New Zealand Dollar: Interest Rate Decision Preview

The New Zealand central bank has the power to influence the exchange rate to a considerable degree although analysts are divided as to whether it will when it meets to decide its next policy step on Thursday.

The meeting of the Reserve Bank of New Zealand (RBNZ) on Thursday, November 9, (Wednesday 20.00 GMT) stands out as the New Zealand Dollar's main event of the week.

The RBNZ will decide what to do with the country's base interest rate and communicate guidance on future policy moves. No move on the interest rate is expected, but markets will be keen to hear what the Bank has to say on policy, particularly now that a new government has been installed.

The RBNZ is a 'bank of banks', which means it safeguards and lends money to high street and commercial banks, who then safeguard and lend that money to customers in the wider economy.

The RBNZ charges interest on its loans to other banks just as bank's charge us interest when we borrow from them, and the interest rate it charges is known as the 'OCR' (Official Cash Rate), and it is decided by the RBNZ's governor after consultation with his staff at regular meetings of the bank such as the one this evening.

The base interest rate set by the RBNZ is important because it is passed on by other banks - with a profit margin added on - to their customers, therefore, it has a knock-on effect on wider interest rates.

When inflation rises the RBNZ raises interest rates to dampen inflation by encouraging people to save rather than spend and discouraging them from borrowing by making borrowing more expensive.

When growth slows down the RBNZ lowers base interest rates to encourage more spending (rather than saving) and more borrowing by making borrowing cheaper.

Impact on Kiwi

Changes in the RBNZ's base interest rate has a direct and significant impact on the New Zealand Dollar.

When interest rates rise, so does the Kiwi, because the higher interest rates attract greater inflows of foreign capital from global investors looking for a profitable but safe place to store their money; this increases demand for the host currency raising its value.

When interest rates fall foreign investors sometimes withdraw their capital and search for somewhere with higher interest rates to put it.

Thus nations act like huge 'banks' for international financial markets, with those nations that can offer higher interest rates getting more of the share of the multi-trillion dollar pie.

Coming back to the meeting of the RBNZ this evening - if it decides to raise interest rates from the current 1.75% level, or signals it may raise them in the future - it will lead to a rise in the Kiwi, whilst if it lowers or signals it may lower interest rates in the future that will weaken the Kiwi.

Currently, the vast majority of economists and analysts do not expect the RBNZ to change the OCR because they signaled in August that they did not intend to change interest rates until 2019, and not enough has happened since then to alter that perception.

With expectations so low of a rate change this evening, the focus will be on the wording of the monetary policy statement which accompanies the decision and explains why the Bank did what it did, even if it did nothing. If the wording suggests inflation is rising faster than expected then that would increase the chances of a rate rise in the future, which will impact on the exchange rate accordingly.

New Government

Apart from the RBNZ's view on the path of inflation and interest rates investors will also be watching for the RBNZ's response to the recent changes in the New Zealand government.

The October general election was a significant even for the Kiwi which weakened substantially around the time because the parties which gained power had policies which economists said would lead to weaker growth, as well as policies of reforming of the RBNZ, which they said would encourage lower interest rates.

The main policy reform suggested by the new government for the RBNZ to adopt is a mandate for fostering 'full employment'.

This would mean the RBNZ would have to take into account the state of the labour market before making decisions about monetary policy.

Generally, this leads to lower interest rates because they stimulate spending which increases growth and creates jobs.

But lower interest rates also mean a weaker NZD.

The other major plank of reform the new government wants to implement is for the RBNZ to make decisions via a committee rather than the governor alone as is currently the case - again this is thought to marginally favour lower interest rates - also known as 'dovish' policy.

Apart from that, the wider economic policies embraced by the new government are also seen as potentially negative.

The new government wants to limit foreign ownership and lower immigration substantially, both measures are seen as reducing growth, and investors will be keen to assess what the acting governor of the RBNZ Grant Spencer has to say about the economic outlook in light of these new policies event though only a few have been approved.

One question on investors minds might be whether uncertainty brought about by regime change has impacted business activity to the extent that interest rates may now stay lower for longer than previously anticipated.

Analysts' Views

Currency analysts at Canadian investment bank TD Securities expect a shift in the RBNZ's statement to signal that the next move in interest rates will be up which would help the currency.

"We look for a shift in rhetoric to suggest that the next move for the OCR is up. We look for a quarter-point upgrade to the Bank’s inflation forecasts across the forward estimates to justify this hawkish stance," say TD Securities.

ING's Head of Foreign Exchange Strategy Chirs Turner thinks NZ political risks are already fairly priced into the currency - and "the story may, in fact, be slightly overdone."

The RBNZ's inflation expectations are likely to be key to FX volatility, says Elias Hadid, Analyst at Commonwealth Bank of Australia.

"Our base case scenario is for the RBNZ to make no material changes to its growth, inflation and policy outlook," says Hadid.

The RBNZ's current projection is for just a single interest rate rise by March 2020, bringing the OCR to 2.0%.

If the RBNZ changes its inflation forecast, however, it may also change when it expects to make the first hike, which could have a knock-on impact on the Kiwi.

The RBNZ's current projection for inflation is for headline CPI (Consumer Price Index) to rise to 2.0% by March 2019, which is in the middle of their 1-3% ideal range.

ACLS Global Chief Strategist Marshall Gittler thinks the meeting will be something of a non-event for markets as it is too soon after the election to expect big changes or dramatic pronouncements from the RBNZ:

"With the new government just getting started, it’s a bit too early to estimate what impact they might have on the economy, meaning it’s probably wisest to keep the outlook unchanged until they see how things unfold."

Gittler expects no change in the policy guidance paragraph of the accompanying statement which has "effectively remained unchanged since February" and therefore offering, "little impetus to trading either before or after the event."

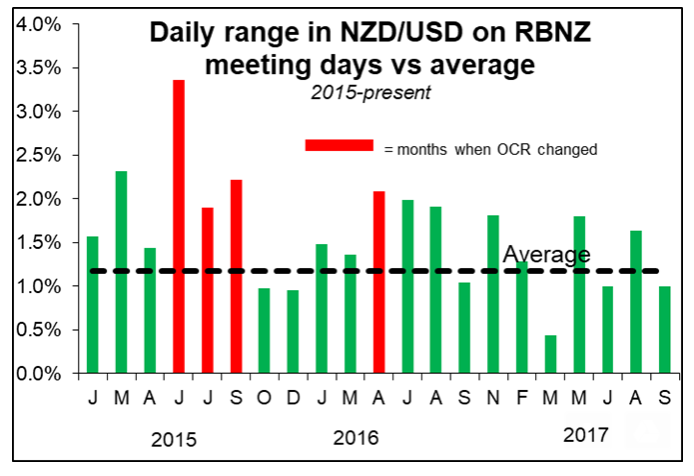

Indeed, as central bank meetings go, those of the RBNZ do not historically show much more volatility than usual.

The graph below, provided by ACLS's Gittler, for example, shows the length of the daily range on RBNZ meeting days which have shown nothing extraordinary recently, suggesting exceptional volatility is unlikely tonight.