GBP/NZD Week Ahead: Nearing Overbought

- Written by: Gary Howes

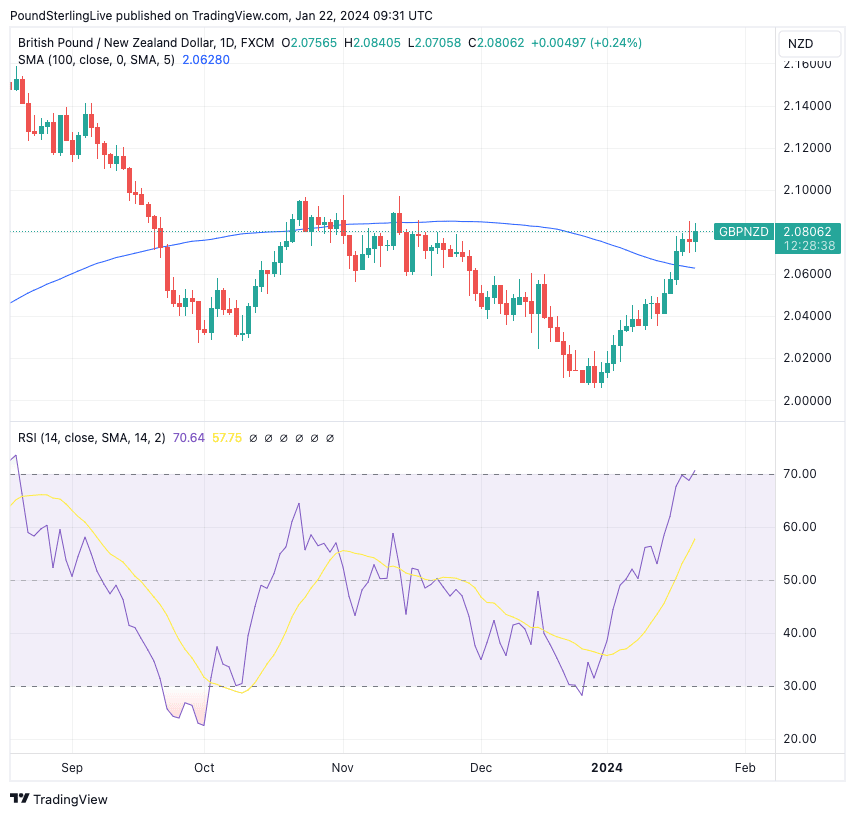

- GBP/NZD technical setup constructive

- Further upside possible

- But watch for RSI at overbought levels

- Signals potential for pullback in 1-2 week timeframe

- New Zealand inflation is week's key focus

Image © Adobe Stock

The Pound to New Zealand Dollar has experienced three consecutive weeks of advance, and further gains are possible, especially if the midweek release of NZ inflation disappoints.

Weekly GBP/NZD chart indicators are positive, underscoring the medium-multi-week outlook as constructive.

Concerning the coming five days, further advances are still possible with GBP/NZD trading above the 200-day moving average, as well as shorter-term MAs.

But, we note the Relative Strength Index (RSI) has risen to 70.51; anything above 70 signals overbought conditions. Typically, GBP/NZD occupies small amounts of time at such readings before a retracement and consolidation set in.

Above: GBP/NZD at daily intervals with the 200 DMA and RSI annotated. Track GBP and NZD with your own custom rate alerts. Set Up Here.

We are, therefore, on high alert for a pullback in the coming one to two weeks.

For now, pullbacks are likely to be shallow, with 2.0608 being the initial support zone. Note that the early 2.06s are also the location of the 100-day and 50-day moving averages, which speaks of solid support.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

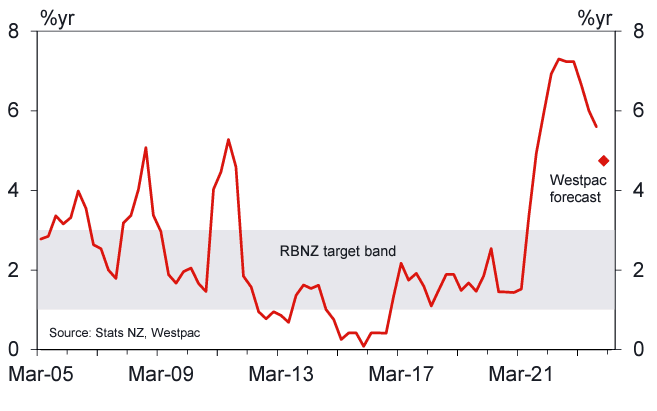

The major domestic event in the coming week is the release of New Zealand inflation for the final quarter of 2023 on Tuesday at 21:45 GMT, which will likely prompt a recalibration in market expectations for Reserve Bank of New Zealand interest rate policy.

"An enduring feature of 2023 (at least before Q4) was the stickiness of core inflation indicators such as non-tradables inflation. These indicators need to sustainably decline to make the case for OCR cuts. We suspect we won’t see such evidence until the middle of the year at the earliest," says Kelly Eckhold, Chief Economist NZ at Westpac.

The market is looking for a 0.6% quarter-on-quarter increase for Q4, with the year-on-year rate falling to 4.7% from 5.6%.

Should the outcome beat expectations, the NZ Dollar can be supported as investors push back expectations for RBNZ rate cuts.

However, analysts at Westpac anticipate a below-consensus reading of 0.5% q/q, which, if realised, could undermine NZD.

"Inflation is being pulled down by softness in import prices, including the price for food, fuel and airfares," says Eckhold. "Our forecast is lower than the RBNZ’s projection (published back in November) with most of that difference due to prices of volatile imported items."

The New Zealand Dollar continues to struggle, with the new week seeing some additional selling pressure linked to a poor showing in Chinese equity markets.

"AUD and NZD are among the worst performing G10 currencies YTD. Weak China data, a firm USD and unimpressive domestic data have not helped and will likely prevent near-term recovery," says a note from the FX strategy team at Barclays.

The Kiwi was softer against most G10 peers, in line with further declines in the Hang Seng index, which takes it to levels not seen since 2009.

The overall decline in Chinese stocks reflects a decision by commercial banks to keep their benchmark lending rates unchanged.

"This provided further disappointment for investors and follows a similar decision by the country’s central bank not to lower policy interest rates, amid wavering economic activity," says Nikesh Sawjani, Lloyds Bank.

The New Zealand Dollar is lower against the Pound, Dollar, Euro and the majority of G10 peers, reflecting a strong sensitivity to Chinese sentiment.

Besides China's lacklustre performance, the major global trend impacting the Aussie is the retreat in market expectations for the timing and scale of central bank interest rate cuts.

A retreat in Federal Reserve rate cut bets has been particularly notable, weighing on equities and 'high beta' financial assets such as the Kiwi Dollar.

This is because rate cuts are seen as pro-growth, boosting stocks and commodities, assets to which NZD is positively aligned.

"The high-yielding, safe-haven USD has regained ground across the board of late as central banks’ concerted push back against overly dovish market expectations has finally started to bear fruit," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"Higher US and global yields have weighed on risk assets, resulting in tighter global financial conditions, burnishing the currency’s safe-haven appeal," he adds.

Crucially, he says this trade that supports the Dollar has further to run:

"With the U.S. rates markets still attaching a c.50% chance to a Fed cut in March and pricing in c.130bp worth of rate cuts in 2024, we believe the reassessment of the dovish market expectations is not over yet."

This week's excitement in the U.S. falls on Thursday with the release of GDP and the PCE inflation gauge.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes