Turkish Lira Stares into Abyss after CBRT Cut Emboldens Bearish Market

- Written by: James Skinner

- USD/TRY, GBP/TRY rally as CBRT cut pushes TRY to new lows

- Market angst over inflation policy a key driver of TRY losses

- TRY’s recovery prospects limited by risk of further rate cuts

- Some analysts look for eventual reversal of cuts, TRY relief

Above: File image of CBRT Governor Şahap Kavcıoğlu. Image © CBRT

The Lira tumbled again following the Central Bank of the Republic of Turkey’s (CBRT) November decision to cut its interest rate, which has left the Turkish currency on the edge of an abyss.

Turkey’s Lira came under pressure again on Thursday after the CBRT cut its benchmark interest rate to 15%, from 16% previously, although at the time of writing the sell-off in the badly bruised currency had appeared to lose some of its steam around the lows established on Wednesday.

Trading was volatile and the spread or difference between buying and selling prices had widened significantly on the interbank market, suggesting poor liquidity and the ongoing risk of volatility in Turkish exchange rates.

New lows and exchange rate volatility come as investors contemplate the outlook for borrowing costs and inflation following the CBRT’s third interest rate cut in as many months, which could yet be followed by another rate cut in December.

“The Board will consider completing the use of the limited space implied by these impacts in December,” the CBRT said in its monetary policy statement, which indicates not only that borrowing costs could fall again by year-end but also that such a move could mark the end of the CBRT’s cutting cycle.

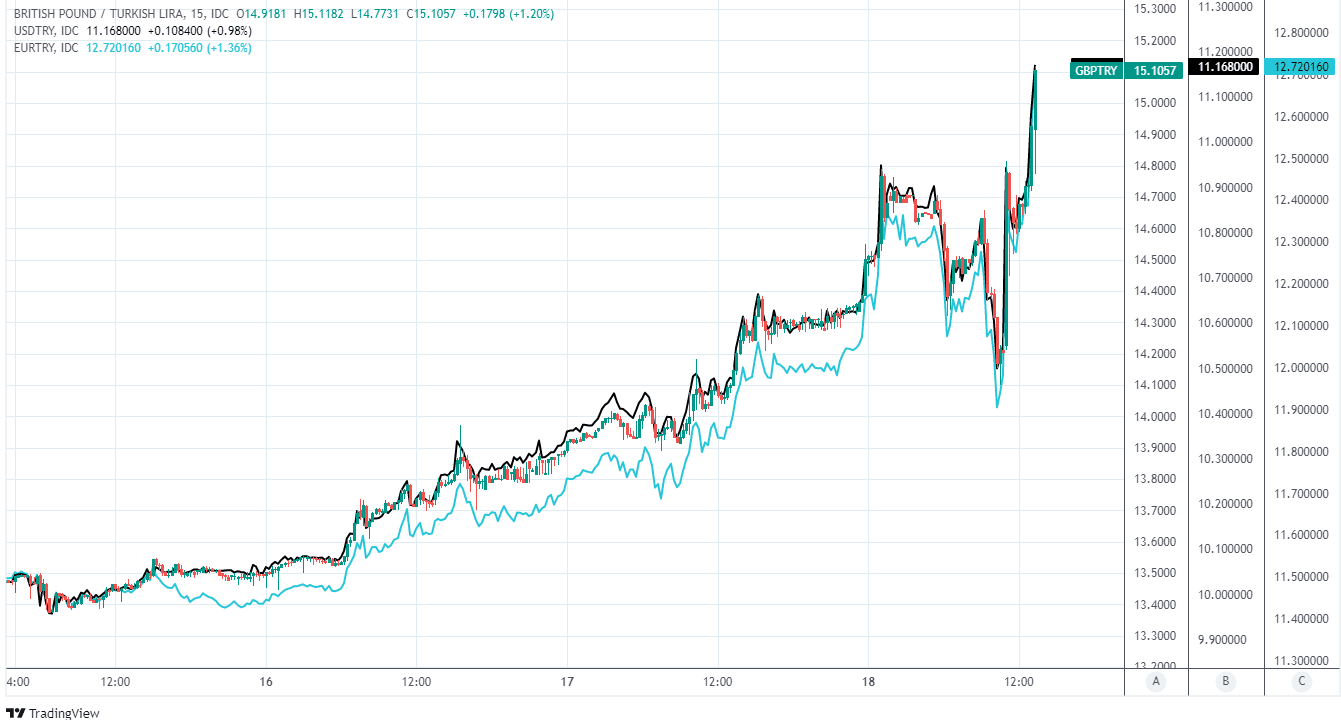

Above: GBP/TRY, USD/TRY and EUR/TRY shown at 15-minute intervals.

- GBP/TRY rates at publication:

Spot: 14.90 - High street bank rates (indicative band): 14.38-14.48

- Payment specialist rates (indicative band): 14.77-14.83

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The CBRT attributed its decision to cut the cash rate to lingering downside risks to Turkish and global economic activity connected to the coronavirus after dismissing rising Turkish inflation rates as the result of supply side factors that have lifted prices of commodities and many other goods lately.

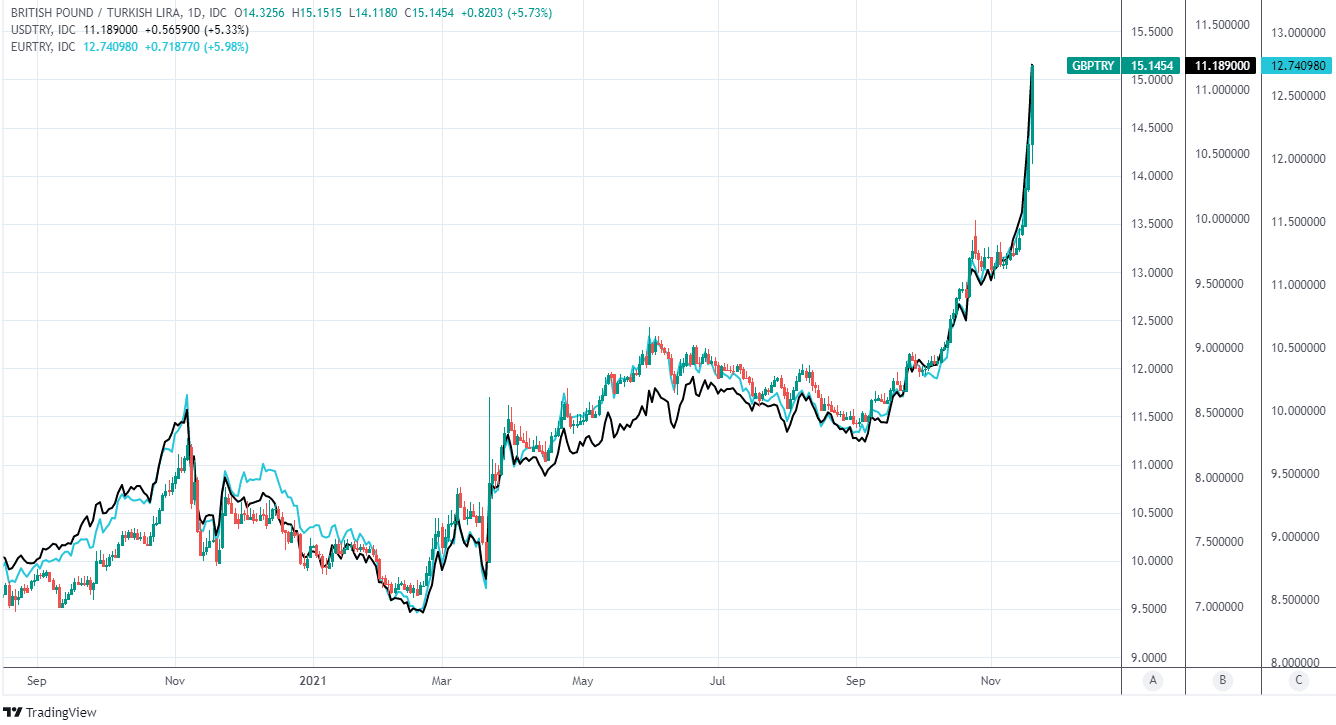

Commodities including food and energy have seen prices rise across the world this year but many of these goods are imported into Turkey and have been made even more expensive by year-to-date declines in the Lira, which had lifted USD/TRY and GBP/TRY more than 40% for 2021 on Thursday.

“We warned our readers of the risks of deeper cuts today after Erdogan's comments yesterday. USDTRY has jumped to close to 11. We think things will get worse before they get better. A further and final cut in December (likely of 100bps) anticipated by the CBRT will continue pressuring the lira until the CBRT goes into reverse gear and tightens rates,” says Cristian Maggio, head of portfolio strategy at TD Securities.

Previously on Wednesday this week the Lira had slumped to new all-time lows after President Recep Tayyip Erdogan was widely quoted telling the Turkish parliament that he would “not stop” until the burden of high interest rates had been lifted from Turkish businesses and households.

President Erdogan famously and controversially attributes high levels of inflation, which came close to 20% in Turkey during October, to high interest rates in what is an unorthodox assessment that turns upside down on its head the view and approach to inflation taken elsewhere in the world.

Above: GBP/TRY, USD/TRY and EUR/TRY shown at daily intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“By throwing a bone to markets in the form of December rate guidance, the CBRT narrowly avoided a full blown currency crisis, but speculation over the lira and rates in Turkey will remain elevated. In our view, USDTRY is just one Erdogan headline on inflation away from sliding through the 11 handle,” says Fawad Razaqzada, an analyst at ThinkMarkets.

Typically central banks lift interest rates in order to reduce inflation and cut them wherever there is a need to lift inflation, with underlying thinking being that such changes in borrowing costs can influence price pressures by either stimulating or simply curbing economic activity.

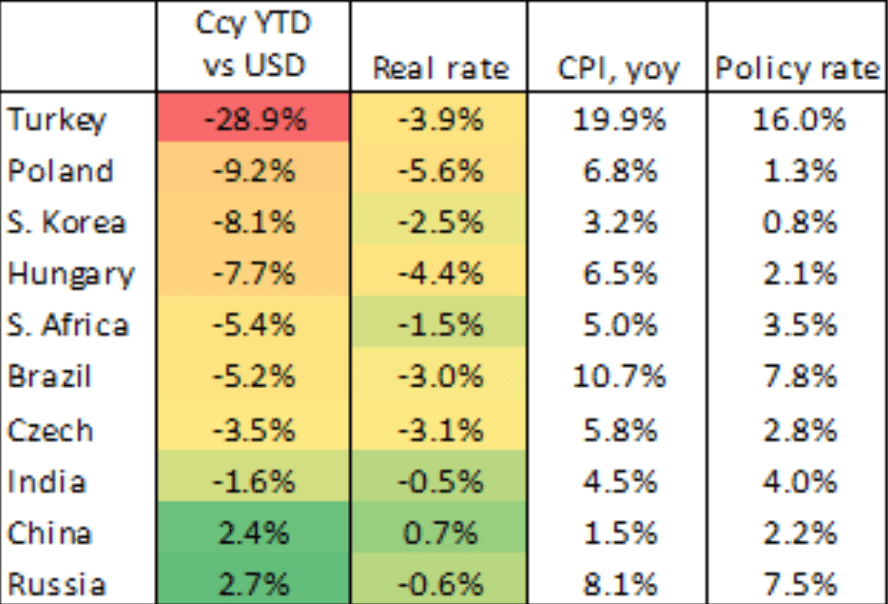

“The widening real rate gap can partly be blamed for the lira's woes this year. Real rates are only part of the story, of course. As our table illustrates, there are currencies where losses have been more limited this year like the HUF and PLN despite a bigger negative rate gap,” writes Kenneth Broux, a strategist at Societe Generale, in a research note ahead of the decision.

High levels of inflation have eroded the inflation adjusted returns earned by investors in Turkish assets for years but CBRT rate cuts have exacerbated this downward pressure on real-terms returns for bondholders, although analysts at Societe Generale say this does not fully explain the Lira’s losses.

One obvious explanation for the difference between the performance of the Lira and other currencies with larger negative real-terms interest rates would be speculative activity among traders betting against the Turkish currency.

Above: Real interest rates and other statistics for various currencies. Source: Societe Generale.

While Turkey’s Lira had already slipped to new historic lows on Thursday, lifting USD/TRY and GBP/TRY above their highs, many analysts and investors evidently maintain bearish outlooks for the currency and so even further losses couldn’t be ruled out.

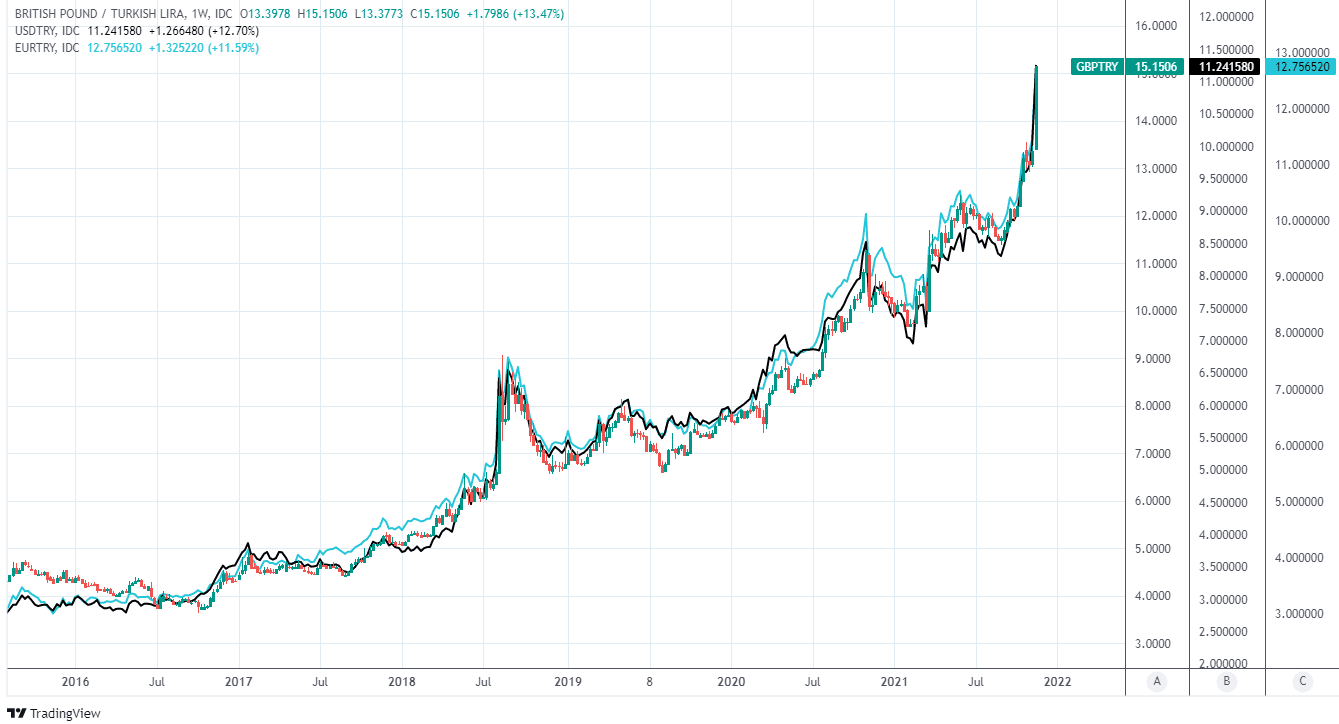

“USD/TRY has experienced a parabolic uptrend after crossing above the upper band of a multi month ascending channel (9.95/9.85),” says Tanmay Purohit, a technical analyst at Societe Generale and colleague of Broux.

“Next projections are located at 11.35 and 11.60. Achievement of these objectives could lead to a pause; 10.22, the 50% retracement of the last bout of strength is near term support,” Purohit also said.

While the Lira could yet fall further, some analysts have suggested there may eventually be scope for it to enjoy a modest recovery once into the New Year if the CBRT reverses, or even simply pauses its cycle of interest rate cuts.

“Our expectations for another 100bps rate cut at the November meeting should trigger further local currency depreciation. However, the CBT remaining on hold in 2022 should allow TRY to partially recover, especially as inflation begins to fall,” says Eimear Daly, a strategist at Barclays.

Above: GBP/TRY, USD/TRY and EUR/TRY shown at weekly intervals.