New Zealand Dollar at Risk of Stalling as it Reaches Key Levels on Several Major Pairs

The New Zealand Dollar (Kiwi) has been one of the strongest currencies of late as the economy continues to shine and the currency manages to avoid some of the headwinds faced by fellow commodity currencies.

Unlike the Aussie Dollar, which has weakened on falling demand for Iron Ore from transforming China, and the Canadian Dollar which has softened as a result of the collapse of the price of oil, the Kiwi has actually seen its commodity prices rise, as proven by the rally in Dairy prices via global dairy trade auctions.

We recently commented on the volte face executed by the GBP/NZD pair after the exchange rate - which had been rising strongly - suddenly reversed and started to weaken.

Yet we also noted how the pair has now reached - and started to pierce - a robust double layer of support made up of the 50-day moving average and the neckline of the previous double bottom pattern at 1.7980 (current level 1.7945).

These levels are likely to hold up the pair in its tour south, limiting NZD gains.

Along with this observation, however, we also have analysis from Blackwell Global’s Steven Knight who is suggesting a similar dynamic is afoot on the NZD/USD pair.

Here too the pair appears to be nearing a weighty level which could cap NZD gains.

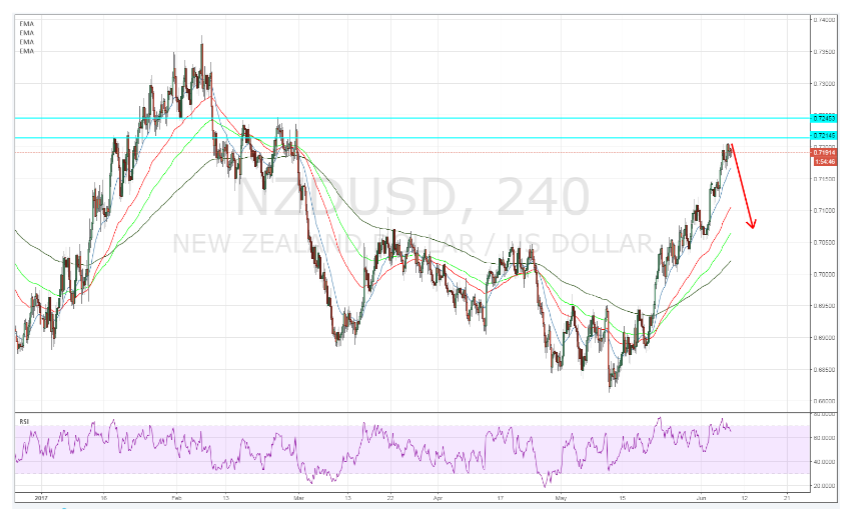

“The past month has been almost meteoric for the venerable Kiwi Dollar as the currency has continued to rally to its current position at 0.7190. However, despite the strong bullishness, the various technical indicators are signalling that a change could be in the wind for the pair. In particular, price action is nearing a key reversal/supply zone which could be suggesting that a decline is likely in the coming days,” said Knight.

The most “concerning factor” according to the analyst is the “looming supply zone”, by which he means an area where sellers are likely to come into the market in higher numbers (light blue lines on chart below), which could push the exchange rate down.

This zone is at about the 0.7215 level which is just above the current 1.7200 level.

Blackwell’s Knight sees the FOMC decision next week as a key determinant for the pair, with the potential for a rate hike to provide the catalyst for a reversal.

“However, the Kiwi Dollar is still relatively at the behest of the U.S. Federal Reserve’s looming rate hike decision. At this stage, it remains unclear whether the central bank will hike rates at its coming FOMC meeting but the reality is that the NZDUSD is likely to be struck with a range of volatility regardless of the outcome. Subsequently, this is likely to result in a change in tack for the pair and, if the central bank hikes rates, will lead to a significant depreciatory period,”

The most likely scenario is for the pair to “fail to penetrate” the supply zone and fall back down, driven by bearish bets following the Federal Reserve’s decision to increase rates.

If the Fed is more hawkish than expected – which means more in favour of hiking rates in the future – then the pair could sell-off more rapidly, with Knight indicating 0.7055 as a level to look out for.

“In addition, any move by the U.S. Federal Reserve to raise rates, or take a hawkish tone in the looming meeting could also cause depreciation for the Kiwi Dollar. Subsequently, there are plenty of factors to suggest that the pair could be in for a rough week ahead given both the technical and fundamental aspects,” concluded the analyst.