The New Zealand Dollar Slumps as Investors Take Flight from RBNZ Ahead of Decision

- Written by: James Skinner

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of Financial Services Council NZ

- NZD weakens across the board ahead of RBNZ rate decision.

- GBP/NZD consolidates above 2.0 handle amid NZD weakness.

- As consensus eyes fourth rate cut, market moves to price it in.

- But cut likely to see RBNZ shift into neutral stance, sit on hold.

- Could fuel 'buy the rumour, sell the fact' response in NZD Wed.

The New Zealand Dollar weakened across the board on Tuesday as markets moved to price in a fourth 2019 interest rate cut from the Reserve Bank of New Zealand (RBNZ) although the prospect of a shift in the central bank's policy stance could boost the Kiwi on Wednesday.

Even a softening Pound Sterling was higher against the Kiwi Tuesday, consolidating above the 2.0 handle as investors took flight from the New Zealand currency ahead of the November interest rate decision due from the RBNZ at 01:00 on Wednesday, which is expected to see the cash rate cut from 1% to 0.75%. The Pound-to-New-Zealand-Dollar rate has reached its highest level since October 2018 this week but it remains to be seen if the British currency can retain the initiative over the Kiwi.

Consensus among economists has favoured a rate cut on Wednesday for a while now although the financial markets have been slow to bake the anticipated move into the Kiwi cake and were still early on Tuesday, underpricing the prospect of a cut this week. Pricing in the overnight-index-swap market implied a November 13 cash rate of 0.81% on Tuesday, down from 0.86% in the prior session but still some way off the 0.75% that will prevail if the RBNZ pulls the proverbial trigger on Wednesday.

"We saw thin trading in NZD rates ahead of Wednesday's Reserve Bank of New Zealand policy decision, with the market jittery and starting the day with 65% priced for a cut. Weaker New Zealand inflation expectations however led to a rally in the front end, down to 1.04% in 2y into the close, before an Australian bank changed its RBNZ call to a cut from hold. I still see the RBNZ cutting tomorrow, which is now 80% priced in. The focus is now on the OCR track and forward guidance," says Sam Kirtley, an Australia-based rates trader at UBS.

Above: Pound-to-Kiwi rate shown at daily intervals.

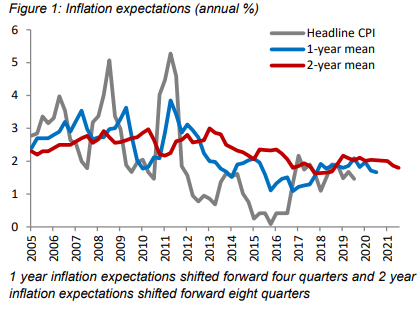

The RBNZ has cut its cash rate three times this year in the hope of not only protecting New Zealand from an ongoing global economic slowdown, but also in an effort to lift growth and inflation. Kiwi inflation has been running below the midpoint of the 1%-to-3% target range for years now and on Tuesday, the RBNZ's quarterly survey of inflation expectations showed that Kiwis expect the consumer price index to still be below that midpoint in two years time. The anticipated rate fell from 1.86% to 1.80% last quarter.

Changes in rates are normally made in relation to the outlook for inflation, which is sensitive to economic growth, but impact currencies because of the influence they have over capital flows and decisions of short-term speculators. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

"More than 70% economists are forecasting a 25bp cut and OIS prices around an 80% probability of a cut. Recent RBNZ comments, however, suggest it is a much closer call, particularly its qualification of the scope for further easing with “if necessary” at the last meeting. Subsequent data have been ambiguous at worst. We see significant risk of an unchanged decision, or a cut accompanied by a signal that the hurdle for further easing is very high," says Adam Cole, chief FX strategist at RBC Capital Markets.

Above: RBNZ consumer inflation expectations survey results for the third quarter 2019.

The RBNZ has identified unemployment and wage growth as being key to achieving its inflation target. It wants to stimulate the economy with lower borrowing costs in the hope of fostering lower joblessness and faster wage growth that strengthens the Kiwi expansion. However, last week Statistics New Zealand data showed the unemployment rate rising from 3.9% to 4.2% during the third quarter, marking a departure from the coveted 'full employment' level, while jobs growth slowed markedly.

The RBNZ said in August and September, after the jobless rate had fallen to its earlier 3.9% level, that Kiwi employment had reached its "maximum sustainable level" before committing in both months to using interest rate policy in order to keep maintain that status quo.

That commitment is in line with the new mandate it has been operating under since April 01, which is a product of the Labour Party and New Zealand First coalition government that saw the bank obligated to "support maximum sustainable employment" in addition to keeping inflation "near the 2 percent mid-point" of the target range.

"NZD’s muted FX reaction to a disappointing 3Q employment report (which drove a rates repricing) suggests that short NZD positioning may limit downside from a potential dovish surprise from the RBNZ next week. However, if the RBNZ remains on hold, short NZD positioning may lead to a squeeze even if the tone remains cautious. The risks of the RBNZ remaining on hold may be underpriced given recent positive trade momentum and decent trade balance and 3Q CPI data," says Hans Redeker, head of FX strategy at Morgan Stanley, in a recent note to clients.

Above: NZD/USD rate shown at daily intervals.

New Zealand inflation surprised on the upside in the third quarter, rising 0.7% during the period although the annual rate declined from 1.7% to 1.5% and is now even further below the coveted midpoint of the 1%-to-3% target. Given the fall in the annual rate last quarter's inflation data might not be enough to prevent the RBNZ from cutting the cash rate Wednesday but it could mean that if the bank does cut, it might then be more inclined to be sit on hold a while before taking any further action.

RBNZ Governor Adrian Orr said in September that weak growth and inflation pressures mean Kiwi interest rates can be expected to be "low for longer" and that there "remains scope" for more fiscal and monetary stimulus to support the economy "if necessary" in the months ahead. The insertion of the words "if needed" into the guidance on future policy moves led markets to believe that, after three rate cuts this year, the bank might be looking to take a step back and observe the effect of its work for a while.

Morgan Stanley strategists are betting that even if the RBNZ does cut Wednesday, the Kiwi Dollar will rise because the bank would be likely to also signal a pause in its cutting cycle, potentially prompting markets to price-out some of the additional 2020 rate cut, to 0.5%, that they've also been betting on.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement