Buy New Zealand Dollar, Sell Pound Sterling: TD Securities Strategists

The New Zealand Dollar has fallen just about far enough against the Pound, say exchange rate experts at TD Securities who suggest punters position for a rebound.

The New Zealand Dollar is being tipped to stage a recovery against the British Pound by analysts at global financial services giant TD Securities who believe Sterling's recent run higher against the antipodean currency might be coming to an end.

Although in a strong uptrend, TD Securities analyst Mark McCormick - who is the bank's North American Head of FX Strategy - doesn't think the Pound has much more scope to strengthen against the New Zealand Dollar.

The Pound-to-New Zealand Dollar exchange rate has been rising since mid-July when lows in the vicinity of 1.74 were rejected; the market has now recovered to 1.93+.

McCormick believes the Kiwi is now undervalued at such levels, whilst the Pound is temporarily overvalued.

The inference, therefore, is that each currency will drift from their relatively 'under' and 'over' valued positions back towards their 'real' or 'fair' as it is called by analysts, value.

This will involve the Kiwi rising and the Pound falling, leading to Pound-to-New Zealand Dollar exchange rate falling.

It's All a Question of Politics

The reason McCormick sees the New Zealand Dollar temporarily undervalued is owing to politicically-inspired weakness.

The new government is proposing policies which are viewed as negative for the currency, and even though they have not yet been implemented (mostly) the expectation they will has weighed on the Kiwi's exchange rate.

Yet McCormick thinks the risks to the currency have been overestimated, and once this becomes clear it will recover.

"While there is room for the government to enact reforms that would potentially weaken the supply-side (and thus potential growth of the economy), we think there is room for NZD to tactically price out some of the negative risk premium," says McCormick.

Data Ignored

The other major driver expected to help the Kiwi recover is relatively strong economic data, which hitherto has not been adequately reflected in the exchange rate.

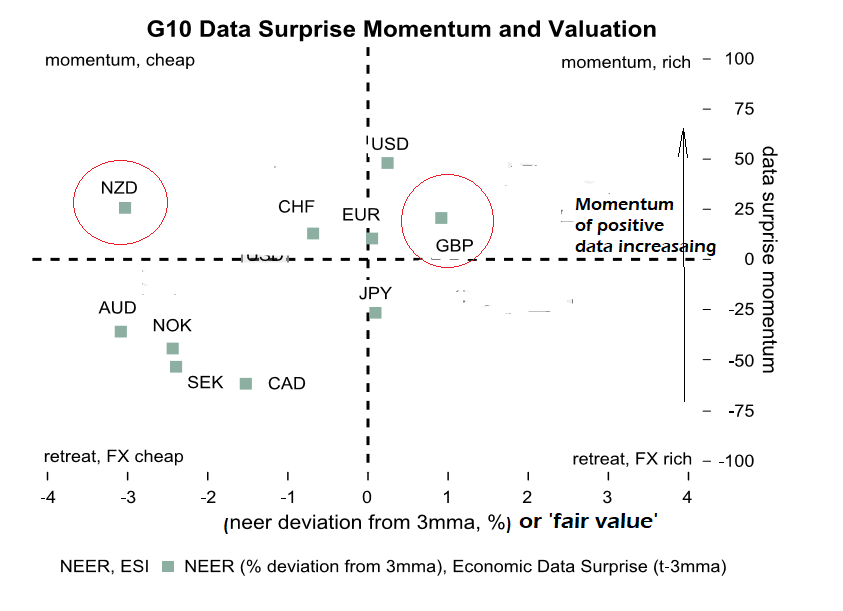

"NZD data has started to improve against market expectations over the past three months. In fact, NZD data has shown the strongest momentum on this metric, but kiwi continues to trade at a 3% discount," says McCormick.

This contrast with the Pound which has been absorbing - or pricing in - the implications of UK economic data:

"GBP, on the other hand, shows modest data acceleration, but the currency has largely priced most of this in. What’s more, under the hood, the acceleration in the UK data surprise indicators mask some of the inconsistencies of the top-tier reports."

Not a Betting Man...

The final factor relates to what analysts call 'sentiment' and 'market positioning'.

This is about comparing the number of positive or negative bets on a currency in the futures market.

It actually works in a sort of contrarian way, which means the opposite is indicated by what the majority of traders are betting.

If an extreme number are betting that the Kiwi will go up - otherwise known as being 'long' - then the market tends to be about to go down, and vice versa for betting down, or being 'short' as it is called.

In the case of the Kiwi and the Pound, the positioning and sentiment data show traders are heavily long the Pound and heavily short the Kiwi, inferring the former will actually weaken and the later will rise.

"We also note that our momentum-based trading signal that shows CTAs are heavy longs in GBP, but extremely short NZD. By the same token, our hedge fund tracker shows that while the macro community has pulled back a bit on GBP, they remain modestly long," says TD.

CTA's are Commodity Trading Advisers - which is type of active investment fund like an asset manager or hedge fund, ie one which actively trades.

GBP/NZD Trading Recommendation

TD Securities must be quite certain of their conclusions as they include clear-cut trade recommendations for profiting from the expected fall in GBP/NZD.

They see the pair falling from current levels to a target of 1.8696.

They place a stop - which means an order which will automatically close the position - if they are wrong and the market rises instead to 1.9620.

"We added a short GBPNZD position to our model portfolio. The trade is booked at current levels (spot reference 1.9305) and targets a move to 1.8696. We place the stop above the recent high at 1.9620, implying a 2/1 reward to risk ratio."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.