GBP/NZD Outlook Limited by Buoyant Kiwi into BoE

- Written by: James Skinner

- GBP/NZD could struggle to make it back above 1.95

- If a softer USD keeps NZD/USD buoyant above 0.62

- Jobs data eyed by NZD as BoE poses risks for GBP

Pine timber being exported from Wellington, New Zealand. Photo by James Anderson, World Resources Institute.

The Pound to New Zealand Dollar exchange rate has climbed from three-month lows but the buoyant Kiwi Dollar could mean that Sterling struggles to get far above the nearby 1.95 level and ultimately remains limited by tough technical resistance up around 1.9624 in the days and weeks ahead.

New Zealand’s Dollar fell with many other currencies on Tuesday after global market risk appetite was restrained by unease in the Asia Pacific over a U.S. lawmaker’s visit to the region and anger in Beijing over a stop-off in Taiwan.

“The ADXY [Asian Dollar Index] is holding on to a slight gain thus far today, but still trades below the 102.00 resistance area,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

The Pound to New Zealand Dollar rate rose back above the 1.94 level as risk aversion crimped market appetite for many currencies but Sterling would likely struggle to extend its advance much further if demand for safe-havens ebbs and leads the U.S. Dollar to soften afresh later in the week.

Above: Pound to New Zealand Dollar rate shown at 4-hour intervals with Fibonacci retracements of July declines indicating possible areas of short-term technical resistance for Sterling. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

GBP/NZD had been suppressed and was previously struggling to overcome the 1.94 level in prior trade due a buoyant performance from the Kiwi, which benefited previously as the U.S. Dollar beat a fortnight long retreat from the highs notched against many currencies in mid-July.

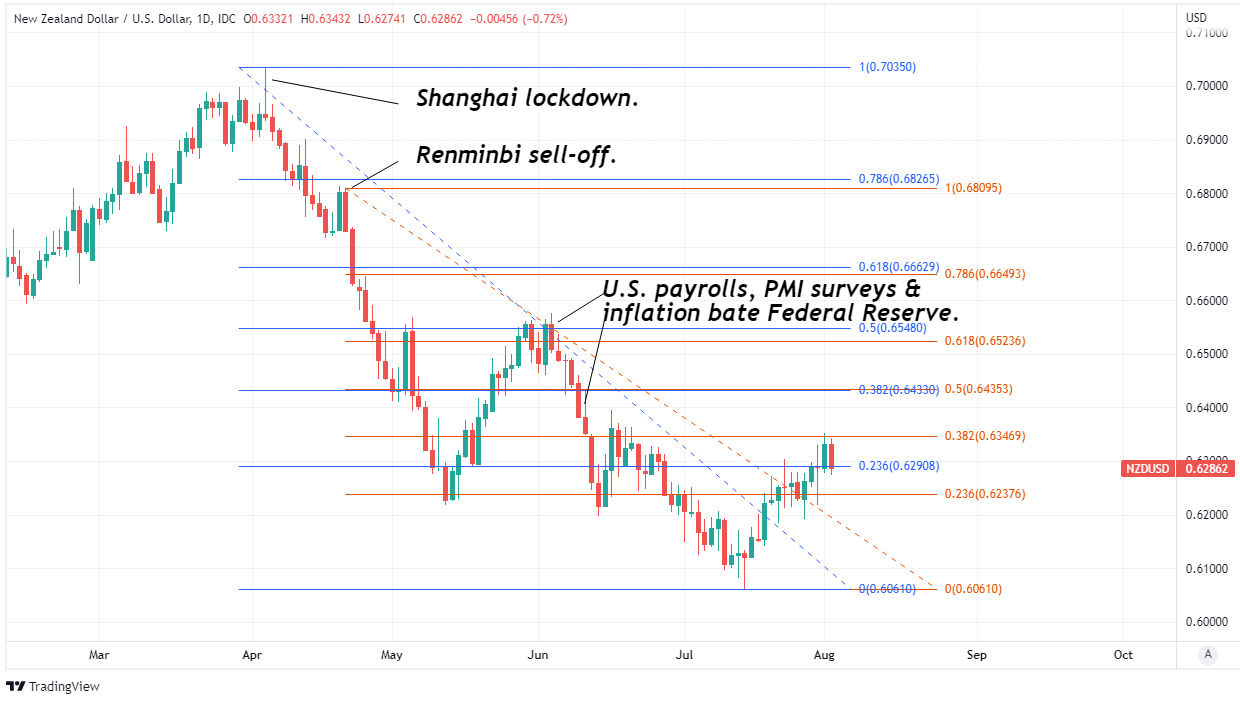

“The Kiwi surged higher overnight, outperforming amidst broad USD weakness, with ISM data showing that manufacturing activity is slowing, but also that price pressures are starting to ease,” says Finn Robinson, an economist at ANZ.

“The rest of this week in the US will be focused on labour market data – with JOLTS and July payrolls. With the Fed focused on the labour market, any signs of a turning point may see the market unwind Fed pricing further, causing more DXY weakness,” Robinson and colleagues said on Monday.

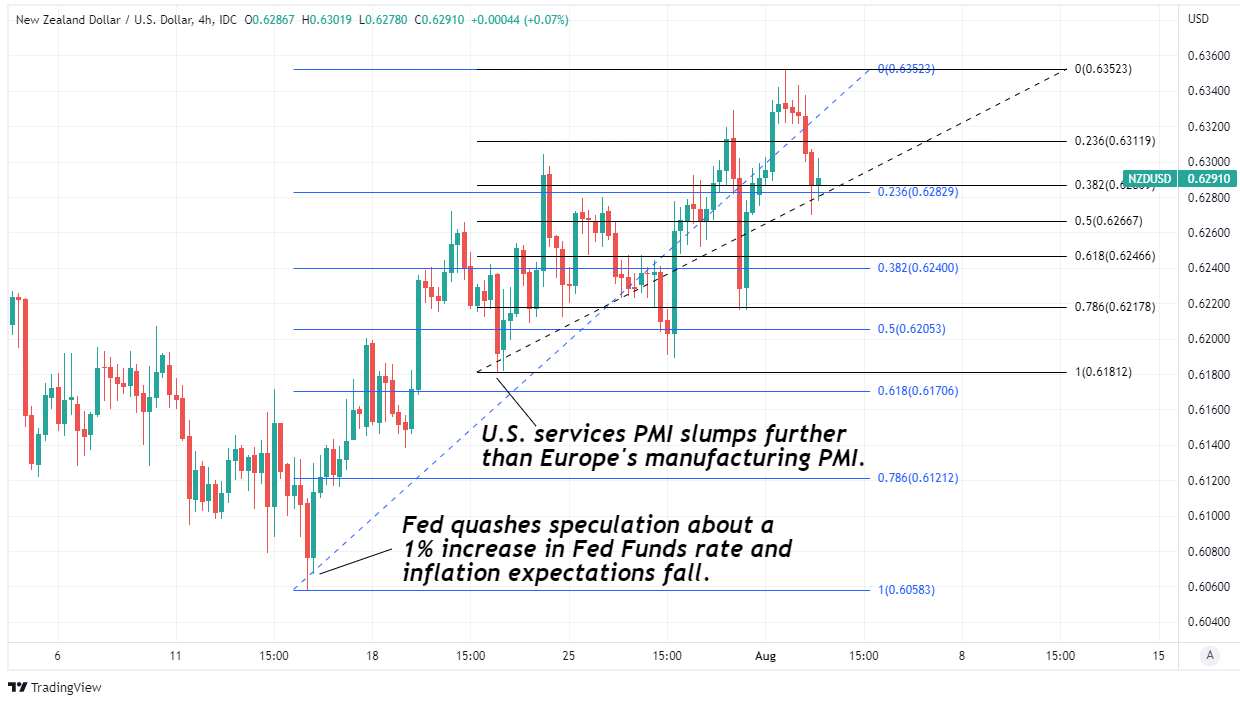

Above: NZD/USD shown at 4-hour intervals with Fibonacci retracements of mid and late July recoveries indicating possible areas of technical support for the Kiwi. Click image for closer inspection.

Above: NZD/USD shown at 4-hour intervals with Fibonacci retracements of mid and late July recoveries indicating possible areas of technical support for the Kiwi. Click image for closer inspection.

The New Zealand Dollar and other currencies were boosted on Monday when the Institute for Supply Management (ISM) Manufacturing PMI survey suggested that inflation pressures within the sector moderated at a rapid pace in July.

Monday’s survey left the prices subcomponent of the PMI sitting at its lowest level since September 2020 in a turn of events that could have a moderating effect on the Federal Reserve interest rate outlook and U.S. Dollar if replicated in other parts of the U.S. economy like the services sector.

“The dreary world economic outlook is a weight on NZD. However, NZD may receive support from the labour force report on Thursday,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Above: NZD/USD shown at daily intervals with Fibonacci retracements of April declines indicating possible areas of technical resistance for the Kiwi. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

“Our ASB colleagues consider widespread and acute worker shortages kept employment growth sluggish, the unemployment rate at a record low of 3%, and wage growth at its highest annual rate since 2008 of 3.4%/yr,” Capurso and colleagues said on Tuesday.

The mid-July recovery that is illustrated by the rebound in the main Kiwi exchange rate NZD/USD has had a suppressive effect on GBP/NZD and has ultimately acted to keep the latter pinned down in the lower half of a three-month range spanning the gap between 1.9042 and 1.9674.

Both exchange rates will be sensitive to the messages and implications of the raft of important economic figures due out from the U.S. in the days ahead, with GBP/NZD potentially benefiting from any further rebound by the greenback.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of 2022 downtrend indicating possible areas of technical resistance for Sterling. Click image for closer inspection.

“Resistance in the low 0.63s is vulnerable, with potential for this corrective rally to reach 0.6400 multiday. NZ jobs data on Wednesday should indicate a fresh unemployment low, and thus support the NZD on the day,” says Imre Speizer, head of NZ strategy at Westpac, in reference to NZD/USD.

The rub for the Pound, however, is that the New Zealand Dollar could benefit if employment figures point to continuing strength in the Kiwi labour market overnight and into Europe's Wednesday while Sterling itself faces homegrown risks around this Thursday’s Bank of England (BoE) interest rate decision.

There is high uncertainty over whether the BoE will lift its Bank Rate by a typical quarter percentage point to 1.5% or if it will opt for one of the larger half percentage point increases that have recently been popular elsewhere in the world including in New Zealand.

The latter kind of increase would take the benchmark up to 1.75% and another post-financial crisis high, likely benefiting Sterling along the way, although the Pound to New Zealand Dollar rate would risk coming under pressure if the BoE sticks to the slow and steady pace taken thus far.