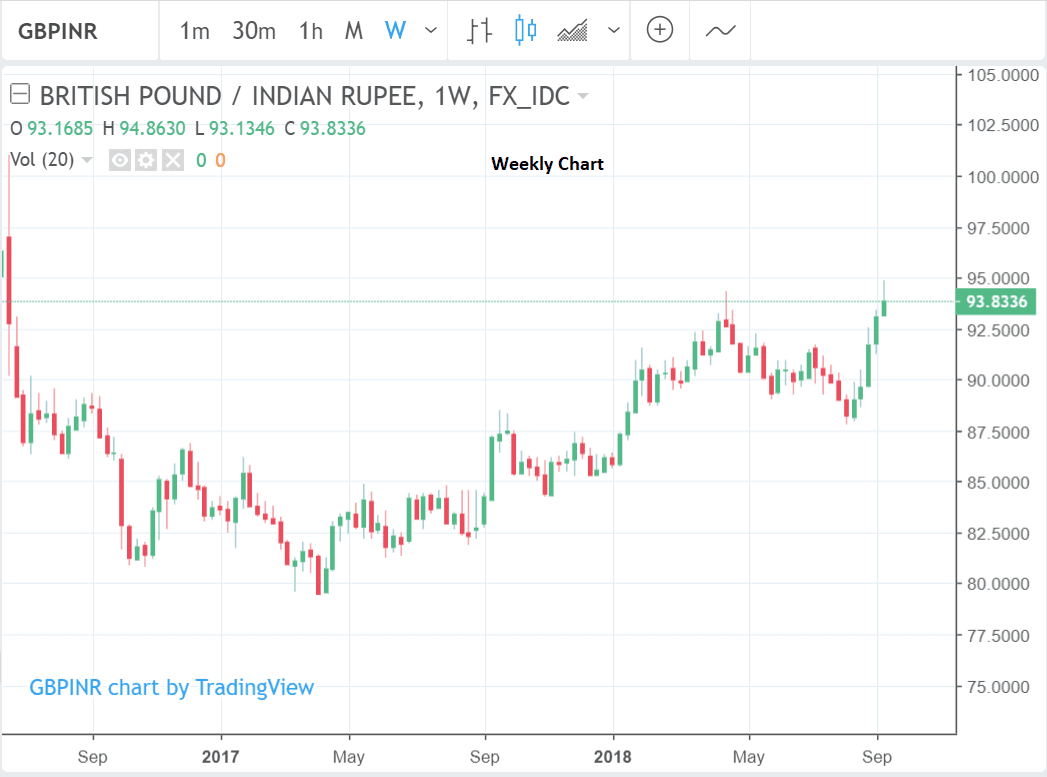

Pound-Rupee Reaches Two Year Highs, but Beware an Intervention

- GBP/INR has broken above April highs and reached highest level since June 2016

- Rupee has been hit by a combination of EM outflows and rising oil price

- Modi calls emergency meeting to discuss ways to prevent further Rupee weakening

The Pound reached new two year highs against the Rupee on Wednesday after it peaked at 94.86, due to a combination of optimism over a Brexit deal, rising oil prices and escalating trade war rhetoric.

The pair then rolled over and has since sold off heavily after the news that the Indian authorities are discussing ways to support the currency.

Prime minister Nahrendra Modi has called for an emergency meeting this weekend to tackle the problem of the depreciating Rupee and a hike in base lending rates by the Reserve Bank of India has been touted as one possible solution.

The weaker Rupee is making it more expensive for Indian companies to service their relatively high levels of foreign exchange denominated debt, and is also leading foreign investors to sell their Indian assets for fear of foreign exchange risk eroding the value of their holdings.

An unnamed finance ministry official said the Reserve Bank of India was intervening to stop the depreciation, but as of yet intervention has been relatively low-key in scope.

The Dollar-Rupee rate, meanwhile, rose to record highs of 72.91 and according to reports from Bloomberg news Mumbai-based traders said they though the RBI was intervening via state owned banks selling Dollars at around the 72.50-72.65 level.

"Thus so far the RBI's intervention does not seem to have stemmed the sell-off by very much. One reason could be that they are holding back out of fear of incurring the US's ire due to India being on the US Treasury's watchlist of potential 'currency manipulators'," says strategist Viraj Patel with ING.

However, dynamics in the oil price market could soon illicit a more forceful response from authorities.

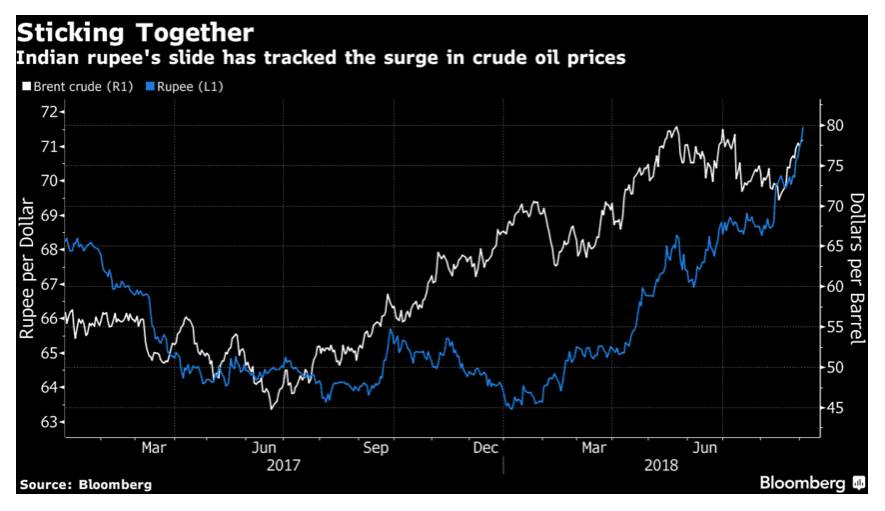

The value of the Indian Rupee is closely aligned to that of oil because India has to import most of its oil and the commodity accounts for a full third of all Indian imports.

The chart below shows the close correlation between oil and the Rupee.

The outlook for the Rupee is rendered even more uncertain give how vulnerable oil prices are to geopolitical events.

US sanctions on Iran's energy industry could drive oil prices to $100/barrel or higher in November, for example, according to Fereidun Fesharaki, founder and chairman of consultancy FACTS Global Energy, in an interview with CNBC - such a spike would add increasing pressures on the Rupee.

The supply glut which weighed so heavily on oil prices in 2016 has now been completely absorbed.

Iran is one of the largest producers in the world and its contribution would be hard to replace, even by unconventional sources such as US shale, says Fesharaki.

The price of oil has been held back by worsening trade war fears which have weighed on commodities in general, but if the US and China were to decelerate the trade war, the price would have "only one way to go: up," adds Fesharaki.

From a technical perspective GBP/INR has broken above the key April 17 highs which is a bullish sign for the pair, although a break on a closing basis would be an even more bullish (or bearish for the Rupee).

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here