New Zealand Dollar Forecast: Delta Variant to Prevent a 2021 Rate Hike says Morgan Stanley

- Written by: Gary Howes

- Morgan Stanley says market wrong on RBNZ rate hike expectations

- They forecast GBP/NZD at 1.88 in one year

- NZD/USD forecast at 0.75 in one year

Image © Adobe Stock

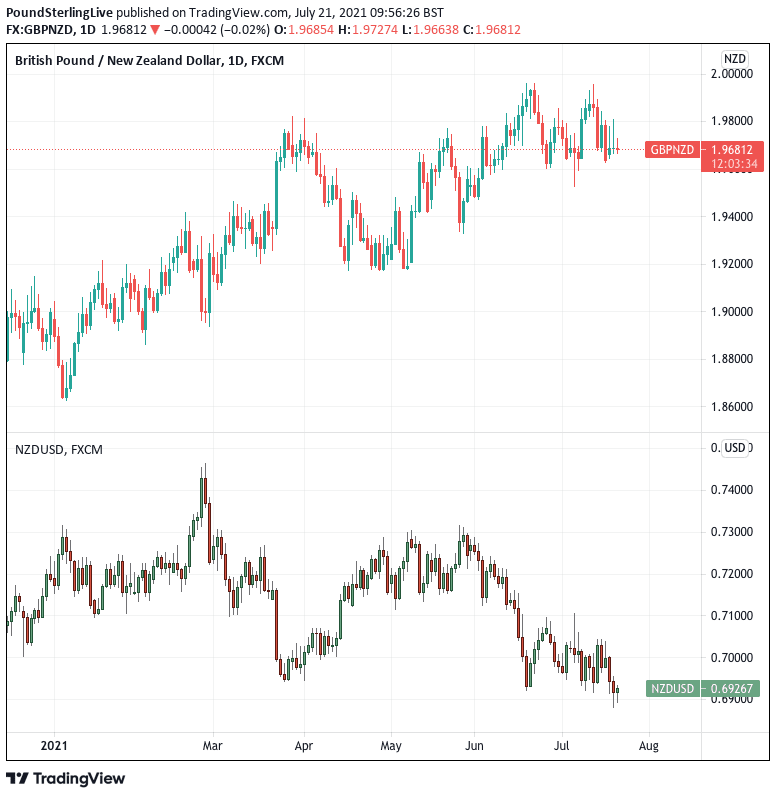

- GBP/NZD reference rates at publication:

- Spot: 1.9680

- Bank transfers (indicative guide): 1.8990-1.9130

- Money transfer specialist rates (indicative): 1.9500-1.9542

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Reserve Bank of New Zealand is unlikely to raise interest rates in 2021 according to a major investment bank, creating the potential for a readjustment lower in the New Zealand Dollar.

Money market pricing shows investors think an interest rate hike is likely at the Reserve Bank of New Zealand (RBNZ) as early as November, however Morgan Stanley says the first rate hike is only likely a few months later.

"International border restrictions remain and are likely to remain for some time, and we are skeptical that the RBNZ would want to begin tightening policy actively when border restrictions remain," says David S. Adams, an analyst at Morgan Stanley in a recent research and strategy briefing.

Furthermore, Adams says the Delta variant of Covid-19 poses significant downside risks to the economy should it take hold. "We think the balance of risks on COVID-19 are asymmetrically negative vis-à-vis the Delta variant."

Above: New Zealand exchange rates in 2021.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The call comes as global markets take fright at the rapid spread of the Delta variant of Covid-19 that is sweeping across the world. Indeed, the WHO said on Wednesday that a global third wave was now transpiring that means even those countries that were relatively unscathed in 2020 will now suffer.

This is particularly true of many Asian countries.

New Zealand maintains a strict border policy to prevent the arrival of Covid-19 cases in the country, allowing the economy to function close to full capacity.

However, the closed borders have resulted in skills shortages in the labour market with data showing that while hiring intentions at New Zealand firms are at a 5 year high shortages of skilled labour have also reached an all-time high.

The strong labour market and better-than-expected economic growth data for the first quarter are reasons why the RBNZ has indicated it is bringing forward its expectations for when interest rates will be required to rise.

"Members agreed that the major downside risks of deflation and high unemployment have receded,” the RBNZ said at its July policy meeting. "The committee agreed that a ‘least regrets’ policy now implied that the significant level of monetary support in place since mid-2020 could be reduced sooner."

Image courtesy of Morgan Stanley.

Central banks tend to react to rising inflation and strong economic data by raising interest rates in order to cool the economy and avoid creating unwarranted asset bubbles and excess inflation.

The RBNZ's projections from the May meeting showed the central bank to be guiding a full hiking cycle beginning in May 2022 with 2-3 hikes per year following.

"Market pricing right now is even more aggressive, with almost a full 25bp rate hike priced in for the November 2021 meeting and several more hikes implied in 2022," says Adams.

Above: The market is seeing rate hikes sooner than the RBNZ guided back in May.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"Such a hawkish tone suggests an imminent hike, either in August or October, and NZD could therefore benefit from an attractive carry earlier than expected," says Francesco Pesole, a foreign exchange strategist at ING Bank.

Although many in the market now see a November rate hike at the RBNZ as likely, Morgan Stanley are urging caution.

"We think hikes in 2021 are a bridge too far, though, given: 1) the RBNZ is still purchasing assets and a hike before fully tapering seems aggressive to us; 2) international borders are largely still closed, limiting employment gains in certain sectors; and 3) COVID-19 risks remain asymmetrically negative, particularly given the rising Delta variant."

On the matter of Covid presenting a potential barrier to higher interest rates in New Zealand, Morgan Stanley says the Delta variant poses a key risk to the outlook.

"We think the government has a conservative reaction function and an uptick in cases would likely generate meaningful restrictions in activity in the hopes of eliminating viral transmission," says Adams.

The above shows New Zealand is a distinct laggard in the vaccination race.

The UK offers an insight into just how many people must be vaccinated in order to avoid a wave of Covid infections: the above chart shows a significant proportion of the UK population are now fully vaccinated, however cases are still rising.

A regular weekly survey of Covid antibodies by the ONS shows 90% of UK adults now test positive for antibodies, yet cases continue to rise.

This reveals how high the bar is set for herd immunity when it comes to the Delta variant, indeed it appears such a bar can only be achieved through both natural infections and vaccinations.

New Zealand therefore has to allow natural infections if it is to ever get back to 'normal'.

"We think markets may finally be overpricing the RBNZ's hawkishness. We thus look to close our relative value rates trades, which benefited from RBNZ hawkishness. Moreover, we look to enter a receiver position to the November RBNZ meeting, which we think is overpriced to the hawkish side," says Adams.

Morgan Stanley forecast the U.S. Dollar to New Zealand Dollar exchange rate at 0.74 by the end of 2021, 0.74 by the end of March 2022 and 0.75 by the end of June 2022.

Meanwhile, their GBP/USD forecasts for these timeframes are 1.40, 1.41 and 1.41.

This allows for a cross rate forecast of 1.89, 1.90 1.88 for the Pound to New Zealand Dollar exchange rate.