New Zealand Dollar and Aussie Outperform on Improved Sentiment

- Written by: Gary Howes

Image © Adobe Stock

Global risk sentiment continues to recover and this is aiding the New Zealand Dollar, say analysts.

Those bellwethers of global investor sentiment, the S&P500 and Nasdaq equity indices, registered strong gains overnight rising by 1.6% and 2.6% respectively.

"The Australian and New Zealand dollars are benefitting from the ongoing rebound in global equity markets that extended further overnight," says Lee Hardman, Currency Analyst at MUFG.

The New Zealand Dollar is a pro-cyclical and 'risk on' currency that tends to advance when investor optimism is improving and global equity markets are rising.

This is particularly the case when there is a Chinese element to the drivers behind that improved sentiment, given New Zealand and Australia's close ties to the world second largest economy.

That China's bellicose response to Nancy Pelosi's Taiwan visit has culminated in 'war games' around Taiwan is offering some relief, with investors fretting earlier in the week that the response could have been more severe.

"The top performing G10 currencies have been the high beta commodity currencies of the Australian and New Zealand dollars as they continue to reverse losses from earlier in the week that were driven by the flare up in geopolitical tensions between the US and China over Taiwan," says Hardman.

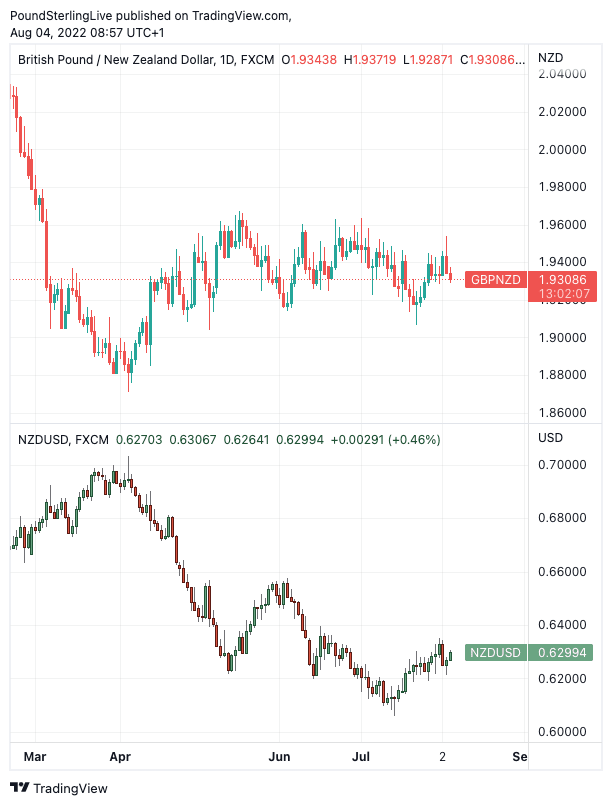

Above: GBP/NZD (top) and USD/NZD (bottom) at daily intervals.

The New Zealand Dollar rose two-thirds of a percent against the U.S. Dollar Thursday, taking NZD/USD to 0.63 at the time of writing.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) fell 0.45% Wednesday and is lower a further 0.15% Thursday at 1.9316. This takes rates on bank accounts to ~1.8770 for Kiwi payments and ~1.9253 at independent payment specialists.

Further improvements in investor sentiment came from U.S. data that confirmed the U.S. economy is growing, despite a wall of worries that include rising local interest rates.

The Institute for Supply Management (ISM) Services PMI confounded market expectations by rising for the month of July in contrast to the alternative barometer compiled by S&P Global.

The headline rose from 55.3 to 56.7, aided by sharp increases in new orders and overall business activity within the U.S. economy's largest and most important sector.

"The tentative improvement in global investor risk sentiment was supported by the release yesterday of the ISM services survey for July," says Hardman.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Looking ahead, should investor sentiment continue its modest improvement the New Zealand Dollar and its Australian cousin would also be expected to see further gains.

The outlook remains challenging however, not least because the U.S. Federal Reserve is showing little inclination to end its interest rate hiking cycle.

The Fed will continue to force a slowdown in the U.S. economy until it is convinced it has turned the tide on inflation.

The reduction in global liquidity resulting from higher interest rates would in turn be expected to weigh on global economic activity.

Therefore bouts of weakness in markets and downturns in sentiment remain possible, which could pressure the high beta New Zealand Dollar.

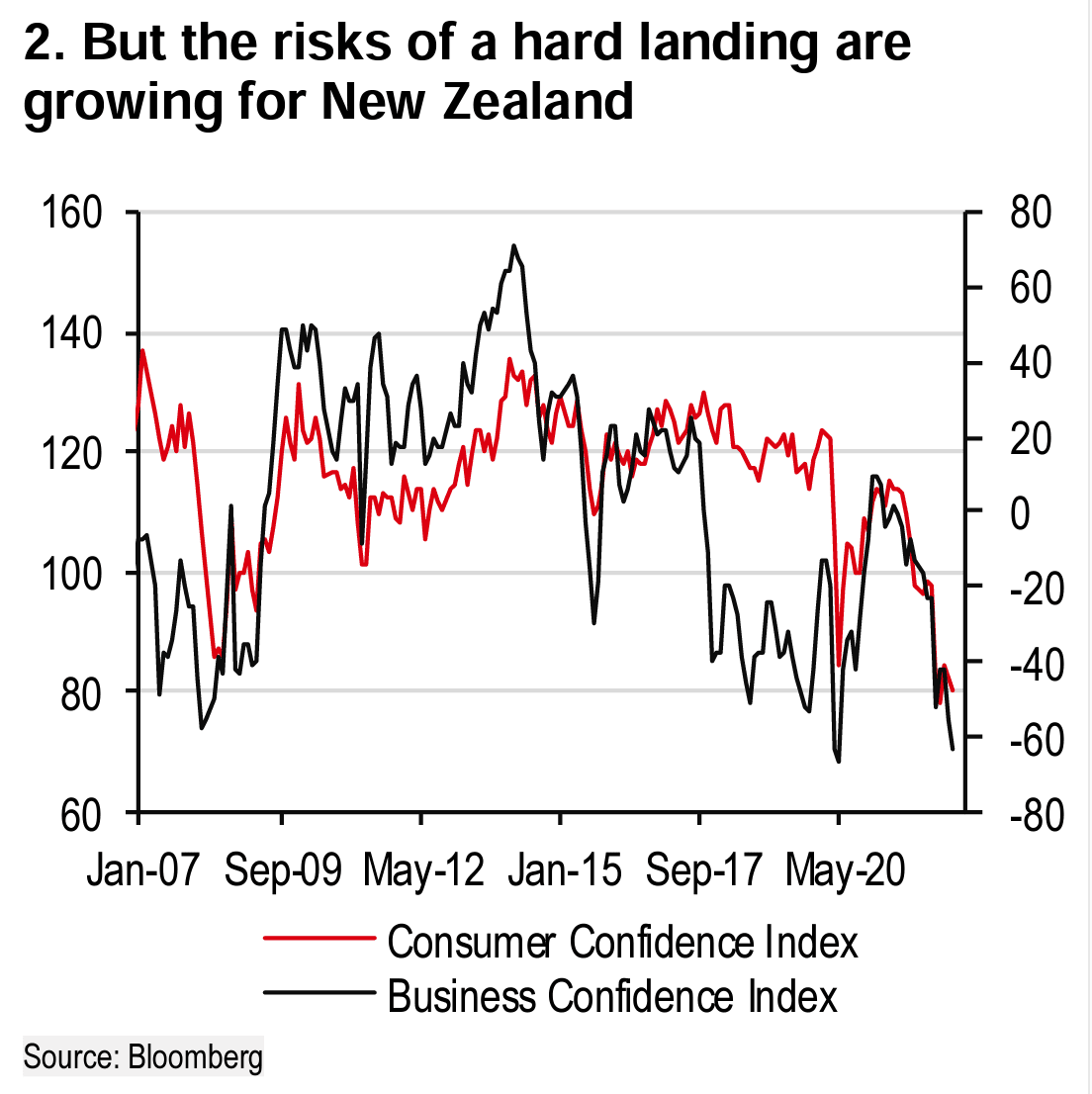

Domestically, economists remain concerned the New Zealand economy could slowdown sharply over coming months.

"A dismal growth outlook as hard landing risks rise adds to the challenging external backdrop facing New Zealand," says HSBC, the international investment bank and lender.

The latest assessment of the outlook for the New Zealand economy leads HSBC's foreign exchange research team to lower their New Zealand Dollar forecasts and maintain a cautious stance on the currency.

"We have been bearish on the NZD for some time as persistent geopolitical tensions, global supply disruptions, a slowing Chinese economy, and a hawkish Fed painted a challenging backdrop for the risk sensitive currency," says Paul Mackel, Head of FX Research at HSBC.

In a mid-year currency market assessment Mackel adds "Domestic growth concerns are now becoming more prevalent at a time when the RBNZ is hiking further and faster to re-anchor inflation expectations."

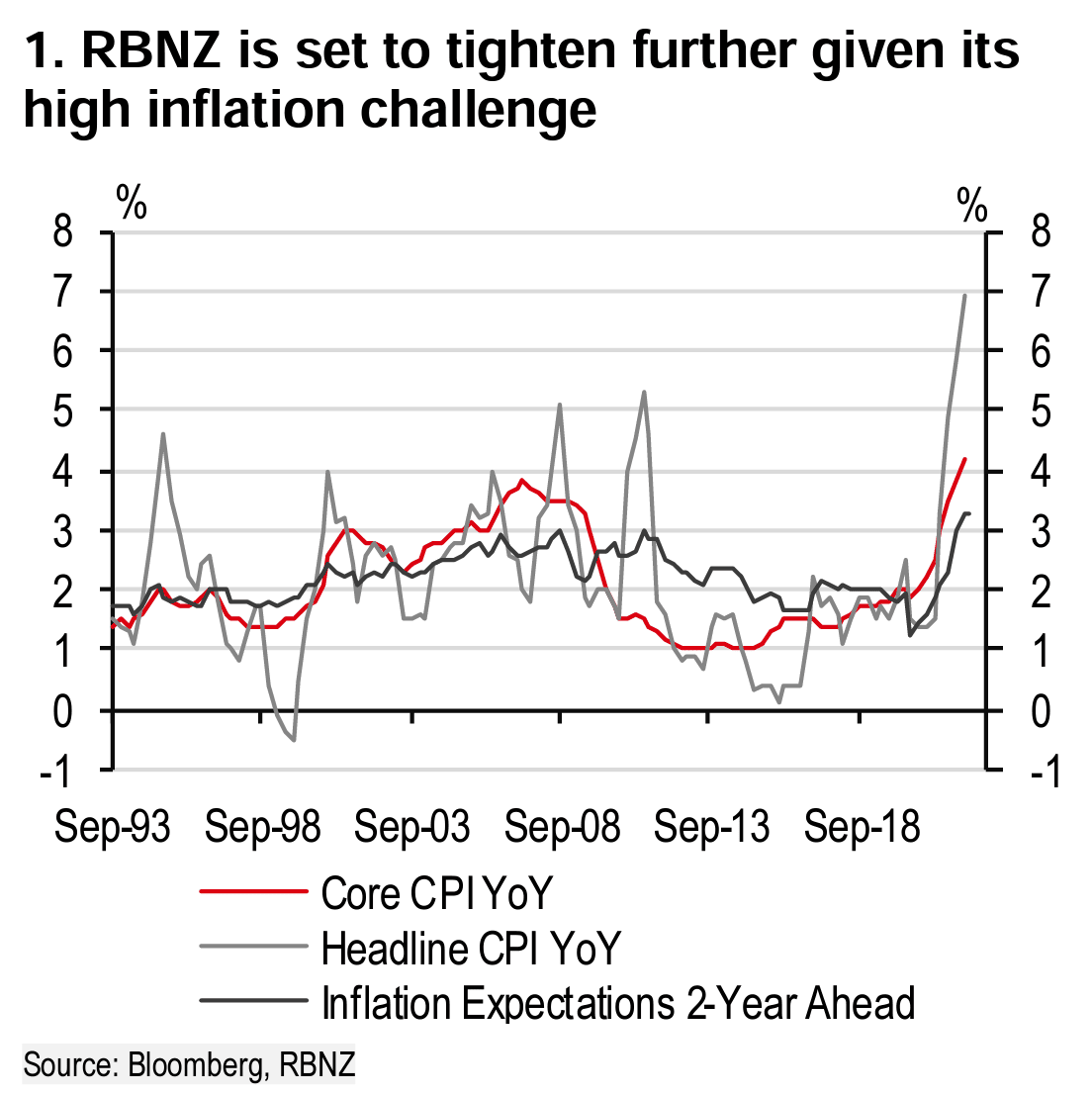

Further interest rate hikes are meanwhile expected from the RBNZ as HSBC economists say inflation is still yet to show any signs of easing and inflation expectations continuing to climb higher.

However, this dynamic is no longer anticipated by HSBC's currency analysts to provide outright support for the NZ Dollar.

"Further RBNZ hikes will struggle to lift the NZD given how much is already priced in and the dominance of risk over relative rates".

HSBC remains bearish on the NZ Dollar and lower their NZD/USD forecasts to 0.58 by the end of the fourth quarter of 2022 and 0.57 by the end of the second quarter of 2023.

HSBC's forecasts for the GBP/USD exchange rate for these points are 1.17 and 1.16, this implies a Pound to New Zealand Dollar forecast of 2.0172 and 2.030.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes