Polish Zloty Outperforms and More Gains Possible

- Written by: James Skinner

- PLN top performer on FX market this week

- Outperforming even safe-haven JPY & CHF

- But may rise further NBP tone on FX shifts

Image © Adobe Images

The Polish Zloty rallied against all counterpart currencies alike in the penultimate session of the week, furthering a recently emerged trend that already makes it the top performing currency on the market this week and it could yet rise further in the days ahead.

Poland’s Zloty built further on a one week advance over the Dollar, Pound, Euro and others on Thursday as it continued to outperform even the safe-haven currencies in what has been a volatile period of trading for global financial markets.

The USD/PLN and GBP/PLN exchange rates had each fallen by almost three percent for the week to Thursday while the all-important EUR/PLN pair was down almost two percent, making for an even stronger performance than that seen by the safe-haven Japanese Yen and Swiss Franc.

This placed the Zloty on course for its best week since 2015 and marks an abrupt change of fortunes for a currency that had spiralled to financial crisis lows just last Friday, a point when global markets came apart at the seams in response to the discovery of a new derivative of the coronavirus.

“Markets have been pushing EURPLN and EURHUF ever higher, seemingly on the back of a marked decline in the real rates support for PLN and HUF, and despite the fact that real rate support for the EUR has fallen and Eurozone inflation has risen. We also note that the weakness in PLN and HUF throughout November was in tandem with a sizable drop in the main equity indices in these two countries,” says Nimrod Mevorach at Credit Suisse.

Above: GBP/PLN, USD/PLN and EUR/PLN shown at daily intervals.

- Reference rates at publication:

Pound to Zloty: 5.3944 - High street bank rates (indicative): 5.2056-5.2434

- Payment specialist rates (indicative: 5.3460-5.3674

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

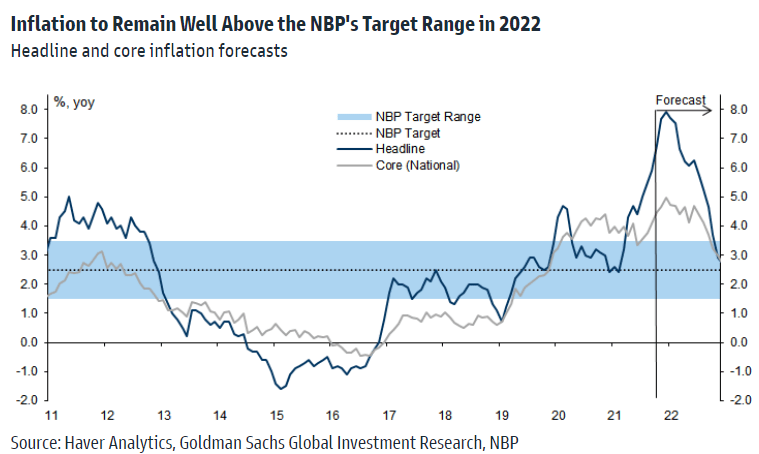

The Zloty’s rally has picked up steam and built further since Tuesday when official data revealed that Polish inflation rates leapt further during November, reaching some 7.7% in an outcome that may have led the market to anticipate further action from the Bank of Poland next week.

“Our view is that investors will continue to price in more and more risk premium for PLN and HUF as long as the rise in inflation in these countries is not met by corresponding increases in the policy rates,” Credit Suisse’s Mevorach said in a Thursday note to clients.

Poland’s central bank surprised the market in November when it lifted the country’s main interest rate by 0.75% to 1.25%, making for a second consecutive increase that followed on from October’s surprise move to raise the benchmark from its coronavirus crisis low of 0.1% to 0.50%

The Zloty drew little benefit from either of those interest rate rises and may be relevant in this regard that as they were announced the Bank of Poland had also continued to reiterate threats to intervene in the market if the currency strengthened too much for its liking.

Bank of Poland officials had been keeping a watchful eye on the Zloty since adopting an interventionist approach toward in late 2020 following what were stratospheric rallies for many European currencies last year.

Source: Goldman Sachs.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The NBP is cognizant of the possible second-round impact of a weaker zloty on consumer prices. Governor Glapinski last week resorted to verbal intervention after the zloty slumped to a 12-year low of 4.7415/EUR,” says Kenneth Broux, a strategist at Societe Generale

Driving the market’s improved responsiveness to Polish inflation is potentially the softening tone of Bank of Poland Governor Adam Glapinski, who’s indicated through media appearances this last week that the NBP’s opposition to a rallying currency could now be lessening.

Readers won’t have to wait long in order to find out as the Bank of Poland is set to announce its latest interest rate decision next Wednesday and economists at Goldman Sachs have warned clients that there’s a risk of a similar sized move to that announced in November.

“The relentless increase in inflation continues to put pressure on the NBP, and we now see risks that the Council may hike by more than our baseline forecast of 50bp at next week's MPC meeting,” says Kevin Daly, co-head of CEEMEA economics at Goldman Sachs.

“Considering the prominence of high inflation and the weak Zloty in the public discourse in Poland, we think that this time around the NBP will be more cautious in delivering a dovish surprise,” Daly wrote in a note to clients this week.

Above: GBP/PLN, USD/PLN and EUR/PLN shown at weekly intervals.