GBP/NZD Rate Week Ahead Forecast: A Breakout is Due

- Written by: Gary Howes

- GBP/NZD set to release pent-up energy

- Look to UK inflation data midweek

- And Thursday's Autumn Statement

- NZD in recovery mode says ANZ

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBP/NZD) has consolidated around 1.93 for about seven days now as near-term price action increasingly resembles a coiled spring, but a busy UK calendar could mean this pair finally offers up some excitement this week.

For GBP/NZD, November's price action has been largely focussed on global events: this is a pair comprised of two 'high beta' currencies that are reactive to global conditions, allowing both to benefit in the wake of last week's U.S. inflation surprise.

But when pitted against each other, neither the Pound nor New Zealand Dollar appears to be gaining the upper hand:

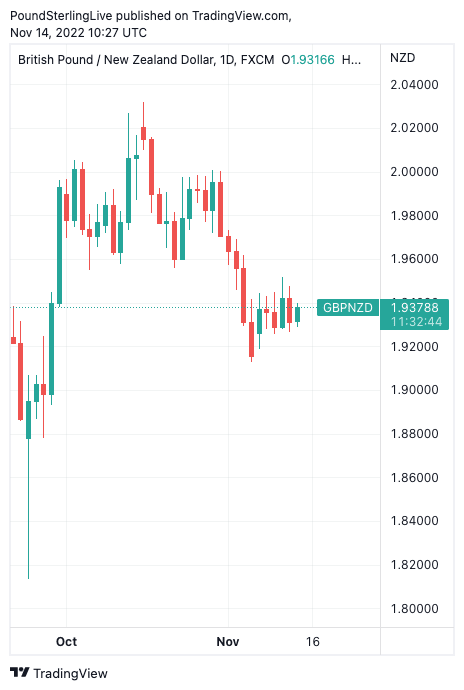

Above: GBP/NZD at daily intervals. To better time your payment requirements, consider setting a free FX rate alert here.

The above daily chart confirms the recent consolidation around the 1.93 level in GBP/NZD, which comes just days ahead of some key UK-based events that could finally propel the exchange rate in a new direction.

Tuesday sees the release of wage and employment data, with the market consensus looking for the Average Earnings Index, with bonuses included, to rise 6.0% in September.

The unemployment rate is expected to remain unchanged at 3.5% but job losses of 155K are expected to be reported for the three months to September.

Should the data disappoint, then the Pound would be expected to fall and GBP/NZD would probe 1.92 again.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Wednesday's CPI inflation reading is however expected to be of greater importance for GBP/NZD, given it has a direct bearing on the future of Bank of England interest rate decision-making.

Headline CPI inflation is forecast to report at 10.6% year-on-year for October, up on September's 10.1%.

The core CPI reading is seen at 6.4%, well ahead of the Bank of England's 2.0% target and consistent with further interest rate rises.

It remains difficult to predict how the Pound would react to either a stronger-than-expected or weaker-than-expected reading.

The long-running assumption is that hotter inflation is good for a currency in that it prompts the market to raise bets for further central bank interest rates rises.

But the UK economy is suffering a significant hit under surging inflation, therefore a weaker reading could benefit the Pound as it implies less economic damage ahead.

Look for a test of 1.96 over the coming days if the market gives a positive reaction to the week's data.

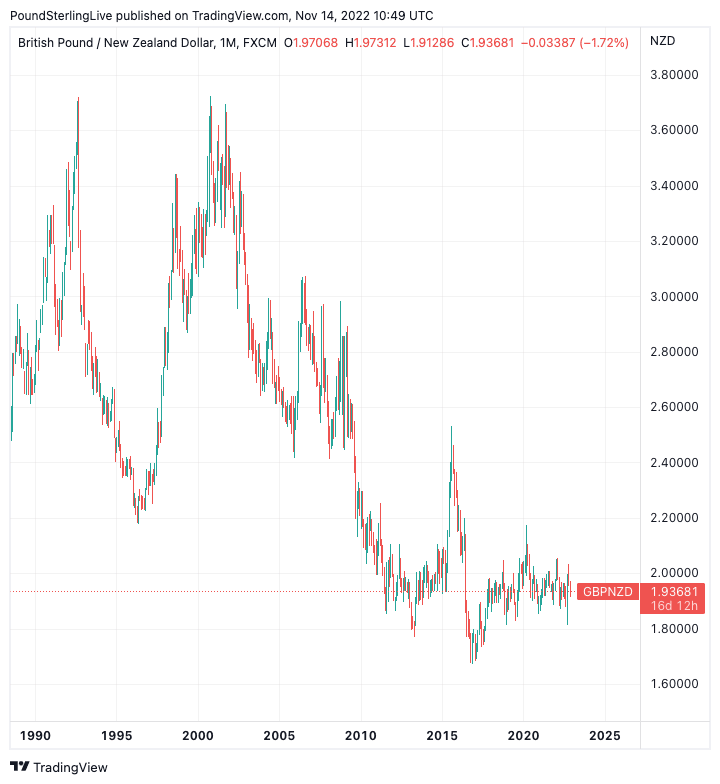

Above: Long-term, GBP/NZD is in a protracted period of decline.

The big event for GBP/NZD comes on Thursday when Chancellor Jeremy Hunt lays out his tax and spending plans for the coming months and years as he endeavours to regain the market's confidence and convince investors the UK's debt position remains sustainable.

Media reports suggest he is seeking to fill a 'black hole' of around £55BN and will do so by cutting spending and raising taxes.

However, the cost of Hunt's plans will be lower economic growth, which is a natural headwind to Pound Sterling's appreciation potential.

"Attention turns to the UK with the budget announcement on 17th November. We continue to expect GBP under-performance against most of the non-USD G10 currencies going forward," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

But what of the NZD side of the GBP/NZD equation?

The New Zealand Dollar appears to have found its feet following a soft period during the third quarter.

GBP/NZD might come under pressure should the Kiwi prove more resilient, and prone to recovery, over the coming.

"Although domestic data and considerations aren’t really playing a role, the Kiwi should at least benefit from having the highest bond yields in the G10, and what looks like a fair degree of economic resilience. The vibe in the market seems to also be that cycle lows may be in for the NZD," says David Croy, a Strategist at ANZ.

Regarding the GBP/NZD pair specifically, Croy says to expect "range trading ahead of new UK fiscal plan set to be unveiled this week. Expect volatility as NZD and GBP vie for attention".

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes