Macanese Pataca: Gaming Revenues Refresh Post-covid High

- Written by: Sam Coventry

Image © Adobe Images

Revenues from Macau's most important economic sector have risen to retest post-Covid highs, according to official data.

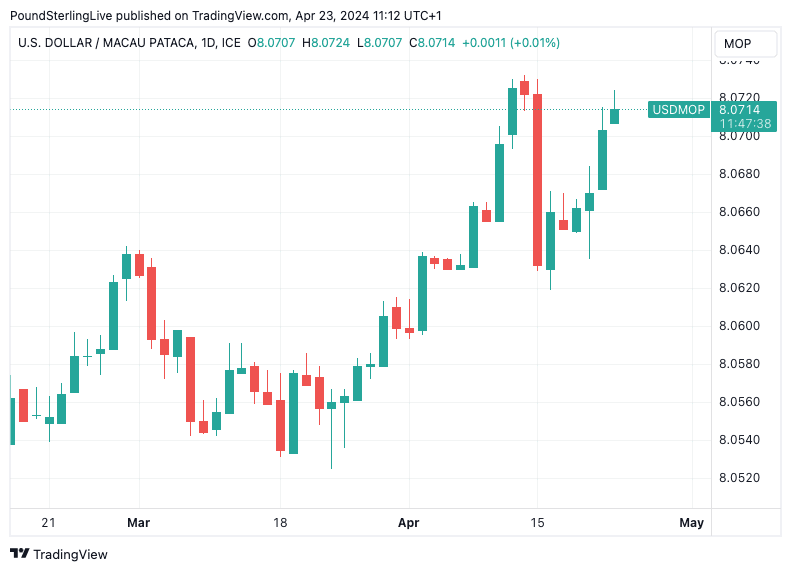

However, global factors remain firmly in control of the HKD-pegged Macanese Patacan, which could be close to revisiting recent lows against the U.S. Dollar.

Yet, improved revenues from gaming will assist authorities in defending the peg at a time when Asian currencies have come under increased pressure from a surging U.S. Dollar.

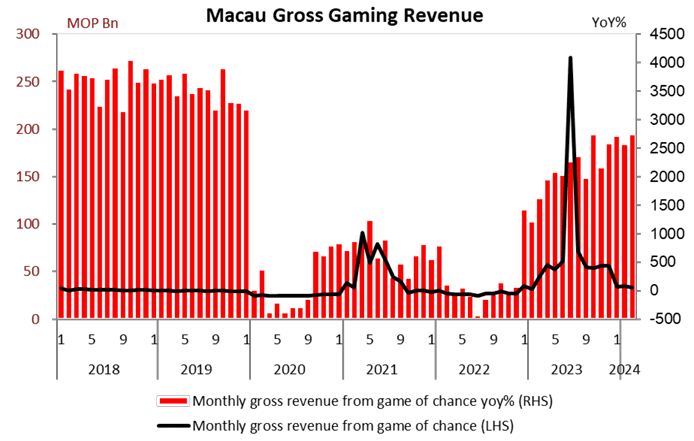

Macau reported gross gaming revenue grew 53.1% year-on-year and 5.5% month-on-month to MOP19.50bn in March, refreshing the post-Covid high.

Compared to the same period in 2019, the gross gaming revenue in March was down by 24.5%.

Above: The Pataca has come under pressure in 2024, alongside other Asian currencies.

"The gross revenue of casinos in the special administrative region dropped by more than 85% between 2019 and 2022," says David Hunting, analyst at SportBet. "It was surpassed by revenue generated by casinos in Nevada."

At its peak, the gambling industry generated over 40% of the GDP of Macau. For the first quarter of 2024, gross gaming revenue rose by 5.9% over the previous quarter to reach MOP57.33BN.

"Broadly, the gaming sector in Macau continued to hold up well in recent weeks. Based on the current trajectory, we expect to see around 20% year-on-year growth in gross gaming revenue this year," says Keung Ching, Hong Kong & Macau Economist at OCBC.

Image courtesy of OCBC.

Although the Pataca is pegged to the Hong Kong Dollar, maintaining a peg requires significant revenues, particularly in times of Dollar strength.

Analyst concerns for Asian currencies have grown amidst fading expectations that the Federal Reserve will cut interest rates in 2024, which pushes up the cost of global finance.

"Asian FX markets have been on tenterhooks with higher US yields and a strong Dollar," says Michael Wan, Senior Currency Analyst at MUFG Bank Ltd. "We have already highlighted downside risks to our Asian FX forecasts in part stemming from these global trends."

Analysts at MUFG say Dollar strength should still continue over the next one to two months, but they stress the window for Dollar strength is likely to close in 2H24 with markets already meaningfully pricing out Fed rate cuts.

Mecanese revenues from the gaming sector are expected to ultimately recover to pre-COVID revenues, although this could take some time given that China's post-COVID consumer recovery has disappointed.

"Barring any retracement risks, Asian FX may continue to stay under pressure given the unfortunate mix of high for longer, geopolitical risks, renewed volatility in RMB, JPY and the bumpy China recovery," says Christophe Wong, FX Strategist at OCBC Global Markets.