Worrying Signs in U.S. Treasury Markets Amidst Reliance on Chinese and Japanese Demand

- Written by: Gary Howes

-

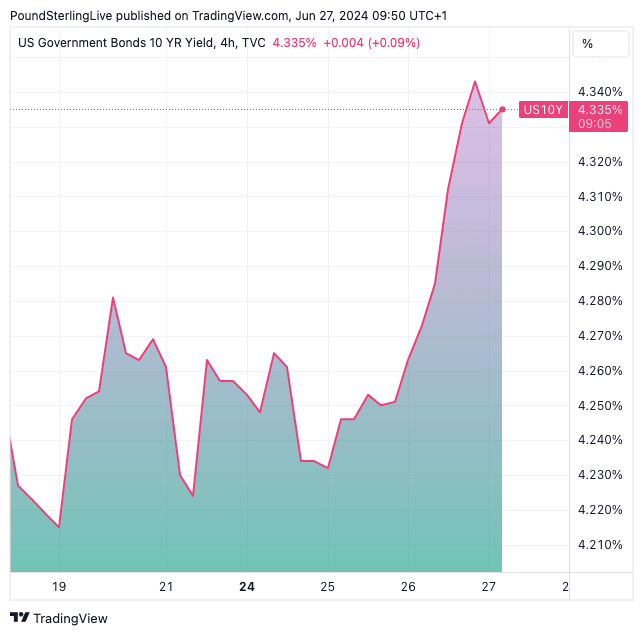

Above: U.S. ten-year Treasury yields have risen sharply over the past 48 hours.

Rising U.S. bond yields come amidst signs of thin liquidity in the Treasury market and concerns about waning demand from China and Japan.

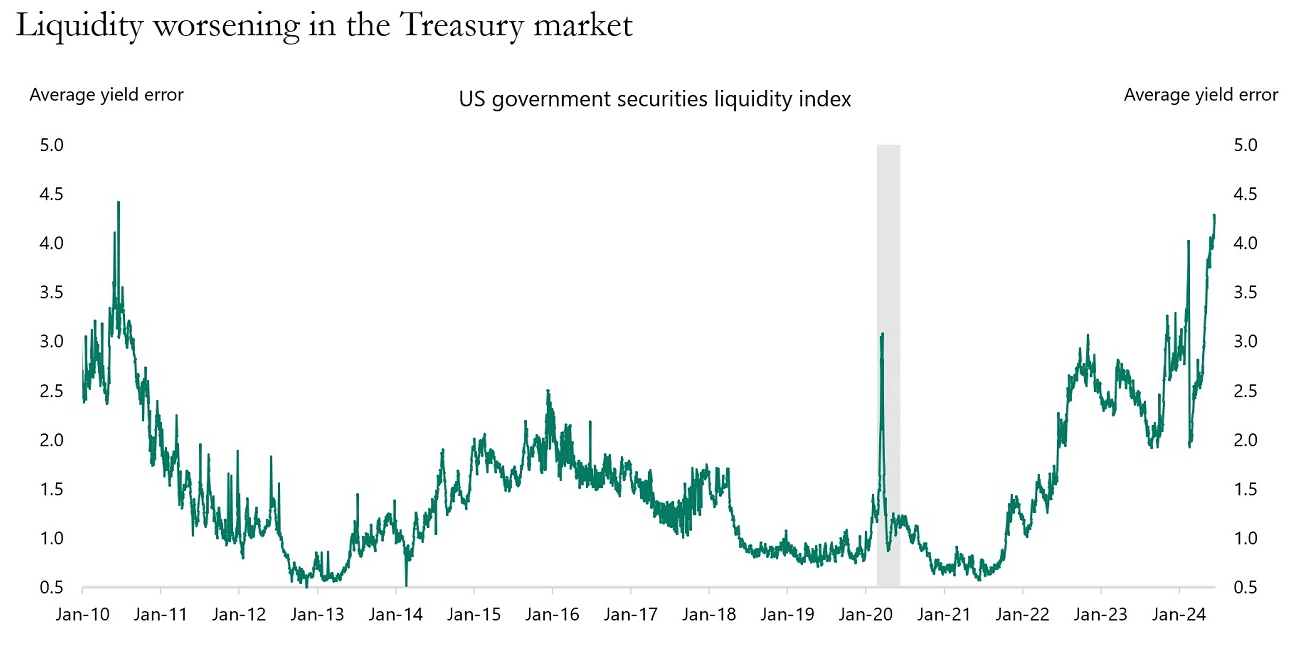

"Measures of liquidity in Treasury markets continue to send worrying signals, with the average yield error approaching 4.5," says Torsten Slok, Chief Economist at Apollo.

Slok's observations come as U.S. Treasury yields rally amidst new signs that global inflation rates are turning higher again and comments from Federal Reserve governors that an interest rate cut in 2024 is not yet assured.

U.S. ten-year Treasuries rose nearly 2.0% on Wednesday and have risen further to 4.40% at the time of writing Thursday. Stock markets fell and the Dollar rose.

Image courtesy of Apollo.

Slok says the above chart is an index that displays the average yield error across the universe of U.S. government notes and bonds with a remaining maturity of one year or greater, based off the intra-day Bloomberg relative value curve fitter.

"When liquidity conditions are favourable, the average yield errors are small, as any dislocations from fair values are normalised within a short time frame. Average yield error is defined as an aggregate measure for dislocations in Treasury securities across the curve," he explains.

When demand is strong, liquidity is more abundant. The chart suggests some stress in one of the world's most critical financial markets.

Treasury yields are rising amidst falling demand for U.S. government bonds. This is as members of the Federal Reserve's rate-setting committee warn against expecting imminent rate cuts.

Above-consensus inflation readings from Australia and Canada this week have meanwhile sent a warning signal to investors that global inflation might be picking up again, which will further weigh on demand for bonds.

Louis Sangan, Global Capital Markets, Senior Associate at Validus Risk Management, says the U.S. market has a potentially destabilising reliance on foreign demand to finance its debt. He says significant holdings by foreign governments and entities of U.S. Treasuries make a large percentage of the outstanding issuance (Japan 14.37% and China 9.94%, as of January 2024).

"This dependence introduces a further risk to U.S. interest costs and debt sustainability," warns Sangan.

Of concern is Japan’s shifting interest rates: "As the Bank of Japan raises rates, U.S. Treasuries may become less attractive compared to Japanese bonds if the interest rate gap narrows," says Sangan.

Another concern is geopolitical tensions regarding China.

"Geopolitical tensions and tariffs, which look almost guaranteed to increase irrespective of the outcome of the November 2024 US presidential election, raise concerns that China may reduce its USD holdings," says Sangan.

He explains this introduces a buyer's dilemma – "if these major investors pull back, who will buy future U.S. debt? This could lead to higher interest costs, term premium increase and accelerated U.S. fiscal deterioration."