Polish Zloty Fends Off Dollar and Pushes GBP/PLN Lower as NBP Policy Supports

- Written by: James Skinner

- PLN outperforms USD, GBP et al on NBP rate stance

- Withstands USD rally following Fed’s hawkish signal

- After NBP hints rates could reach highest since 2013

- In battle to pull inflation down from two decade peak

Image © Adobe Images

The Polish Zloty fended off a rising U.S. Dollar and pushed GBP/PLN lower throughout the opening week of the new year after the National Bank of Poland (NBP) lifted its interest rate for a third time and warned the market that further increases are likely over the remainder of 2022.

Poland’s currency flexed its muscles and exercised its legs further on Thursday when outrunning a rising U.S. Dollar and almost keeping pace with the safe-haven Japanese Yen in price action that pushed the Pound to Zloty rate back below 5.46 on the interbank market.

The Pound to Zloty rate had attempted to rise back toward 5.50 in the early days of January only for its opening gambit to be scuppered when the National Bank of Poland lifted its benchmark interest rate from 1.75% to 2.25% on Tuesday.

“There persists a risk of inflation running above the NBP inflation target in the monetary policy transmission horizon. In order to reduce this risk, i.e. striving to decrease inflation to the NBP target in the medium term, the Council decided to increase NBP interest rates again,” the central bank said.

Tuesday’s rate rise was the third since September and came in the wake of data showing that Polish inflation had risen to 7.8% in annual terms for November, which is more than double the 3.5% upper limit of a target band that permits a one percentage point deviation in either direction from 2.5%.

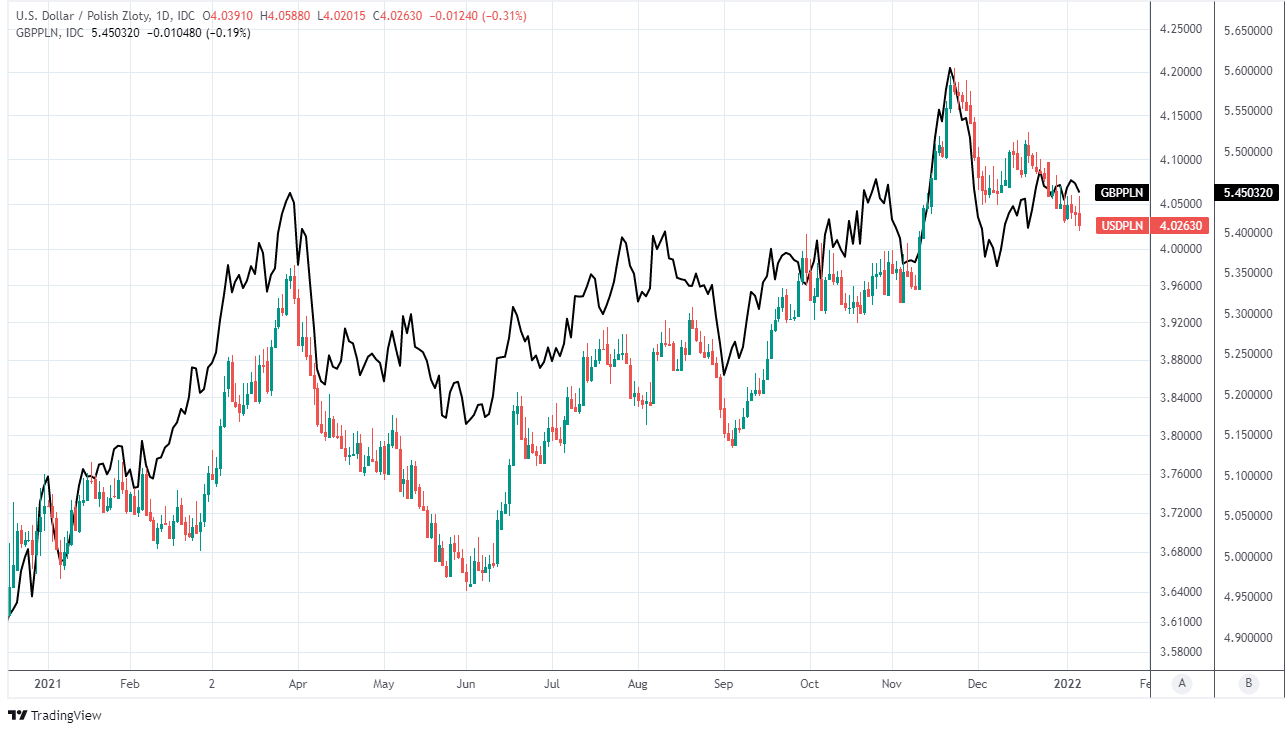

Above: USD/PLN shown at daily intervals alongside GBP/PLN.

- GBP/PLN reference rates at publication:

Spot: 5.4530 - High street bank rates (indicative band): 5.2620-5.3000

- Payment specialist rates (indicative band): 5.4040-5.4257

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The Tuesday interest rate rise lifted the Zloty immediately although the rally extended through Thursday after Governor Adam Glapinski said in a Wednesday press conference that Polish inflation pressures could mean the cash rate has to rise as far as 4% over the course of the next year or so.

“Our forecast implies that policy rates will rise to +3.00% early this year and we have argued that the risks to this forecast are skewed towards further tightening. We expect inflation in Poland to remain high throughout 2022, as we think that the administrative measures introduced aimed at curbing inflation will limit the peak, but prolong the duration of the inflation overshoot,” says Tadas Gedminas, a CEEMEA economist at Goldman Sachs.

“In our view, two factors are likely to be key in determining how far rates rise this year: first (and most obviously), the near-term path for inflation; and, second, the extent to which the Zloty exchange rate responds to the NBP’s tightening,” Gedminas and colleagues said on Wednesday.

Governor Glapinksi and colleagues attribute much of the increase in inflation to surging international commodity prices, which have lifted inflation rates in many other parts of the world during recent times, with a mere supporting role being played by the strong Polish economic recovery and rising rates of pay growth for workers.

Some analysts see domestic factors playing a larger role in sustaining inflation rates above targeted levels during the months ahead, however, and are now forecasting that Poland’s main interest rate could eventually be lifted to 4.5% as a result in what would be further supportive of the Zloty.

Above: GBP/PLN shown alongside EUR/PLN.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We see different sources of elevated inflation than the MPC chairman. External shocks were amplified by a pro-inflationary GDP structure in Poland, based on a consumption boom. High CPI also reflects demand pressures and a wage-price spiral, the impact of which will only grow this year,” says Rafal Benecki, chief economist for Poland at ING, who tips the country’s cash rate to rise to 4% in 2022 and 4.5% next year.

If Benecki and ING colleagues are right in their forecasts it would mean Poland’s cash rate is set to rise to its highest level since 2012 over the next two years, although even Governor Glapinski’s suggestion that it could go back to 4% implies that Polish interest rates could reach their highest since 2013 in the near future.

It’s this kind of outlook for borrowing costs and interest returns that likely explains why the Zloty was able to rise on Thursday even as the U.S. Dollar overran larger and typically more resilient currencies as the market responded to minutes of December’s Federal Reserve meeting, which suggested strongly that the bank is close to lifting its interest rate and beginning a process that would shrink its mammoth $8.8 billion balance sheet.

“The upside risk on inflation suggests some potential for PLN appreciation, even if EUR/PLN may be somewhat sticky in the short term, after a relatively powerful strengthening over the past two weeks,” says Jakub Barowski, a strategist at Credit Agricole CIB.

“Food and energy-related prices are among the main drivers of inflation currently, but core inflation also accelerated to a two-decade record high level at the end of last year and there is a risk of second-round effects that would keep inflation elevated,” Barowski and colleagues said Wednesday.