Norwegian Krone: Norges Bank says 1st Cut Only Likely in 2025

- Written by: Sam Coventry

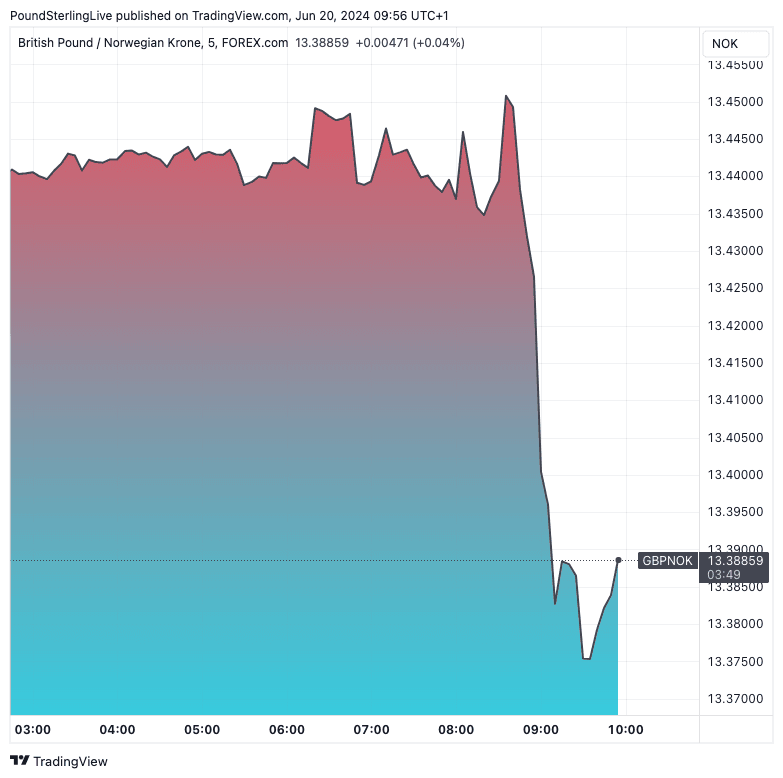

Above: GBP/NOK reacts to the Norges Bank's guidance.

The Norwegian Krone rose sharply after the Norges Bank maintained interest rates and signalled it was not any closer to cutting interest rates.

The Pound to Krone exchange rate is down nearly half a per cent on the day due to the updated guidance showing that the timing of a first cut was pushed back to 2025. It is quoted at 13.38 at the time of writing.

The Euro to Krone is down by a similar amount at 11.3060, and the Dollar to Krone is lower 0.20% at 10.5484.

Norges Bank said it doesn't expect Norwegian inflation to fall to the 2.0% target rate until at least 2027 and said it would raise interest rates again if needed.

"We change our call: First cut in March, rather than in December," says Kjersti Haugland, an economist at DNB, Norway's biggest bank.

"Norges Bank’s verbal guidance and updated interest rate projections reinforce the message that it won’t start cutting interest rates until the end of the year at the earliest," says Jack Allen-Reynolds, Deputy Chief Euro-zone Economist at Capital Economics.

Crucially, the central bank raised its own projections for the path of interest rates, which clearly signals that it doesn't expect to cut interest rates until at least 2025. The first-rate cut was moved from September to March 2025.

"The NOK has risen sharply since the decision and is the strongest currency in the G10 FX space on Thursday. USD/NOK is back at its weakest level since early June. There could be a continued grind higher for the NOK if the Norges Bank looks like it will be an outlier and impose a significant delay to rate cuts," says Kathleen Brooks, an analyst at XTB.

Foreign exchange markets are highly responsive to shifts in interest rate expectations; earlier in the day, we saw the Swiss Franc fall after the SNB cut interest rates for a second time in 2024. By contrast, Norge Bank's message that rate cuts are now even more distant explains the NOK's move higher.

"Since our macro estimates do not deviate substantially from Norges Bank’s new forecasts, we change our Norges Bank rate forecast, delaying the first cut from the December meeting to the March meeting. We continue to expect two more cuts in the following two quarters, i.e. further 25bp cuts at the meetings in June and September," says DNB's Haugland.