Vodafone Q3 Results: Strong Growth, But Market Reacts to Germany Weakness and Merger Risks

- Written by: Sam Coventry

-

Image © Adobe Images

Vodafone's fundamentals are improving, but profitability pressures, Germany's weakness, and merger risks may be weighing on investor sentiment.

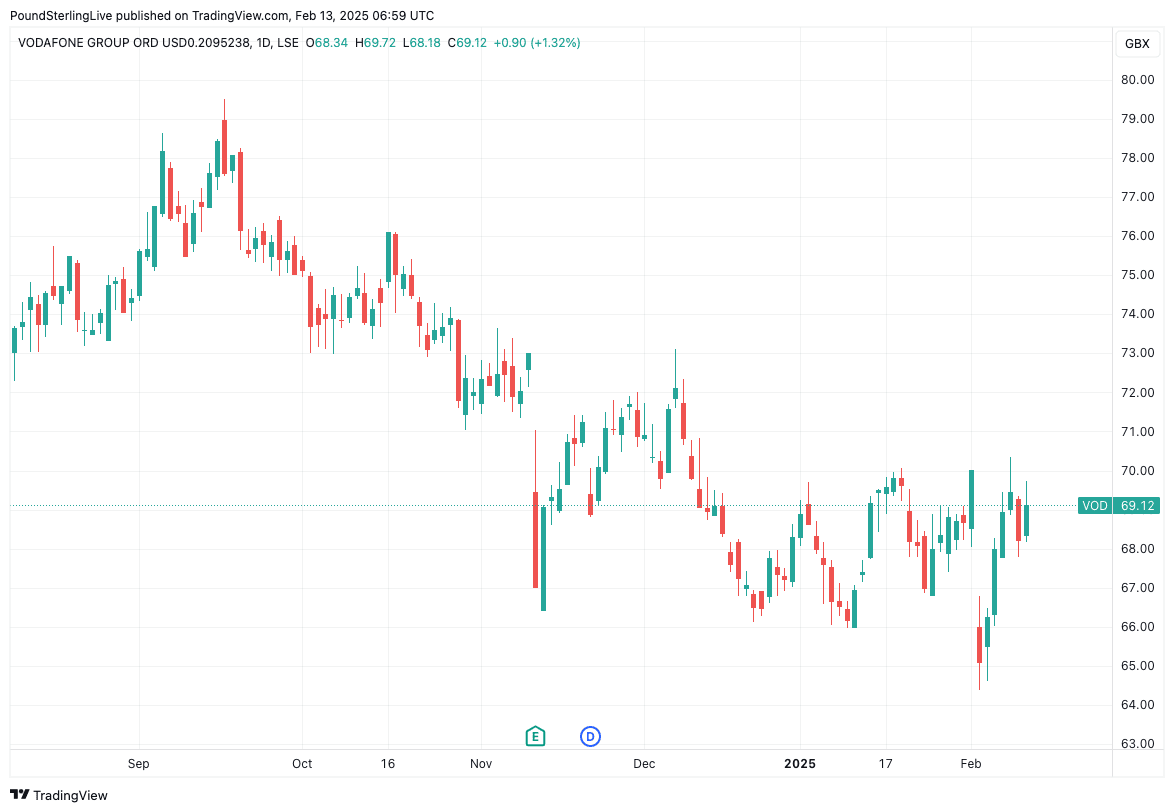

Despite reporting strong revenue growth in Q3 FY25, the Vodafone share price dropped 5.37% on the day, as investors reacted to challenges in its largest market and concerns over the execution of its UK merger with Three.

Revenue Growth Accelerates, But Profitability Under Pressure

Vodafone reported group service revenue growth of 5.6%, reaching €7.9 billion, with organic growth accelerating to 5.2% (up from 4.2% in Q2). This was driven by a strong performance in the UK, Africa, and Türkiye, where Türkiye’s service revenue surged 97.5% in euro terms.

Total revenue increased 5.0% to €9.8 billion, despite adverse foreign exchange movements. However, Vodafone’s operating profit declined by 18.4% to €1.0 billion, reflecting margin pressures and continued struggles in Germany.

Adjusted EBITDAaL grew modestly by 2.2% to €2.8 billion, but the EBITDA margin declined to 28.8% from 29.9%, raising concerns about cost pressures.

"The signal’s getting stronger at Vodafone, with service revenue growth exceeding expectations, thanks to dialled-up performance in the UK, Africa, and Turkey. But Germany remains a dropped call, weighing on overall performance," says Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Germany’s Decline Remains a Major Drag

Vodafone’s German operations, which contribute 34% of group service revenue, continued to struggle, with service revenue falling 6.4% in Q3. The TV law change, which ended bulk TV contracts in Multi-Dwelling Units (MDUs), had a -3.8 percentage point impact, while broadband losses and mobile pricing pressures further weighed on performance.

Vodafone has invested heavily in a turnaround strategy, with new management and restructuring initiatives, but the German market’s competitive intensity and regulatory challenges remain a significant hurdle.

"With €2bn in share buybacks on speed dial and over €2.4bn in free cash flow expected for the year, the case for good returns is still alive and well - but investors will want to keep an ear out for static from Germany’s ongoing struggles," says Britzman.

UK Merger with Three Faces Execution Risks

A major milestone for Vodafone was the regulatory approval of its £11 billion UK merger with Three, which is expected to be completed in the coming months. The deal aims to create one of Europe’s most advanced 5G networks, but investors remain cautious about the integration process, potential regulatory conditions, and the timeline for realising cost synergies.

Vodafone’s UK performance was strong, with organic service revenue up 3.3% (Q2: 1.2%). The company also added 72,000 broadband customers, marking its best-ever quarter for fixed-line growth.

Africa & Türkiye Drive Growth

Vodafone’s Africa operations continued to accelerate, with organic service revenue growth improving to 11.6% (Q2: 9.7%). South Africa and Egypt saw above-inflation growth, driven by strong data demand and price actions.

Vodafone’s financial services platforms, Vodafone Cash and M-Pesa, continue to gain traction, with M-Pesa now accounting for 27.8% of service revenue in its international markets.

Türkiye also delivered exceptional growth, with service revenue up 97.5% in euro terms (83.4% organic growth, adjusted for hyperinflation). Price adjustments and a growing customer base have helped Vodafone navigate economic volatility in the region.

Market Reacts to Profitability Concerns

Despite reaffirming full-year guidance of €11 billion Adjusted EBITDAaL and at least €2.4 billion in free cash flow, investors appear unconvinced about Vodafone’s ability to translate revenue growth into higher profitability.

Vodafone has also been conducting a €2 billion share buyback program, of which €1.5 billion has been completed, but this has not prevented today’s 5.37% share price decline. Investors may be looking for stronger signs of margin improvement and a clearer path to sustainable profit growth.

Outlook: Can Vodafone Convince Investors?

Vodafone’s ongoing portfolio transformation, including the €8 billion sale of Vodafone Italy, is aimed at reducing debt and refocusing on core markets. However, the market remains focused on whether Germany can stabilise and if the UK merger will deliver long-term value.

With improving revenue momentum but continued profitability concerns, Vodafone’s upcoming quarters will be crucial in rebuilding investor confidence. The key question now is whether Vodafone can turn its revenue gains into sustainable earnings growth while navigating the complex landscape of regulatory and operational challenges.