Why Gilt Yields May Continue to Rise in Coming Weeks

- Written by: Sam Coventry

-

Image © Adobe Images

Analysts at Saxo Bank say UK government bond yields (gilts) may continue to rise in the coming weeks.

A sell-off in gilts has eased at the time of writing on Friday, which corresponds with a stabilisation in Pound exchange rates.

However, analysts at Saxo Bank warn selling pressures can continue from here, meaning the yield gilts offer can continue to rise and pressure UK borrowing costs more broadly.

The rise in yields means investors are demanding a higher compensation level to hold UK debt in the wake of the budget, judging that inflation will eat into the bond's value when held over the coming years.

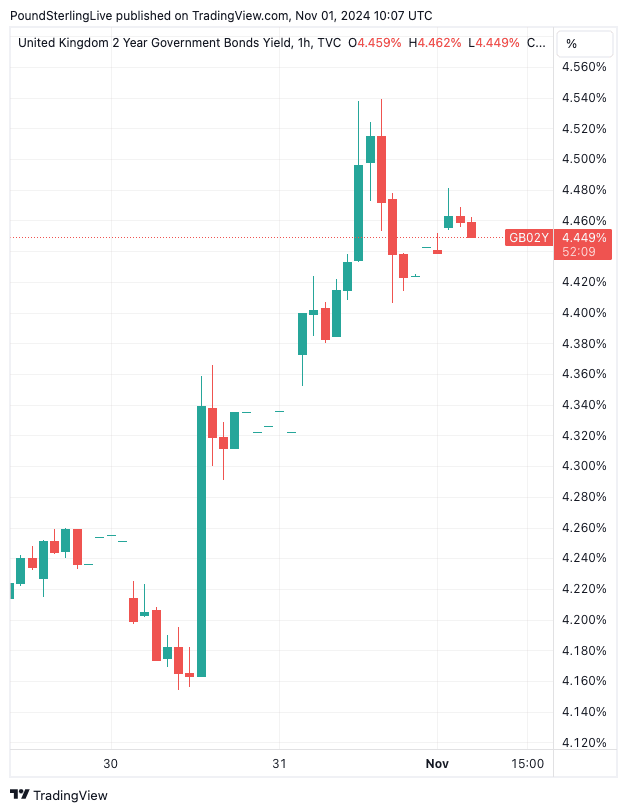

Above: UK 2-year bond yields have risen this week.

"The budget introduces significant inflationary risks," says Althea Spinozzi, Head of Fixed Income Strategy at Saxo. "The planned GBP100 billion in public investment over five years, though aimed at stimulating economic growth, may further fuel inflation in the medium term."

Markets are nervous, with some analysts likening the rise in UK borrowing costs to the aftermath of the Liz Truss mini budget of 2022.

Saxo says large increases in the minimum wage and employer National Insurance costs will likely raise labour costs in many sectors, particularly low-paid service industries like hospitality. This could exacerbate wage inflation and lead to higher prices in these sectors, contributing to broader services inflation.

The Bank of England is meanwhile tipped to slow down the speed at which it cuts interest rates in light of potentially higher inflation levels in the coming months.

This can add to upward pressures on gilt yields.

Saxo says Labour's £100BN in public investment over five years, though aimed at stimulating economic growth, may further fuel inflation in the medium term. Additionally, skills mismatches could worsen, driving up wages in certain sectors. This increased public investment could crowd out private sector borrowing and put upward pressure on interest rates.

To fund its spending spree, the government must increase the amount of debt it issues to the market, and in order to keep borrowing costs lower (yields), there must be a strong demand for the debt.

"The budget necessitates higher levels of gilt issuance, amounting to GBP300 billion for the current fiscal year and an additional GBP94.9 billion spread over the next four fiscal years. This significant increase adds to concerns about the sustainability of government borrowing," says Spinozzi.

The risk is that demand will prove lacklustre, which can drive up yields.

Saxo thinks this rise in bond yields can continue over the coming weeks as investors fret about the UK's economic path in the wake of the budget.

"While the budget aims for growth and investment, the Office for Budget Responsibility (OBR) has revised growth forecasts lower from 2026 onwards, suggesting limited long-term economic benefits from these measures. The fiscal rules, while providing a framework for stability, offer limited headroom, raising concerns about the government’s ability to respond to economic shocks without additional borrowing," says Spinozzi.

The upward revisions in future borrowing requirements suggest sustained high levels of gilt issuance, which could increase the cost of borrowing for the government and potentially affect the broader economy, she explains.