Turkish Lira Well on Course for Worst Year on Record

- Written by: James Skinner, Additional Editing by Gary Howes

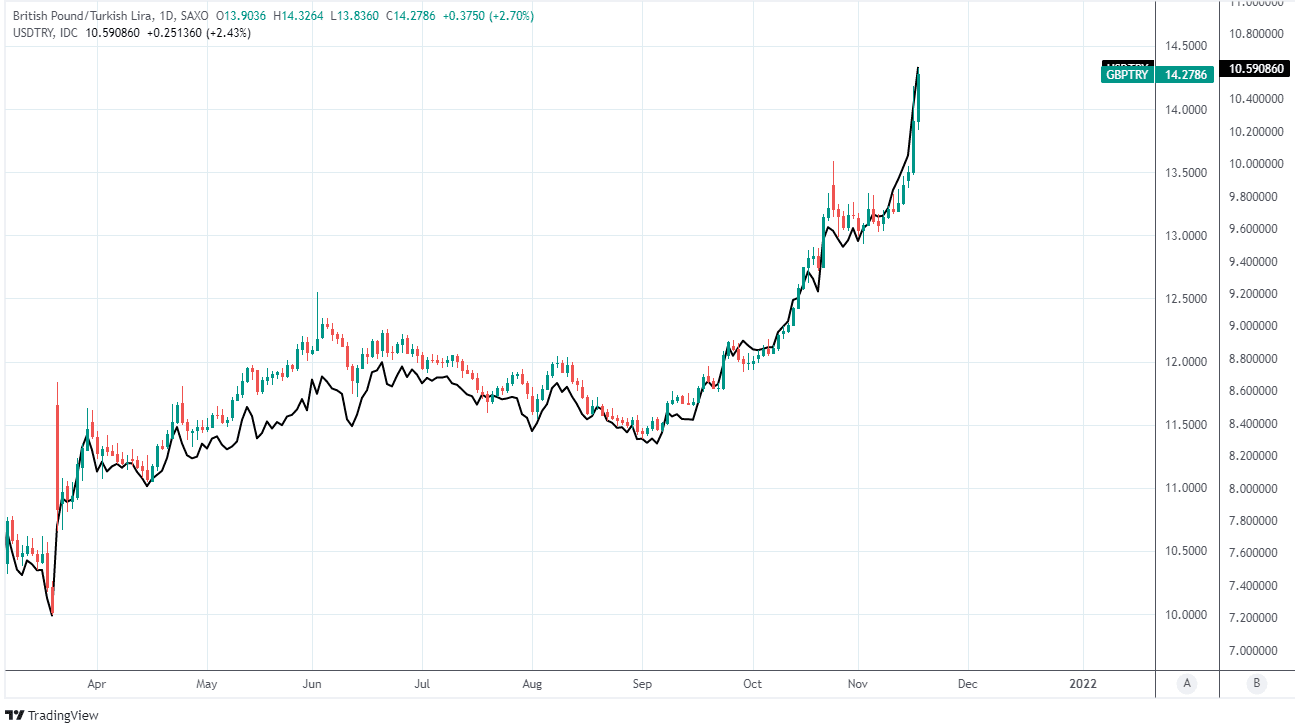

- GBP/TRY, USD/TRY at new highs ahead of CBRT

- 2021 losses surpass 40% on interest rate fears

- Leaves TRY on cusp of worst annual loss to date

Above: File image of President Erdogan, image © G20 Argentina.

The Lira spiralled to new lows that saw 2021’s losses against the Dollar and Pound surpassing the 40% threshold on Wednesday as a perfect storm of adverse conditions threatened to condemn the Turkish currency to its worst year on record.

Turkey’s Lira fell by more than two percent against all major currencies and by almost three percent against some on an intraday basis as the market responded to a cocktail of provocative comments from President Recep Tayyip Erdogan, surging gas prices and elevated risk of another interest rate cut being announced by the Central Bank of the Republic of Turkey (CBRT) in Thursday’s monetary policy decision.

Highly volatile natural gas prices were up nearly 30% on the week and threatening to aggravate an already severe market mismatch between supply and demand for the Turkish currency and its energy importing economy when President Erdogan was reported to have made clear to parliament that he’s a long way from satisfied with the level of interest rates and inflation in the country.

“As long as I am in this job, I will continue my fight against interest rates and inflation until the end. My friends who defend the interest rates should not be offended but I cannot walk with those who defend interest rates,” Erdogan reportedly said.

The remarks come barely a day before the CBRT’s latest interest rate decision.

Above: GBP/TRY shown at daily intervals alongside USD/TRY.

- GBP/TRY rates at publication:

Spot: 14.29 - High street bank rates (indicative band): 13.79-13.89

- Payment specialist rates (indicative band): 14.16-14.22

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Lira has been under heavy pressure ever since the CBRT cut its cash rate from 19% to 18% in a September surprise for the currency market and a decision that many analysts and economists have since said was premature.

Losses were exacerbated in October when the central bank followed up that initial move with an even larger cut that took the benchmark for borrowing costs down to 16%.

“The losses for the Turkish lira had already deepened sharply on Tuesday and we are seeing a continuation of that slide today. Another rate cut from the CBRT on Thursday is imminent, despite surging inflation in the country where CPI is currently above 20%,” says Fawad Razaqzada, an analyst at Think Markets.

“Economists are obviously calling for rate hikes, but that’s not going to happen,” he adds.

Turkish inflation reached 19.89% in October and in the process pushed the real terms or inflation adjusted interest rate of the country far below zero.

But with the market at large convinced that further interest rate cuts are likely in the months ahead that real interest rate could fall even further below zero and would act as a further disincentive for investors who might otherwise hold the currency.

“We expect one last 100bp cut to 15.0% on November 18, but do not think that dollarisation, TRY volatility and the inflation outlook will allow more cuts. If the CBT tries to deliver more cuts, meaning ex-post real rates reaching historical lows, we might see inflation remaining above 20% on a permanent basis,” warns Ercan Erguzel, an economist at Barclays.

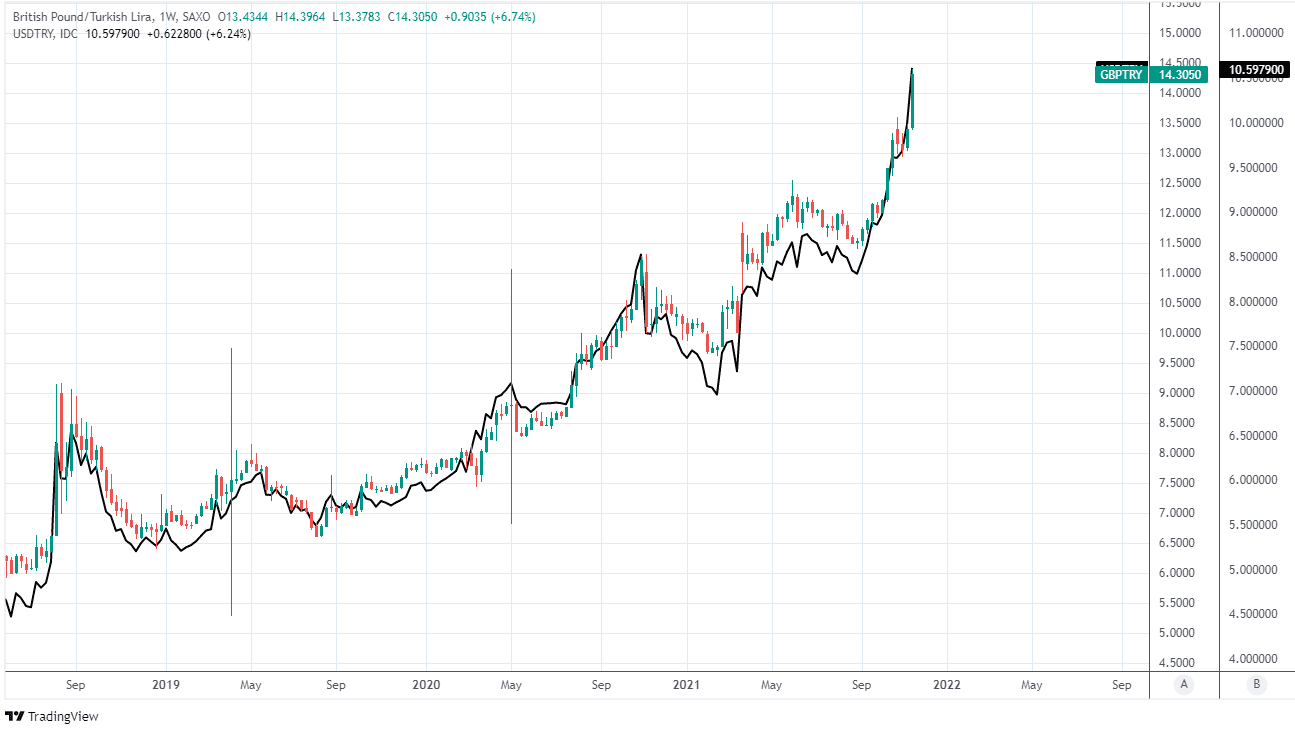

Above: GBP/TRY shown at weekly intervals alongside USD/TRY.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Central banks tend to use interest rate cuts in order to lift inflation and vice versa, but the problem for the Lira is that President Erdogan views rising interest rates as a cause of inflation rather than a cure.

He has repeatedly pressured the central bank to reduce interest rates over the years in order to bring down inflation, in each instance triggering punishing bouts of currency depreciation.

“The FX pass through to inflation is traditionally high and rather fast in Turkey and the recent TRY depreciation could feed into inflation regardless of other developments. In the feedback loop between FX and inflation, we believe that inflation expectations could become an important variable for the exchange rate,” says Murat Toprak, a CEEMEA FX strategist at HSBC.

Toprak and the HSBC team had forecast USD/TRY to end the year at 10.00 before climbing to 10.70 by the end of 2022, although the USD/TRY exchange rate surged to a high of 10.57 on Wednesday and could yet reach new heights if Thursday’s CBRT decision leads to an interest rate cut that is larger than 100 basis points anticipated by economists.

Both USD/TRY and GBP/TRY were up more than 40% for 2021 on Wednesday with barely more than a month to go before year-end, reflecting losses for the Lira that threaten to surpass even those seen during 2018 and the year of Turkey’s last currency crisis.