Russian Rouble's Seismic Sell-off Not Yet Over

- Written by: James Skinner

- Ukraine invasion & sanctions a mortal threat to RUB

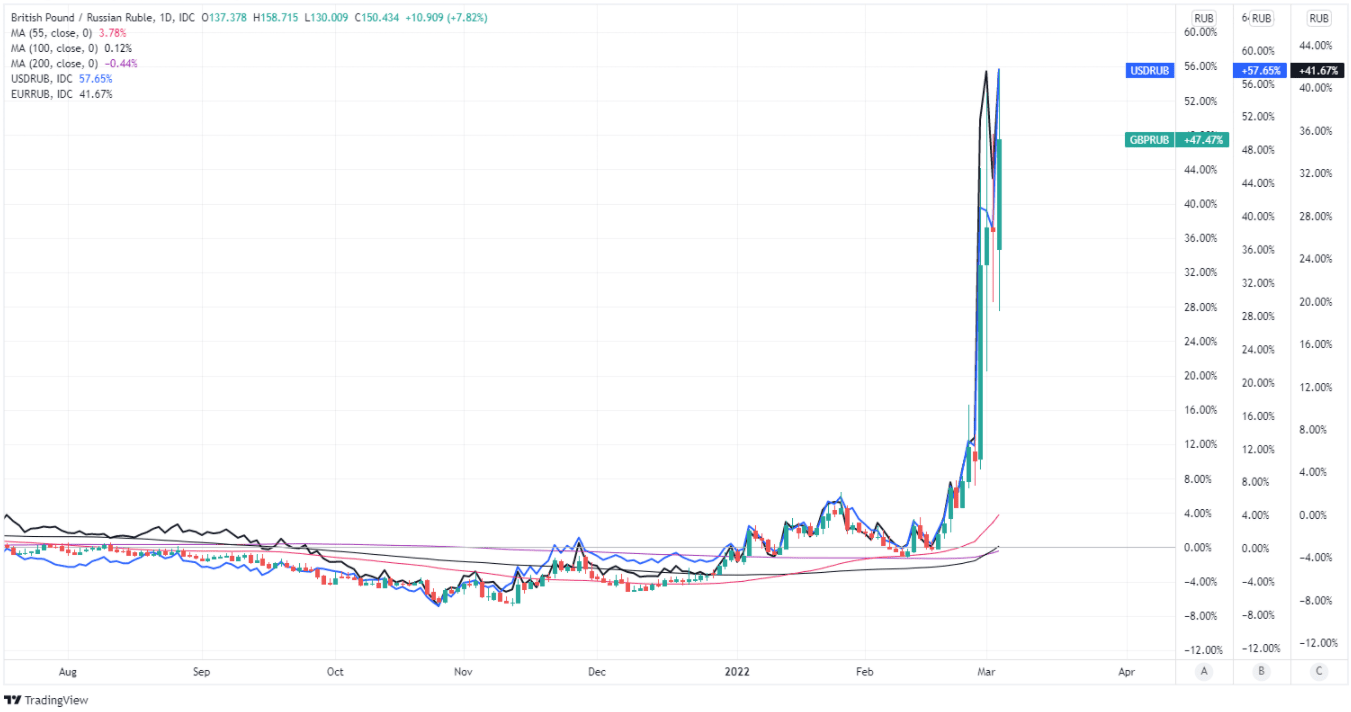

- Sheds roughly half value Vs USD, GBP, EUR thus far

- But countermeasures likely stemming RUB’s decline

- Further sanctions possible & could have side effects

Image © Adobe Images

The Rouble has quickly become the worst performing currency of 2022 following the Kremlin’s attack on Ukraine, leading to aggressive financial sanctions that could potentially be expanded with a progressively more severe impact on the Russian economy and currency as time goes on.

Russia’s Rouble shed around half of its international market value against currencies like the Dollar, Pound and Euro during the week to Thursday after G7 countries and the European Union adopted what is close to the most aggressive financial sanctions package seen so far in modern history.

“The dynamic of the exchange rate is an additional pro inflationary factor that affects the current product prices and causes a drastic rise in devaluation expectations and inflation expectations,” CBR Governor Elvira Nabiullina said in a statement on Monday.

“Considering the restrictions on using the gold and foreign currency reserves in dollars and euros, we have not carried out interventions today. The Government has announced the decision obliging enterprises to sell 80% of their export revenues,” the Governor also said.

Above: GBP/RUB, USD/RUB and EUR/RUB shown at daily intervals.

Sanctions measures include an eviction of many Russian commercial banks from the The Society for Worldwide Interbank Financial Telecommunication (SWIFT) international payment system as well as a freeze on almost two thirds of the Central Bank of Russia’s official reserve assets.

Sanctions prompted the Central Bank of Russia to lift its interest rate from 9.5% to 20%, which is a significant increase that leaves Russian borrowing costs among some of the highest in the world, while the reserve freeze has inhibited - but not yet precluded - authorities’ ability to support the Rouble.

“Russian authorities continued to expand the list of capital controls by denying foreign investors to repatriate money from their Russian subsidiaries and by halting payments of dividends and coupons to foreign investors. These add to forbidding Russian individuals and entities to transfer foreign currency abroad and to the obligation of Russian exporters to sell 80% of their FX income to the state,” says Roberto Mialich, an FX Strategist at UniCredit.

“Last night, USD-RUB broke above 120 after the local market closed. Interventions are likely to continue, despite CBR Governor Elvira Nabiullina saying that the central bank has no means to intervene due to sanctions on its reserves,” Mialich said in a Wednesday note to clients.

While the impact of sanctions has been significant, many Russian companies do still earn foreign currency income, much of which is sold onto the state and is likely to have helped slow as well as limit the decline in Rouble exchange rates during recent days.

“The counter-party limitations and risks posed by aggressive sanctions against Russian institutions have seen the emergence of a two-tier rouble market. Onshore names will trade with onshore names and offshore with offshore. Last night the onshore USD/RUB rate closed around 101 at a time that the offshore rate was being quoted at 115,” explains Chris Turner, global head of markets and regional head of research for CEE at ING.

“It is hard to see that gap being closed anytime soon, although there is a chance that the offshore USD/RUB is dragged a little lower as Russian exporters are forced to sell their accumulated FX earnings over coming days - these flows may go through the onshore market as we understand it,” ING’s Turner and colleagues said on Wednesday.

Sanctions announced so far have led to large differences between Rouble exchange rates in Russia and those in the offshore market, reflecting variations in the international supply of Roubles and what may be at times a more adequate availability of Dollars and other currencies in Moscow.

Above: GBP/RUB, USD/RUB and EUR/RUB shown at weekly intervals, and with weekly moving-averages.

For instance; the USD/RUB reference rate in Moscow was 111.75 on Thursday, while on the international markets the exchange rate varied between 98 and 118: Just as the GBP/RUB exchange rate was quoted at 149.7424 in Moscow but varied between 131 and 158 on international markets.

There is a risk that the above referenced factors beget yet further sanctions during the weeks and months ahead, given that the stated primary purpose of the central bank reserve freeze was to “undercut its ability to engage in foreign exchange transactions to support the Russian rouble.”

To the extent that this is the case it would suggest that despite its already seismic declines, Rouble exchange rates have not yet reached their bottom and that the likes of GBP/RUB, USD/RUB and EUR/RUB could have further to rise.

However, and as with recent changes in oil, gas and agricultural commodity prices; all such measures can have side effects.

“Ukraine’s foreign minister has stated that coordinated efforts to prevent evasion of sanctions are needed. That says that we are not just in our Ukraine metacrisis Scenario B (war and biting sanctions), but the risks are we are edging towards Scenario C (war and biting sanctions and secondary sanctions – and a bifurcated global economy)," warns Michael Every, a global macro strategist at Rabobank.