Australian Inflation Haunts the Market: XTB

- Written by: Gary Howes

-

Image © Adobe Images

Stock markets are selling and the Dollar is bid. XTB's Kathleen Brooks says returning inflation fears could be behind a deterioration in global investor sentiment.

The root cause of the sell-off appears to be twofold:

1, the bond market, which is also selling off on Wednesday. This has caused bond yields across the world to rise sharply. It is also pushing up the French – German 10-year bond spread, which is causing ructions in the French stock market and 38 out of 40 stocks are in the red, including banks that are selling off once more.

2, concerns about the Fed pushing rate cuts further out to the future.

Bonds are selling off and yields are rising after Australian inflation data spooked the market. Annual CPI for May rose to 4% from 3.6% in April, and trimmed mean (core) inflation rose to 4.4%.

Australia now has the highest rate of inflation in the developed world, and the sharp rise in its price pressure is triggering concerns that the deflation trend is under threat and prices could rise again across Europe and the US.

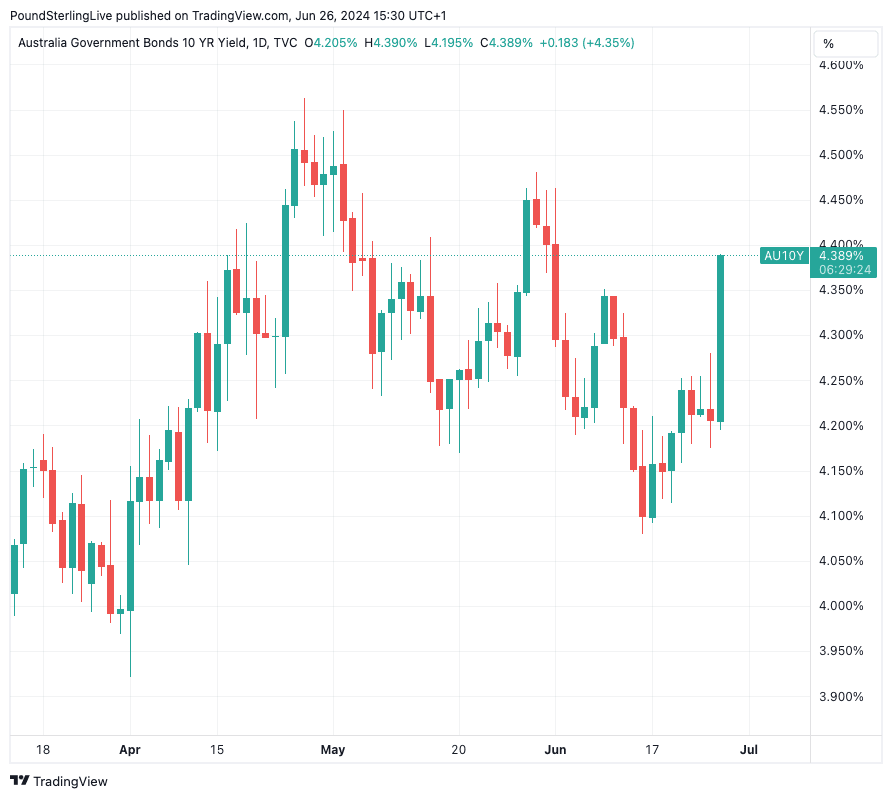

Above: Australian ten-year yields have surged.

The drivers of Australian inflation were also concerning. Financial services and inflation costs triggered the sharp rise in price pressure in May, which suggests that core inflation is rising once again. Goods prices fell last month, which is in line with global trends.

Australian trimmed mean inflation, which is the same as core inflation, also rose to 4.4% from 4.1%. This is lower than the rate of service price inflation in the UK, but it highlights the stickiness of core price growth across the world.

It may surprise some that Australian CPI has the power to move global markets. Usually it does not, however, Australia has a westernised economy and could be seen as a lead indicator for elsewhere. Bond yields are surging across Europe and the US.

The 10-year Treasury yield is higher by 6 basis points, in the UK 10-year yields are higher by 5 bps, yields are also higher by 5 basis points in France, which is putting more upward pressure on the French – German 10-year bond yield spread. Although there is no new domestic driver pushing up the French – German yield spread, when global bond market volatility spikes, this is bad news for France in the current political environment with Parliamentary elections only days away and the hard right expected to win a resounding victory.

Elsewhere, Fed Governor Michelle Bowman, said that inflation will need to fall further for interest rates to be cut, and that rates could remain elevated for some time. This has had an immediate impact on US rate expectations. Last week the market was pricing in a 65% chance of a September rate cut from the Fed, this has now fallen to 60%, which is weighing on sentiment and adding to downward pressure on bond prices, and upward pressure on bond yields.