GBP/NZD Rate Week Ahead Forecast: Pressured

- Written by: Gary Howes

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate remains under pressure and is forecast to test early June lows again.

The New Zealand Dollar has been one of the better-performing global currencies of the past month, and this outperformance can continue in the coming days and weeks.

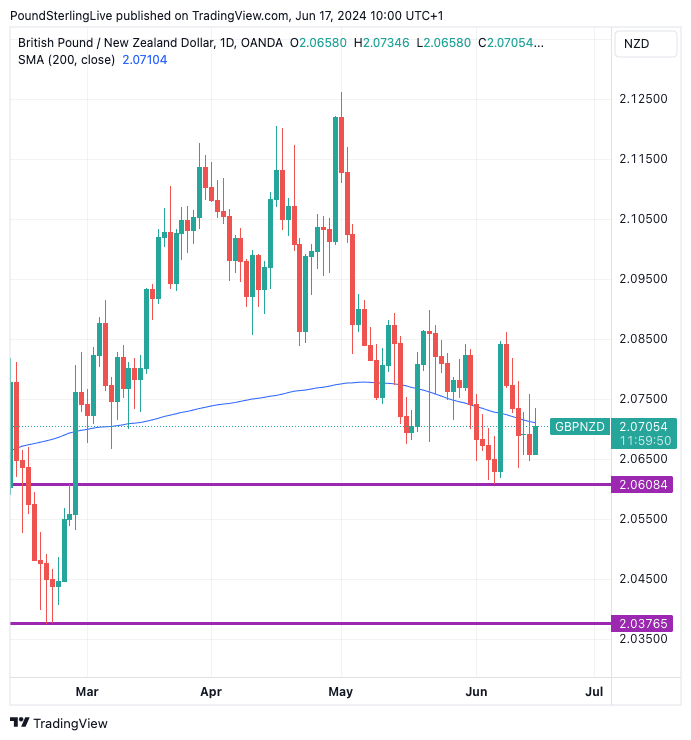

Kiwi strength will ensure GBP/NZD stays under pressure, and we forecast a gradual trend to the 2.06 area, where the exchange rate found support and rebounded in the early days of June.

Above: GBP/NZD at daily intervals. Track GBP/NZD with your own alerts, find out more here.

GBP/NZD is trading below the downward-sloping 200-day moving average, which provides technical confirmation that the downside stance is preferred. This means GBP rebounds are expected to fizzle out, with the legs lower tending to be bigger.

A break of the 2.06 support zone opens the door to a fall to 2.04, the 2024 low. However, this would be something that we would expect in a two- to six-week timeframe. Of course, selling interest can pick up speed if this week's UK data lands on the wrong end of the line for the Pound.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The key release to watch comes on Wednesday when the services inflation print is released. Services inflation beat expectations last month and confirmed underlying inflation trends are running well ahead of levels consistent with a durable fall in UK headline inflation to 2.0%.

"My prediction for next week’s CPI inflation figures. Headline 2.3% (unchanged). Services inflation 6% (+0.1). Goods inflation -1% (-0.2). Core inflation 3.8% (-0.1%). Not enough change to prompt a rate cut from MPC," says Andrew Sentance, an economist and former member of the Bank of England's MPC.

In May, Sentance correctly predicted that April's inflation reading would overshoot expectations, and if he is again correct, these upside surprises will likely boost the pound.

The Bank of England and other economists expect a steady pickup in inflation over the remainder of the year owing to elevated services inflation levels. Another above-consensus reading would raise questions about just how fast the Bank of England can cut interest rates, which can underpin the Pound on a relative interest rate basis.

This would keep GBP/NZD above 2.06, although we doubt it will radically shift the broader negative tone to GBP/NZD.

The Bank of England is in focus on Thursday and guidance regarding the prospect of an August interest rate cut will determine where the Pound ends the week. The market currently sees less than a 50% chance of an August rate cut, meaning there is scope for repricing in a GBP-negative direction.

Dave Ramsden and Swati Dhingra are likely to again vote for an immediate cut. What will be interesting is whether more members of the MPC join them in voting for a cut. If yes, the odds of an August rate cut will rise, weighing on the Pound.

GBP/NZD likely falls below 2.06 if this occurs.

"The pound may lose some of its recent momentum if UK services inflation comes in cooler than expected next Wednesday, as it would raise the probability of a BoE cut in August and bring rates differentials back to the fore," says George Vessey, Lead FX Strategist at Convera.

That said, last month's above-consensus inflation print will be a sober reminder to the MPC that UK inflation is likely to prove sticky in the coming months. This should encourage a degree of caution that can, on balance, mean any weaknesses in the Pound are short-lived.

"Monetary policy will remain a more important driver for the pound sterling, which should remain robust thanks to a late-moving Bank of England and a nascent economic recovery," says David Alexander Meier, an analyst at Julius Baer.