Turkish Lira Forecasts see Significant Downgrade at Commerzbank

- Written by: Gary Howes

Image © Adobe Stock

Turkish Lira forecasts have been downgraded at Commerzbank following President Tayyip Erdogan's successful re-election.

"The Turkish lira appears to be going exponential once again," says Tatha Ghose, Senior EM Economist at Commerzbank.

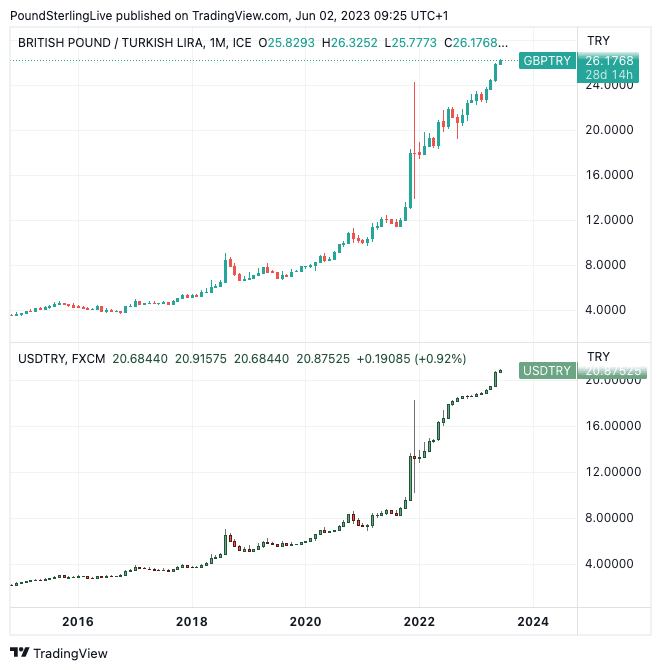

The Pound to Lira exchange rate has surged 6.0% this week as investors and businesses account for Erdogan's comfortable win in the second round of voting, as a multi-year trend of appreciation accelerates once more.

"The electoral race was tight, but the economic outcomes were going to be wildly divergent," says Ghose, indicating the market's anticipation of policy changes.

Against the Dollar, the Lira is 4.74% softer, with USDTRY quoting at 20.87 and against the Euro losses stand at 5.10%. Euro-Lira is quoted at 22.50.

In the run-up to the election, the lira remained relatively stable due to a combination of FX controls, interventions, and the possibility of an opposition win.

"In that scenario, Turkey might have witnessed a return to orthodox economic policies and the use of high interest rates to control inflation," says Ghose.

However, with Erdogan's victory by a decisive 52.2% in the second round, uncertainty surrounding policy direction has dissipated.

Ghose emphasises that the lira's recent depreciation marks a shift in market sentiment, "the exchange rate has started to depreciate once again."

Above: GBPTRY and USDTRY (lower panel) at monthly intervals.

This depreciation is expected to have an impact on inflation, as Ghose explains, "the FX pass-through to inflation will re-accelerate – the apparently falling inflation could begin to reverse."

The outlook for the real interest rate is also expected to deteriorate, further intensifying the depreciation of the lira.

As a result of these developments, Commerzbank has significantly revised its USD/TRY forecast path.

"We have revised up our USD/TRY forecast path significantly, with a target of 25.00 for end-2023 and 30.00 for end-2024," says Ghose.

The revised forecasts reflect the anticipation of ongoing exchange rate depreciation and the potential challenges associated with the inflation-FX spiral.