Kenyan Shilling Extends Decline on Eurobonds Default Fears

- Written by: Gary Howes

Image © Adobe Images

The Kenyan Shilling looks set to extend its multi-month selloff as the country's Eurobonds plunged in value and raised concerns Kenya's foreign exchange reserves are on course to dwindle to uncomfortable levels.

The bonds plunged on Wednesday after Moody’s Investors Service said it may treat a buyback of a portion of the debt, mooted by the government in June, as a default.

David Rogovic, a vice president and senior credit officer at Moody's, told Bloomberg that President William Ruto's recently floated plan to redeem bonds at a price below par value would constitute an economic loss to investors.

"We deem a distressed exchange occurs when there are economic losses to creditors and when the transaction has the effect of allowing the issuer to avoid a likely eventual default," Rogovic said.

The comments lead to a selloff in Kenya's eurobonds and an associated spike in their yield, developments that coincided with further losses in the domestic currency.

Kenya's debt outlook has deteriorated amidst rising global commodity prices and tightening global financial conditions, linked to rising central bank interest rate hikes, spearheaded by the Federal Reserve.

"Countries with significant macro-economic vulnerabilities currently find it difficult to raise funds at palatable rates in the international capital market amid tighter global financial conditions and reduced risk appetite," says Sthembiso E Nkalanga at JP Morgan. "Kenya serves as a test case."

The outlook for Emerging Markets - Kenya and its Shilling included - can however improve once global interest rates start declining as this would ease pressures on funding and repayments.

However, economists reckon this might only be a story for 2024.

"Investors remained convinced that the Fed had already concluded its own tightening crusade last week and that a series of rate reductions are likely to be appropriate during 2024," says Charalampos Pissouros, an analyst at XM.com, a global broker which offers forex trading in Kenya using m-pesa.

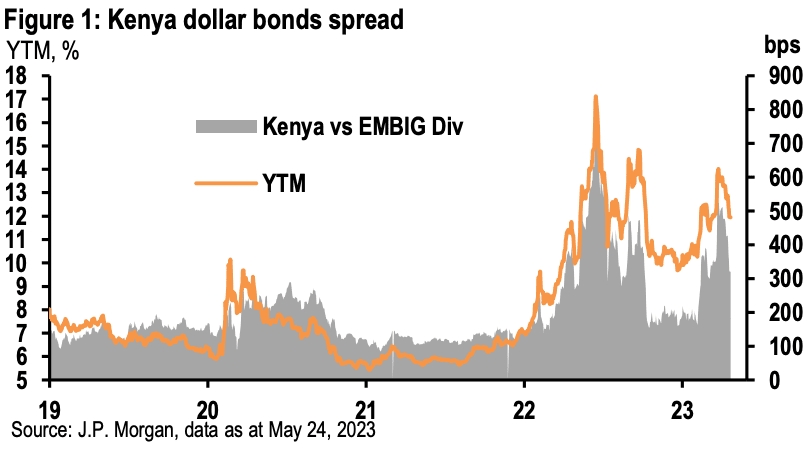

Above: The cost of servicing Kenya's debt ballooned from 2022 when global interest rates started rising as central banks, led by the Federal Reserve, responded to surging inflation. Image courtesy of JP Morgan.

An easing in global financial conditions will likely be slow to materialise given central banks continue to face elevated inflationary pressures and will be wary of making any premature moves that might reignite price rises.

This suggests there is scope for Kenya's shilling to extend losses before the global backdrop improves and turns supportive.

Ruto announced in June his government was considering buying back half of the country's $2BN of 2024 Eurobonds before the end of this year.

"Market concerns centre on the heavy hard currency redemption profile of US$2BN next year, with eurobond yields remaining above 10% to curb, if not effectively shut, its international market access," says Nkalanga.

Without access to international bond markets to refinance upcoming external amortizations, Moody's said it expects Kenya to rely primarily on concessional financing from multilateral financial institutions, along with commercial syndicated loans and borrowing from regional development banks, to meet its external financing needs.

Moody’s Investors Service lowered Kenya's credit outlook to negative last week, having cut the country's senior unsecured debt rating and long-term foreign currency and local currency issuer ratings to B3 from B2.

Kenya's FX reserves are sliding and dropped nearly US$1bn to U$6.4bn YTD on the back of elevated external debt obligations and large import needs, according to JP Morgan.

"Sustained lack of cheap or concessional refinancing options for the 2024 maturity could force a nearly US$2BN FX reserve drawdown to US$4.4BN, which would represent a record low and risks being a precariously low level of import cover," says Nkalanga.

Moody's reckons Kenya has the means to repay the bonds, thereby avoiding a worst-case outcome of default.

The Shilling nevertheless looks set to extend a trend of depreciation that looks set to extend over the coming weeks.

"We are still seeing some pressure on the shilling; the current account has narrowed, but still remains quite significant," Ronak Rasiklal Gadhia, director of frontier banks at EFG Hermes Research, told Bloomberg.

EFG Hermes forecasts the Dollar-Kenyan Shilling exchange rate to rise to 150 by year-end, up from 142.68 at the time of writing.

Pressure in the USD/KES will meanwhile push other cross-exchange rates such as Pound-Shilling and Euro-Shilling higher.