Norwegian Krone Rip Tide: How the FX Death Trap Gets Traders

- Written by: Brent Donnelly, Spectra Markets

This article is an excerpt from Brent Donnelly's AM/FX daily macro newsletter. Readers can get the full copy and more by signing up here.

Image © Dennis Jarvis, Flickr. NIS flagged Crude oil/Shuttle tanker Heather Knutsen, OAS Group.

In the last 10 years, an email I receive about once per month goes something like: “Man, Norway fundamentals look amazing. Look at that current account surplus. Look at all those oil revenues! Why is it trading so weak?”

Norway has been a massive trap for currency traders for many years because it does not trade off domestic fundamentals. Fund after fund, investor after investor, traders cannot kick the habit of piling into NOK only to feel the wrath of its inevitable asymmetry.

NOK is simply an asymmetric risky asset that rallies a bit when things are good and craters when things are bad. I bring this up today because NOK is doing its thing again this morning and even after all these years, people still try to trade NOK off Norwegian fundamentals.

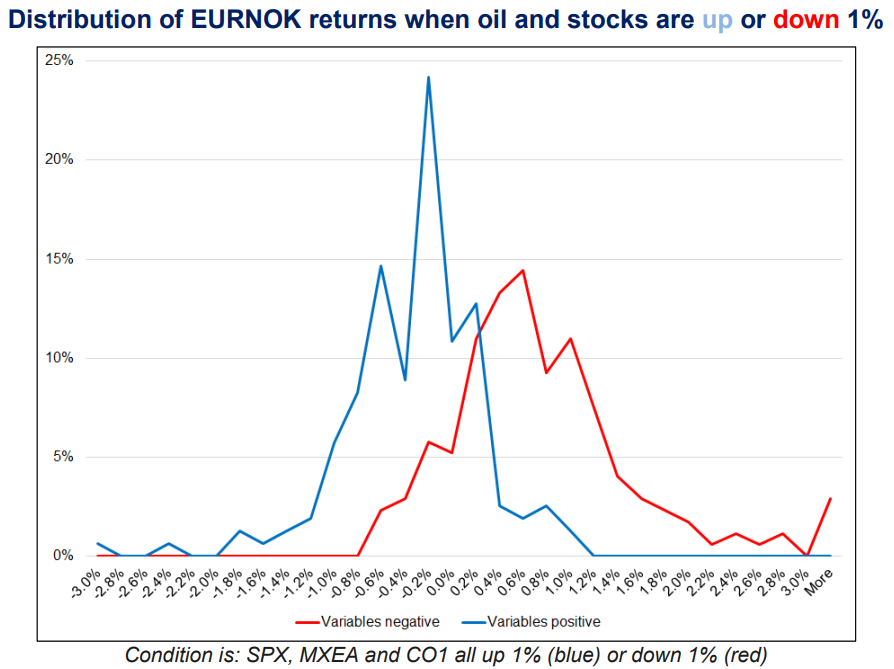

It’s worth knowing that Norway’s fundamentals have nothing to do with its currency. A simple way to see this is to look at all days when SPX, global equities, and oil are up or down 1%. And then ask: what does EURNOK do on these days?

This is not just a matter of fat tails, it’s also a matter of a big fat mode. When oil and stocks are both up 1%, the most common result for EURNOK is unchanged! But when they are both down 1%, the most common result for EURNOK is up 0.6%. The averages of the two histograms are -0.4% and +0.7%. A rather amazing skew.

The money earned by oil companies in Norway is taxed at 78% and that revenue goes directly into Norway’s oil fund. At $1.3 trillion of assets, this fund now represents wealth of about $225,000 per individual in Norway. The problem for the currency arises as this money is invested abroad. I don’t know what portion of foreign assets are hedged vs. unhedged, but at any percentage, the flows become rather large.

Imagine the fund buys $1 billion in Apple stock and hedges 50% of it. Some hedging makes sense since the fund’s liabilities are in NOK. Looking at it simplistically if they buy $1 billion of Apple, they need to be short 500 million USDNOK as a 50% hedge. If Apple falls 10%, now they have a hedge of $500 million and an asset worth $450 million so they need to buy back 50 million USDNOK. But if Apple rallies 10%, they need to sell 50 million USDNOK. So given hedging is symmetrical, why are the moves in NOK asymmetrical? Liquidity.

Liquidity is better when risk appetite is strong. So, when stocks and oil are rallying, it’s easy to sell EURNOK or USDNOK. When the wheels are falling off risky assets, it’s extremely difficult to buy EURNOK or USDNOK. This creates the skew. You are either selling xxx/NOK in a market where it’s easy to sell or buying when it’s difficult to buy.

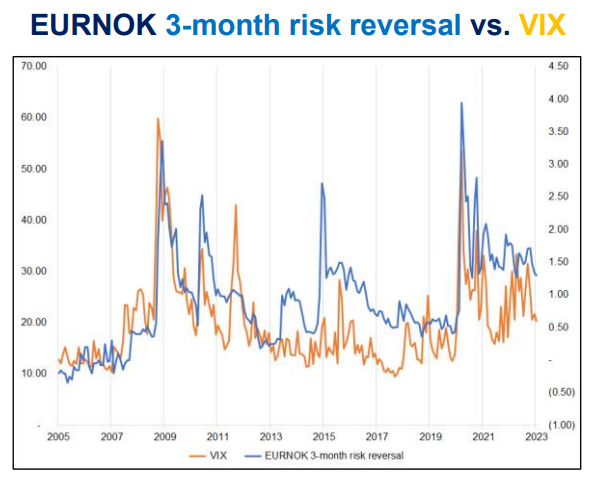

This is revealed in the skew of EURNOK options, which tracks the VIX almost perfectly.

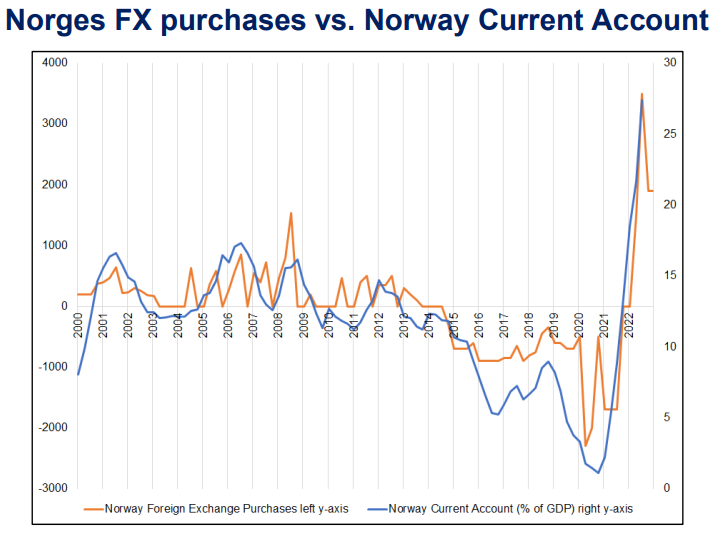

Some of the hedging of NOK comes via the Norges Bank’s monthly sales or purchases (explained here). As you can see, as Norway’s current account surplus rises, the Norges bank buys more foreign currency (sells NOK). It’s worth noting that the skew in EURNOK returns narrowed significantly in the 2016-2019 period when the Norges was buying NOK and therefore you can reasonably attribute part of the asymmetry in NOK directly to this flow.

Conclusion: NOK fundamentals look strong and in the long run, Norway will reap significant economic benefits from their massive wealth fund. The fund is an antidote to Dutch disease that countries like Canada and Australia should envy. On the other hand, this is no reason to buy NOK. The fund’s global investments, and the liquidity skew that impacts their hedging, means that long NOK is an asymmetric bet on global risk appetite, not a bet on Norwegian fundamentals. When things are good, EURNOK goes down slowly. When things are bad, EURNOK goes up quickly