GBP/NZD Week Ahead Forecast: Downtrend Risks Grow, RBNZ in Focus

- Written by: Gary Howes

Image © Pound Sterling Live, Still Courtesy of RBNZ

There are definite signs of a weakening trend in the Pound to New Zealand Dollar exchange rate and technicals are increasingly pointing to lower outcomes.

But this is an important week for both the New Zealand and UK economies, with a central bank decision in the former and an all-important inflation print in the latter likely to stir the pot.

Recent New Zealand Dollar outperformance is the context as we head into these events.

"The strongest currencies since mid-April have been the Australian dollar and the New Zealand dollar. Indeed, the Australian dollar has rallied by 3.7% versus the US dollar, and the New Zealand dollar by 2.9%," says Georgette Boele, Senior FX Strategist at ABN AMRO.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

NZD outperformance comes amidst rising bets that the Federal Reserve will cut interest rates for the first time in September, which has had the effectof easing global financial conditions and boosting investor sentiment.

This is forms a classic pro-NZD backdrop that we think can remain in place in the near-term and pressure GBP/NZD and other NZD exchange rates.

The daily chart shows GBP/NZD has now broken below the 200-day moving average, which our Week Ahead Forecast rules states as shifting the market from uptrend into downtrend.

Above: GBP/NZD at daily intervals with the 200 DMA and RSI (lower panel) annotated. Track GBP/NZD with your own custom rate alerts. Set Up Here

But note in the above that there is some support coming in at 2.0679 which has slowed recent selling and we wonder if it forms the basis of some near-term strength.

Note the RSI indicator in the lower panel has turned up, which also speaks of easing pressures. We expect any strength to take the market back to the 200 DMA at 2.0766.

The main events of the week will be Wednesday's RBNZ decision and the UK's inflation release. Expect the RBNZ to hold the cash rate at 5.5%.

With rates being kept on hold, what matters greatly is the communication and whether it introduces the idea of a need to cut rates in the coming months. This would be warranted owing to the slowing economy, but policymakers will be wary not to risk acting too early given inflation has simply not fallen as far as required.

"They will maintain a very forceful bias, for now," says Jarrod Kerr, Chief Economist at Kiwi Bank. Market pricing shows a decent bet amongst investors for the central bank to cut interest rates for the first time in August as it responds to a slowing ecnomy. Indeed, the central bank will be conscious that it has cut aggressively compared to most G10 peers and therefore has more to play with.

Any hint at such an outcome in August will potentially lead to New Zealand Dollar weakness.

However, economists we follow think it will be too early to signal any major moves and a steady-as-she-goes outcome is more likely.

This means New Zealand interest rates will remain deep in restrictive territory, weighing on domestic activity. But from a currency perspective, this can help extend recent NZD outperformance.

"The economy has weakened. Inflation is falling. But we’re not there yet. Cuts will come (if and) when inflation breaks back below 3%," says Kerr

"The RBNZ are winning the war on inflation. But there are a few battles left. The earliest the RBNZ are likely to cut, is November, after we get the 3Q CPI report," he adds.

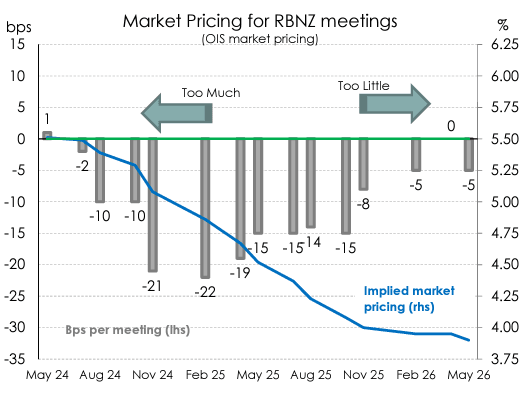

Above image courtesy of Kiwi Bank.

Kiwi Bank says rates markets are factoring in too much, too soon, but then not enough over the medium term, as per the above chart.

The market's 42bps of cuts expected by November compares to Kiwi Bank's 25bps.

But the terminal rate around 4% late in 2025, is well above their expected move to a neutral setting of 2.5-3%.

Any 'hawkish' repricing for 2024 can support the NZ Dollar in the coming weeks, but any aggressive pickup in rate cut bets further down the line will limit upside potential in the coming months.

An important UK inflation print is due on Wednesday, with the outcome likely to determine whether the Bank of England proceeds with an interest rate cut in June.

The market expects CPI inflation to fall to 2.1% year-on-year in April from 3.1% in March, and the core inflation rate to fall to 3.7% from 4.2%. Any deviation from these expectations can influence the currency, with the Pound gaining on upside surprises and falling on any undershoot.