New Zealand Dollar Surges and Takes RBNZ into Nightmare Country

Pound sterling has fallen like a stone against the New Zealand dollar after the RBNZ opted to keep interest rates unchanged at 2.25% in their June policy meeting.

The rapid appreciation of the New Zealand dollar over recent days has accelerated on Thursday the 9th of June and on the basis of recent moves should be the best performing currency in G10 for the second consecutive week.

The reason for the rapid advance in the NZD was the Reserve Bank of New Zealand's decision to stand pat on interest rates.

Heading into the decision analysts were evenly split as to whether or not the RBNZ would cut the rate from 2.25 to 2.0 pct at the June 9th meeting.

The surge in NZD reflects this uncertainty going into the event. It also appears that the RBNZ has a problem on its hands - if the strength of the kiwi was a niggle earlier, then now it is a full-blown headache.

The already unprofitable New Zealand dairy sector will have seen their products become a little more expensive on the world market place while other exporters will also be considering the size of their future order book on this basis.

The already unprofitable New Zealand dairy sector will have seen their products become a little more expensive on the world market place while other exporters will also be considering the size of their future order book on this basis.

The rocketing NZD will also do little to stimulate imported inflation as international products now become cheaper.

Yet, "we expect inflation to strengthen reflecting the accommodative stance of monetary policy, increases in fuel and other commodity prices, an expected depreciation in the New Zealand dollar and some increase in capacity pressures," reads a section of the statement that accompanied the decision.

Just how will this weaker exchange rate be achieved? Is the Bank expecting the dollar to rise following Federal Reserve interest rate rises. Is the Bank expecting the pound sterling to recover after Brexit? All these cannot be guaranteed and leave the RBNZ looking like a passenger.

The Bank did mention that, "further policy easing may be required to ensure that future average inflation settles near the middle of the target range. We will continue to watch closely the emerging flow of economic data."

However, markets remain unconvinced that the RBNZ can do much in the face of rising house prices.

Indeed, one of the standout lines of Wheeler's statement was, "house price inflation in Auckland and other regions is adding to financial stability concerns. Auckland house prices in particular are at very high levels, and additional housing supply is needed."

An Incredibly Hard Call to Make

Our coverage ahead of the June RBNZ event confirmed the world’s leading FX and fixed income analysts are split on what course of action Governor Wheeler and his team will take.

The problem is there are two very strong competing arguments for and against a rate cut, and to us it seems that the RBNZ will lose either way.

Why the RBNZ must cut:

- Inflation remains uncomfortably weak and well below the mandated target

- The NZ dollar remains historically expensive, surpassing NZ exports

- The dairy sector continues to suffer from historically low prices

Why the RBNZ can’t cut:

If you compare the two arguments based on the above then surely a rate cut would be a no brainer?

I would say don’t forget just how debilitating a house price crash can be to an economy - indeed, the entire 2008 crisis was centred around house prices.

I am in no way suggesting that the New Zealand financial system is similar to pre-2008 Europe and America, but who knows what underlying problems boiling below the surface which are specific to New Zealand?

“If the Bank doesn’t cut rates this week there is a very real risk that the NZD forges higher still. This is nightmare country for the RBNZ, a soaring currency accompanied by soaring house prices and soaring household debt,” says Stephen Toplis at BNZ.

Toplis quite rightly points out that the Bank is damned if it does, damned if it doesn’t.

BNZ reckoned no cut was likely and anticipated a dovish statement and warned the Governor would have to work extra hard to keep the NZD in check.

BNZ also believed in order to keep the kiwi dollar under control an explicit confirmation that at least one rate cut will be required before the end of this year.

It appears the RBNZ was just not negative enough.

The Pound vs New Zealand Dollar - Where Next?

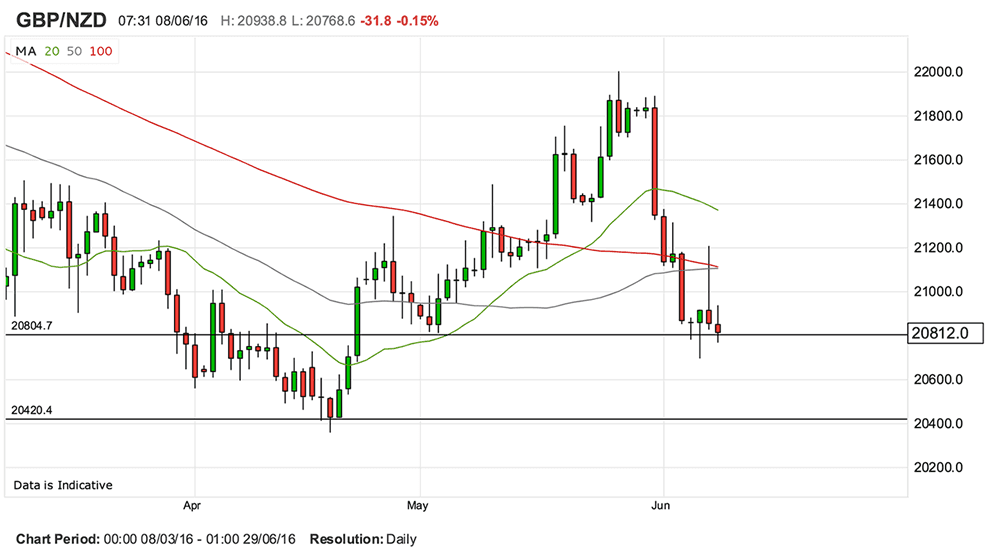

Ahead of the event we had forecast the GBP/NZD to move lower over coming sessions, but not at this speed.

Those with international GBP-NZD payments to make will see their bank accounts offering a transfer of as low as 1.9636. Better rates from independent providers, some as much as 5% higher than bank rates, are seen in between 2.0165 and 2.0022.

Our target was the 2016 lows located at 2.04:

In the event, sterling now sits at 2.0350 New Zealand dollars.

Yet, we will look to see whether some bargain buying takes place over the next couple of days and whether or not the pair can consolidate back above the 2.04 level.

If this is the case then a small rebound could take place, however we would not expect strength to exceed resitance at 2.08.

Not until the RBNZ gives a hint of more agressive interest rate cuts and the United Kingdom votes to Remain in the European Union.

With GBP/NZD subject to a host of bearish trend signals it now looks set to fall back below the 2.0 level.

The big level of support to watch is 1.93 - the base for trade through 2014 and 2015.

NZD/USD Exchange Rate Forecast Towards 0.70

The US dollar, like sterling, has also been a laggard over the course of June exposing the NZD to USD conversion to a convincing recovery.

Here too, the outlook appears to favour the kiwi.

"Taking a look at the pair’s technical indicators demonstrates the strength of the recent rally with price action soaring towards the 70 cent handle. In addition, price remains strongly above the 100 day moving average which is also a bullish signal. However, there might be some bearish pressure building as divergence becomes evident within the RSI Oscillator," says Steven Knight, Senior Market Strategist for Blackwell Global.

While Knight acknowledges the risks posed by the RBNZ he believes the likely play in the days ahead will be a continuation of the bullish trend until the currency pair reaches a key resistance zone at 0.7000, which also represents the bottom of the May’s channel.