New Zealand Dollar: "Things Could Start to Look Better"

- Written by: Sam Coventry

Image © Adobe Stock

The New Zealand Dollar has been weighed down by various factors of late, but a new analysis from Commerzbank says "things could start to look better in the coming months".

The analysis notes the New Zealand and Australian Dollars are still trading well below last year's interim high, thanks in part to broader U.S. Dollar strength and domestic factors.

"The Chinese economy has entered a period of weakness in recent months, which has naturally had an impact on the Australian and New Zealand economies given their close interdependence. All of this has weighed on AUD-USD and NZD-USD," says Michael Pfister, FX Analyst at Commerzbank.

In addition, the analyst notes that previous interest rate hikes are now clearly having an effect on the Australian and New Zealand economies; for example, the unemployment rate in both countries has risen significantly from its trough.

"Economic growth in both countries has now slowed considerably (see charts below). In New Zealand, year-on-year growth actually turned negative in the third quarter. The fact that growth in New Zealand has been significantly weaker is likely to reflect the RBNZ's sharper interest rate hikes," says Pfister.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But, there are reasons to be optimistic, according to the Commerzbank analyst:

"The labour market in both countries remains robust despite clear signs of a slowdown. The central banks also expect the overall labour market to weaken only slightly further."

In New Zealand, most of the interest rate hikes have probably now reached the real economy and the dampening effect should gradually fade. (Read: NZD rallies, ANZ says RBNC could hike again).

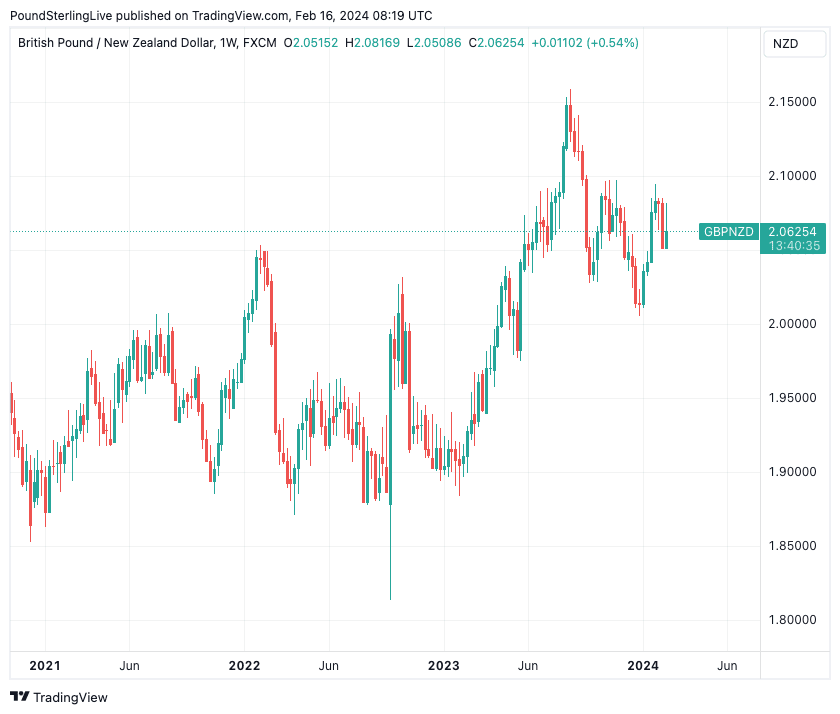

Above: GBP/NZD at weekly intervals, showing a steady strengthening since 2023. Track GBP?NZD with your own custom rate alerts. Set Up Here

In addition, Commerzbank's China experts expect Chinese economic growth to slowly stabilise, which should also limit the negative news for the real economy in Australia and New Zealand.

As a result, economic growth in New Zealand is expected to slowly stabilise, albeit at a weak level.

Inflation in New Zealand has meanwhile "proved more persistent than elsewhere" according to Commerzbank, which should mean the RBNZ continue to act cautiously despite this weaker growth.

Given other major central banks are openly discussing interest rate cuts, a later cut at the RBNZ "should support" the NZD, according to Pfister.

"Despite a weakening real economy, we continue to expect a moderate appreciation of the AUD and NZD. The reason for this is the surprisingly hawkish stance of the central banks, which have not yet been dissuaded by falling inflation and are therefore likely to start cutting rates much later than other G10 central banks," says Pfister.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes