GBP/NZD Week Ahead Forecast: Uptrend Intact, But Some Retracement Possible Nearer-term

- Written by: Gary Howes

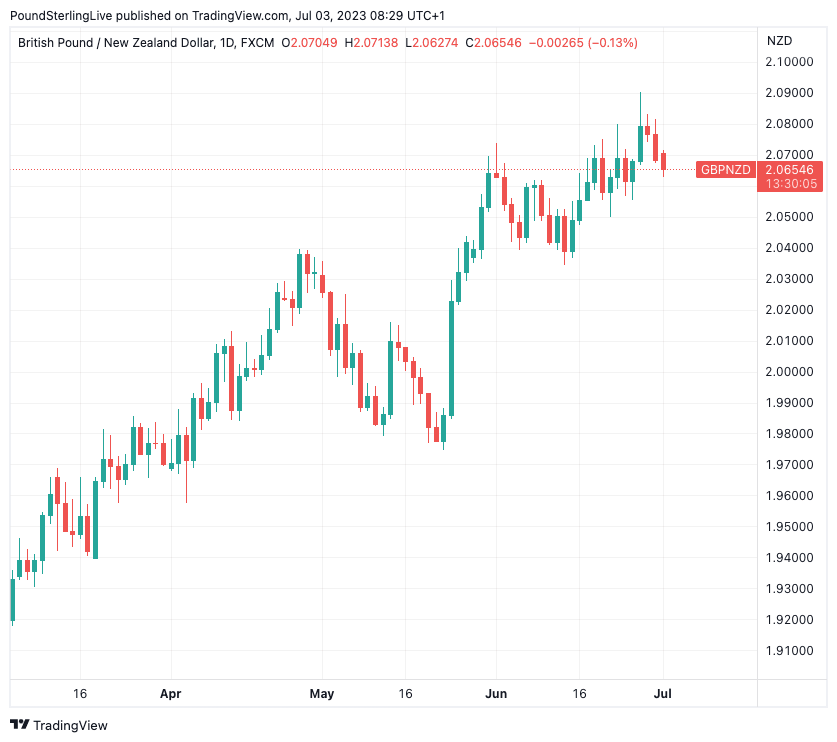

- GBPNZD eases towards 2.06-2.05

- As near-term NZD rebound is given room

- RBA rate decision is key antipodean risk

- Broader global sentiment also important

- GBPNZD remains in a medium-term uptrend

- Therefore further gains likely multi-week

Image © Adobe Stock

The New Zealand Dollar begins the new week with a notable gain against most G10 currencies, extending its upward momentum from Friday, supported by a firm Asian equity market session and positive investor sentiment.

This positive start establishes a favourable immediate-term outlook for the antipodean currency that could extend into the next few days. However, the Kiwi's upward trajectory may face hurdles as soon as Tuesday as the Reserve Bank of Australia (RBA) announces its highly anticipated interest rate decision.

To be sure, this is another empty week for the New Zealand event calender, meaning global sentiment and policy at the RBA will ensure external drivers are in charge. The RBA decision would potentially shore up expectations for New Zealand's interest rate policy given the close associations between the trans-Tasman neighbours.

"This week is another quiet one on the local data front, but with the AUD leading the Kiwi, tomorrow's RBA meeting (we expect a hike) is key by association," says David Croy, a strategist at ANZ.

The market and economists are split 50/50 on whether or not the RBA will proceed with another interest rate hike, an uncertainty underscored by the stop-start nature to RBA decision-making and the view that June's rate hike was "finely balanced".

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

As we note in our GBPAUD week ahead forecast, an RBA rate hike would reflect ongoing domestic labour market and housing resilience, while another hold would reflect last week's below-consensus inflation print.

For the New Zealand Dollar, another rate hike could offer the near-term rebound further impetus and push the the Pound to New Zealand Dollar exchange rate (GBPNZD) back towards 2.05-2.06.

GBPNZD nevertheless remains subject to a medium-term uptrend which means positioning for further upside over the coming weeks will remain a preferred stance for those with an interest in this market.

But some space must be given to the Kiwi Dollar to retrace some recent weakness and we would prefer to see the nearer-term pullback from the multi-year high at 2.0901 (reached last Wednesday) extend, bringing levels around 2.05-2.06 into play for this week.

Above: GBPNZD is trending higher, but some space must be allowed for another retracement over coming days.

ANZ's Croy says the New Zealand Dollar is consolidating against the Pound after hitting a three-year low last week and "psychological support at 0.4800 has held and that's now the key level to watch."

This would equate to resistance in the Pound-New Zealand Dollar exchange rate located at 2.0833.

The New Zealand Dollar has struggled over recent weeks following the Reserve Bank of New Zealand's (RBNZ) signal that it has likely ended its rate hiking cycle, putting it at a disadvantage to currencies belonging to central banks which are still firmly committed to further rate hikes.

The Pound is one such currency given the market anticipates close to 100 basis points of further hikes before the cycle is over, which would leave the NZD with no rates advantage over GBP.

The bar for the RBNZ to restart its hiking cycle meanwhile remains low, particularly given persistent expectations for the New Zealand economy to struggle over the coming months.

Economists at Kiwi Bank have this morning said they foresee the New Zealand economy enduring a double-dip recession as economic contraction endures over the second half of the year and into 2024.

"The June quarter may see a bounce back in economic growth," says Jarrod Kerr, Chief Economist at Kiwi Bank. "However, a recession later this year is still our base case."

Kiwi Bank now forecasts a three-quarter contraction to the tune of 0.4%, beginning from the second half of the year.

"It’s not until late in 2024 that economic growth resumes its long-average pace," says Kerr.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes