New Zealand Dollar: RBNZ to Begin Hiking in May 2022 says Standard Chartered

- Written by: Gary Howes

- 3 RBNZ hikes in 2022 says Standard Chartered

- More than the market expects

- Could aid NZD

- But slow vaccination rate could derail bullish outlook

Image © Rafael Ben-Ari, Adobe Images

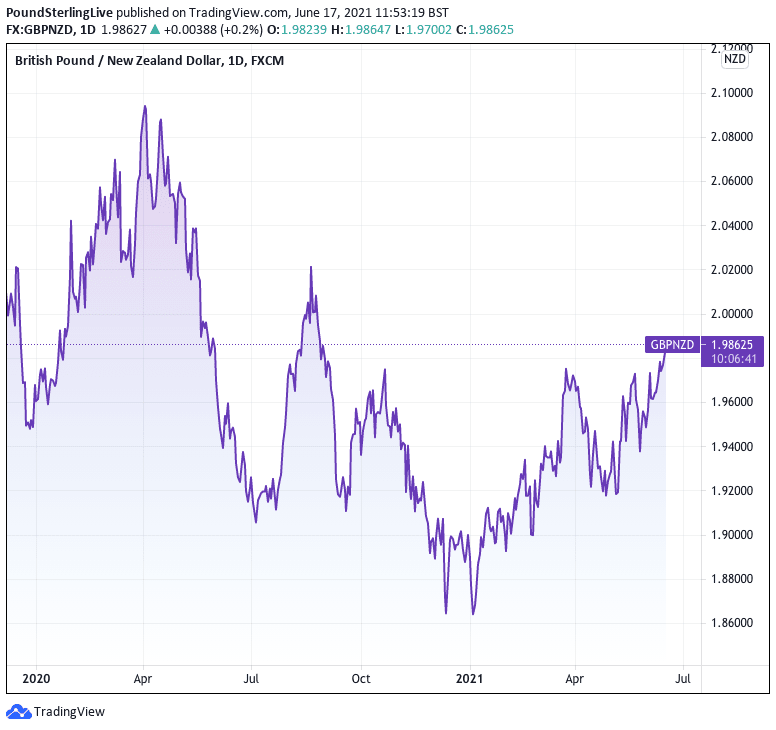

- GBP/NZD reference rates at publication:

- Spot: 1.9873

- Bank transfers (indicative guide): 1.9177-1.9317

- Money transfer specialist rates (indicative): 1.9694-1.99734

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

With the U.S. Dollar being boosted by a shift in stance at the Federal Reserve, could the New Zealand Dollar benefit from an increasingly optimistic mood at the Reserve Bank of New Zealand?

Central bank policy is certainly in the driving seat of global currency markets at present, with those currencies belonging to central banks that are inclined to bring forward the date of their first interest rate rise tending to appreciate in value.

The Dollar roes sharply in the wake of the Federal Reserve's (Fed) June policy update where members of the FOMC indicated they now see interest rates rising in 2023, whereas previously they had guided that such a move would only come in 2024.

What is important for the Dollar here is the direction of travel: expectations for Fed policy normalisation are coming forward and this is a source of support to Dollar valuations.

The same has been true of the New Zealand Dollar and the Reserve Bank of New Zealand (RBNZ) over recent months: recall in 2020 the discussion was that the RBNZ might cut rates into negative territory?

The RBNZ ultimately abandoned this stance in the face of a global and domestic economic recovery and the New Zealand Dollar rose through 2020 and into 2021.

This trade could gain further traction if the RBNZ actually raises interest rates sooner and more aggressively than the market is currently expecting.

"We now expect three policy rate hikes in 2022, starting in May, and two hikes in 2023," says Jonathan Koh, an economist with Standard Chartered.

Above: GBP/NZD since 2020.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

This now puts Standard Chartered in line with the consensus expectation for the first rate rise to come in May 2022, however by estimating there will be three hikes in 2022 Standard Chartered are more 'hawkish' in their expectations than the market.

Therefore, if they are correct and the RBNZ meets their expectations the market will have to react, which inevitably suggests upside for the New Zealand Dollar.

Standard Chartered's call comes as they raise their 2021 economic growth forecasts for the country to 5.5% from 4.0% earlier.

They note New Zealand’s economy expanded 1.6% q/q in the first quarter, ahead of the RBNZ's -0.6% q/q forecast.

The recovery has been broad-based, with 10 out of 16 key sectors now above pre-COVID levels.

"We are cautiously optimistic for the rest of the year. Leading indicators point to a continued recovery, with a positive outlook for manufacturing, agriculture, construction, employment and investment," says Koh.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

But a word of caution is however sounded with regards to the evolution of the Covid-19 pandemic in the country, which could potentially derail the optimistic expectations given the slow rate of vaccinations.

"While the pandemic has been contained domestically, the pace of vaccination has been slow due to supply constraints; only 6.7% of the population has been fully vaccinated so far. At the current pace of 16,400 doses administered daily, we estimate that c.40% of the entire population will be vaccinated by end-2021," says Koh.

Nevertheless, Standard Charted hold a view that the country's labour market will continue to improve through 2021 resulting in lower unemployment and higher wages.

"We expect the output gap to narrow gradually through 2021, before turning positive in Q1-2022. A labour-market recovery and higher pricing intentions are likely to translate to higher inflationary pressures," says Koh.

"Apart from pencilling in OCR hikes, it made tweaks to its assessment of current conditions and forward guidance; this suggests that the RBNZ may be taking a more pre-emptive stance on normalising policy," he adds.