GBP/NZD Rate Stabilising but Narrow Range Possible

- Written by: James Skinner

- GBP/NZD stabilising & could hold above 1.93

- But upside limited by NZD’s high yield appeal

- Returning market risk appetite also aids NZD

- GBP helped as BoE hints of RBNZ style policy

- Tight range possible for GBP/NZD short-term

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate has all but drawn a line under a multi-month sell-off amid signs of an aggressive shift in the Bank of England (BoE) interest rate stance but could struggle to rise by much due to the Kiwi’s high yield appeal and improving market risk appetite.

New Zealand’s Dollar and Pound Sterling have shared an increasingly positive correlation in recent weeks and thus far in June the result has been an almost sideways trend in GBP/NZD, which has recovered above and appears poised to hold above the 1.93 level in the short-term.

That correlation has persisted throughout a variety of market conditions and might be likely to perpetuate the recent sideways trend in the Pound to New Zealand Dollar exchange rate for as long as it remains in place.

“The BoE is also likely to step up the intensity of its tightening. MPC member Catherine Mann spoke, noting demand remains strong and that she voted for a 50bps rate rise at last week’s meeting,” says David Croy, a strategist at ANZ.

“NZD/GBP continues to range-trade. No obvious catalyst in sight for a significant break-out. UK recession fears are rising, but it’s the same in NZ,” Croy said in a market commentary during Tuesday’s Asia Pacific trading session.

Above: NZD/USD at hourly intervals and shown alongside GBP/USD. Fibonacci retracements of mid-June rebound indicate possible short-term areas of technical support for the Kiwi. Click image for closer inspection.

Above: NZD/USD at hourly intervals and shown alongside GBP/USD. Fibonacci retracements of mid-June rebound indicate possible short-term areas of technical support for the Kiwi. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Sterling appeared to benefit in Europe on Tuesday after BoE chief economist Huw Pill reportedly told the Institute of Chartered Accountants in England and Wales on Tuesday the BoE is willing to act “more aggressively” to bring down inflation even if that comes at a cost to the economy.

This somewhat echoed sentiments expressed in a Monday speech by the BoE's Catherine Mann, who also advocated for more aggressive action including larger-than-usual increases in Bank Rate of 0.50%.

That was all in keeping with the newly adopted guidance given following June’s decision to lift Bank Rate from 1% to 1.25% and at least appears to suggest the BoE is now on the cusp of adopting a policy stance that is directly comparable to that of the Reserve Bank of New Zealand (RBNZ).

The RBNZ lifted its interest rate from 1.5% to 2% last month and signalled using its updated forecasts that its benchmark rate is likely to rise to 4% or more by the early months of 2023, although much about whether this outlook is realised or not likely depends on how the economy holds up this year.

“The GDP contraction represents a sizable miss for the RBNZ,” says Nathaniel Keall, an economist at ASB Bank.

Above: Pound to New Zealand Dollar rate shown at daily intervals. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at daily intervals. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

“Still, the Bank will be cautious about overinterpreting it - we still see the inflation risks as tilted towards the upside. The RBNZ will want to be sure the slowdown is genuine rather than an ephemeral statistical blip,” Keall added in a review of last week's first-quarter GDP figures.

There are multiple important economic figures due from the UK in the days ahead, which could impact Sterling, but New Zealand’s economic calendar is devoid of major appointments this week.

That potentially leaves the Kiwi taking its cues from global markets that were on the front foot this Tuesday amid an evident improvement in risk appetite, which returned with U.S. traders following a public holiday on Monday.

It’s not clear if that had to do with remarks from one of the most ‘hawkish’ Federal Reserve’s policymakers who indicated during a presentation in Barcelona, Spain that he may now be comfortable with the stance of, and market outlook for, the Fed’s monetary policy.

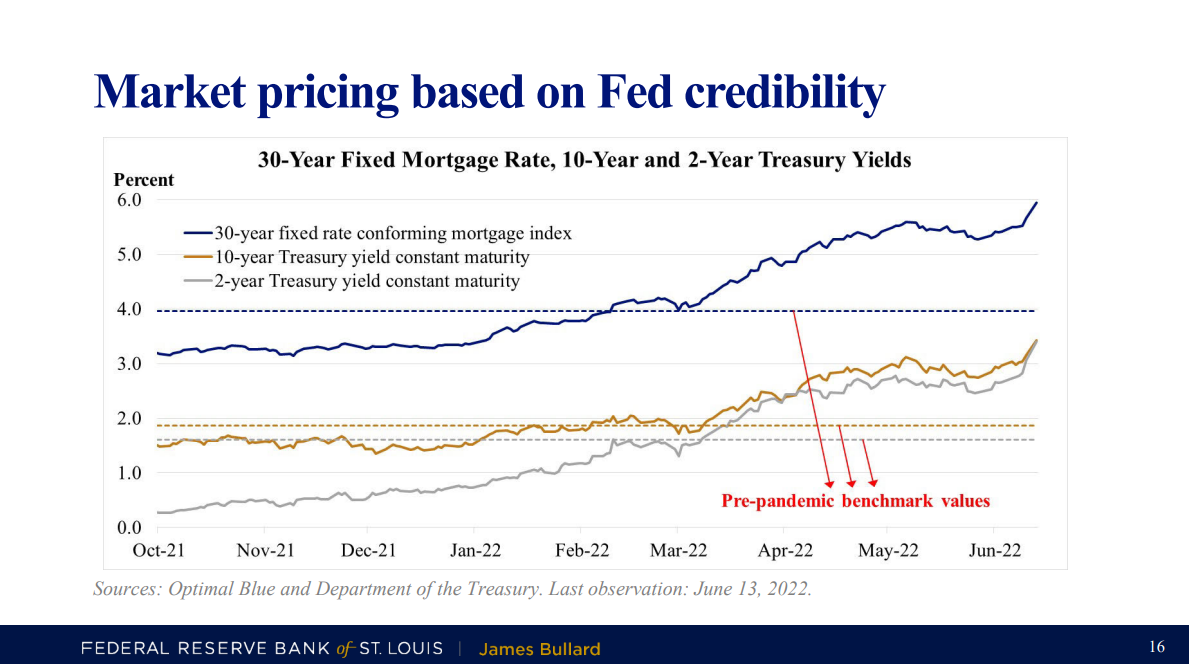

“The fact that market interest rates have moved above their pre-pandemic benchmarks while the policy rate has not can be read as an illustration of the effect of credible forward guidance,” Federal Reserve Bank of St Louis President James Bullard said.

“The Fed still has to follow through to ratify the forward guidance previously given, but the effects on the economy and on inflation are already taking hold,” he added in remarks that were similar to but also very distinct from others he made earlier in June.

Source: Federal Reserve Bank of St Louis.