Pound to Lira Rate Forecast: Fresh All-time Highs a Matter of Time as Political Anxieties Expected to Rebuild

- Written by: Gary Howes

Image sourced Flickr, credit: Astro medya Org. Ltd. ŞTİ. Licensing: CC 2.0.

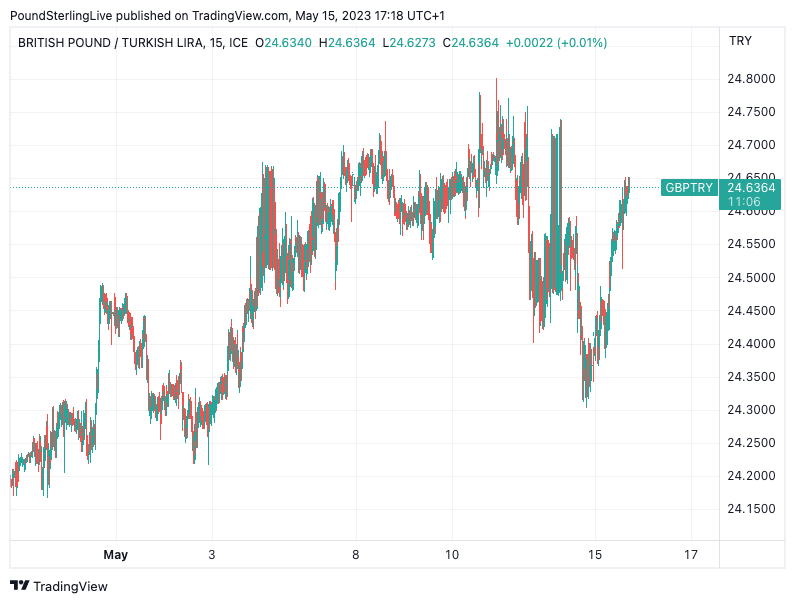

The Pound to Lira exchange rate (GBPTRY) rallied by over a per cent in value to 24.63 at the start of the new week as wrong-footed investors braced for another term of unorthodox policies under President Erdoğan.

GBPTRY rose amidst a broader decline in the Turkish Lira as investors proved surprised by Erdoğan's showing at this weekend's poll.

The incumbent fell just short of the 50% required to secure the presidency outright, defying polls that suggested he was likely to come second.

GBPTRY had been as high as 24.80 on May 10 but pared gains as investors reacted to news that ex-CHP (Republican’s People Party) candidate Muharrem Ince would withdraw from the Presidential race, fuelling hopes of an opposition outright win.

The rally in TRY following the announcement accounted for a scenario whereby Erdoğan leaves office and more pragmatic economic policies are ushered in by his successor.

"Not only did the incumbent President Erdoğan obtain a better-than-expected share of votes, but the People’s Alliance that he represents looks to have obtained a simple majority in the Parliament, at odds with opinion polls ahead of elections," says Irina Topa-Serry, Emerging Market Senior Economist at AXA Investment Managers.

President Erdoğan is set to face joint opposition candidate Kılıçdaroğlu in a run-off on May 28.

That Erdoğan won the first round of voting leads investors to bet on another term for the long-time President.

"Market volatility reflects uncertainty as to the macroeconomic framework and thus the level of interest rates and FX adjustments, as well as corporate earnings ahead," says Topa-Serry.

The GBPTRY exchange rate is likely to remain on a trend of appreciation and could top the all-time high at 24.80 in the run-up to the second round of voting on May 28.

Above: GBPTRY is rebounding in the wake of this weekend's events.

"A recession in the second half of 2023 is on the cards, with more painful adjustments on the currency side likely, before Turkish assets again appear attractive for foreign investors," says Topa-Serry.

"Improving the institutional framework appears to us as key to implementing effective stabilisation reforms, which looks likely to be a long and difficult process – all the more so if President Erdoğan were to be re-elected in the second round on 28 May," she adds.