely to breakout but it is not clear yet in which direction.

The fact that the prior trend was bullish suggests a bias to an upside breakout.

The component waves of the triangle pattern are steeper on the way down than up, however, which suggests the opposite: that there is underlying weakness, which favours a downside breakout.

If the exchange rate breaks higher, confirmed by a move above 2.00 then it will probably extend to the upside target at 2.0400.

If it breaks below 1.8900 it will probably go all the way down to a target at 1.8200.

These targets are generated by extrapolating the height of the triangle at its widest part, by a ratio of 0.618, from the breakout point.

0.618 is known as the 'golden ratio', a mathematical constant found to govern proportionality in natural phenomena and financial market price series.

If there is a week when a breakout is likely then it is the week ahead since one of the most important events on the economic calendar for the Kiwi is scheduled - the meeting of the Reserve Bank of New Zealand on Wednesday August 8 at 22.00 B.S.T.

This promises to cause at least some volatility for the currency and could cause it to breakout from established ranges.

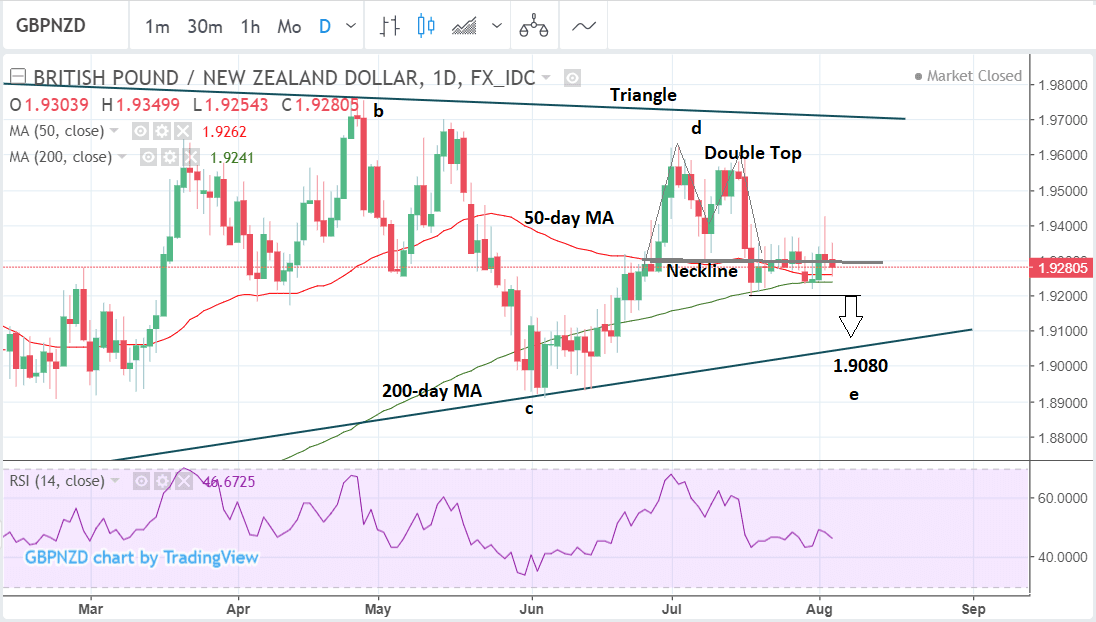

The daily chart gives a more bearish outlook.

The pair has formed a double top reversal pattern at the wave-d highs of the triangle and has broken below the neckline at the base of the pattern, confirming a move lower.

Although it has still not followed-through the the downside despite have broken below the neckline, it probably will eventually.

The double top has generated a downside target at 1.9080, calculated by taking the height of the double top and extrapolating it by 0.618 from the neckline. Confirmation would come from a break below the 1.9190 level.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

RBNZ Dominates the Calendar

The main event for the New Zealand Dollar is the meeting of the Reserve Bank of New Zealand (RBNZ) on Wednesday at 22.00 B.S.T to decide monetary policy.

Recent data has been mixed which suggests the RBNZ will probably continue with their neutral stance, neither hinting at a rate hike nor a cut. This is therefore unlikely to have a significant impact on the exchange rate.

"We expect to see the RBNZ reiterate its recent neutral messaging. Core inflation has increased but downside risks have not gone away, and should these materialise a cut would be firmly on the table. As a result, we expect that the RBNZ will be comfortable with a continued wait-and-see strategy, even as inflation lifts," says a note from ANZ ahead of the event.

The Kiwi appears to be tracking the Chinese Yuan lower at the moment, which is reacting to heightened trade war fears after the US increased tariffs on $200bn of Chinese goods from 10% to 25%.

RBNZ governor Orr will almost certainly comment on the wider geopolitical macro outlook when he comes to make his speech in Wednesday. Orr will not be able to ignore the threat of a global trade war and China slowdown given China is a massive consumer of NZD exports.

"Both the RBA and RBNZ are expected to leave monetary policy unchanged but their outlooks could be vastly different. The RBNZ has many reasons to be cautious while the RBA could find cause for optimism," says Kathy Lien, managing director of BK Asset Management.

"In New Zealand, however, data has taken a turn for the worse. Both countries face serious risks from slower Chinese growth and it will be interesting to see how they address it because so far, the RBA has stayed away from the issue while the RBNZ has concerns," says Lien.

Apart from the RBNZ meeting the other major release in the week ahead for the Kiwi is the global dairy trade auction on Tuesday afternoon.

The global dairy trade index measures the average price of a basket of dairy goods sold at an international bi-weekly auction.

The products include dry whole milk powder which is New Zealand's largest single export.

The changing price of dairy products can impact on the Kiwi given given their importance as an export and therefore their influence on aggregate currency demand.

Recently the index has been in decline and showed a -1.7% fall at the auction a fortnight ago. Further falls could hurt the Kiwi.

The Calendar for the Pound

Last week's price action confirms the Pound is not really paying much attention to Bank of England interest rates, and thus economic activity.

Instead, persistent concerns of the shape of Brexit negotiations remain the key driver.

In the week ahead, therefore, the main focus is going to be on the odds of a 'no-deal' materialising.

Prime Minister Theresa May cut short her holiday to meet French president Emmanuel Macron at his Riviera retreat over the weekend in an effort to gain more support for her proposals.

In the week ahead there is likely to be much focus on the outcome of this meeting. Early signs are Mr Macron has made it clear he does not want to 'go over the head' of his chief negotiator Michel Barnier, so its questionable whether the meeting achieved any traction for May's plans.

Barnier has been critical of May's plan saying the idea of the UK collecting tariffs on behalf of the EU 'unworkable', but without this element of the deal the UK will not be able to forge unilateral trade deals with third parties, killing the dream of new alliances, and making it completely unpalatable to already-sceptical Brexiteers.

May has already had problems uniting her party behind her plan and there remain many dissenters who think her proposals are too concessionary.

She therefore lacks any further negotiating slack to compromise with the EU, and this is why governor Carney has raised his risk assessment of a 'no-deal' outcome.

May's has given as many concessions as she can, yet it's not far enough for the EU. An intractable deadlock appears to be the new threat on the horizon and currency markets are expressing this by keeping Sterling under pressure.

From a hard data perspective the week ahead is fairly quiet, which is likely to further magnify Brexit as a driver.

The main release is Q2 GDP on Friday August 10 at 9.30 B.S.T, which is forecast to show a 0.4% rise after Q1's disappointing 0.2%.

Q2 GDP will be important mainly as a benchmark for comparing Q1 - if it really does come out at 0.4% then everyone will be relieved at the rebound and those who said the slowdown in Q1 was just a 'blip' due to 'the weather', will be vindicated. If, however, Q2 also shows a slowdown then economists will start to wonder whether this part of a deeper more troubling decline. Sterling may react.

Other important data in the week ahead includes the Trade Balance in June, released at the same time as GDP, which is forecast to show a -11.95bn deficit versus -12.36bn previously.

Industrial production is also out at the same time and forecast to show a 0.4% rebound in June. Manufacturing production, likewise, out at the same time and expected to show a 0.3% rise in June.

The Royal Institute of Chartered Surveyors (RICS) house price monitor is out at 00.01 on Tuesday. it showed a 1.1% positive score in June. The RICS monitor is composed of survey answers from surveyors about whether they think house prices have gone up, down or no-change.

Business Investment on Friday at 9.30, Halifax house prices and the BRC Retail sales monitor are out on Tuesday, and New Car Sales on Monday morning at 8.00, are further releases on the UK economic calendar.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here