Pound vs. Indian Rupee in the Week Ahead: Can the Downtrend Endure the Central Bank Fest?

- GBP/INR long-term downtrend likely to extend as RBI widely tipped to raise interest rates

- A break below the 87.75 lows would probably lead to an extension down to the next target

- Main event for Sterling is the BOE rate meeting on Thursday

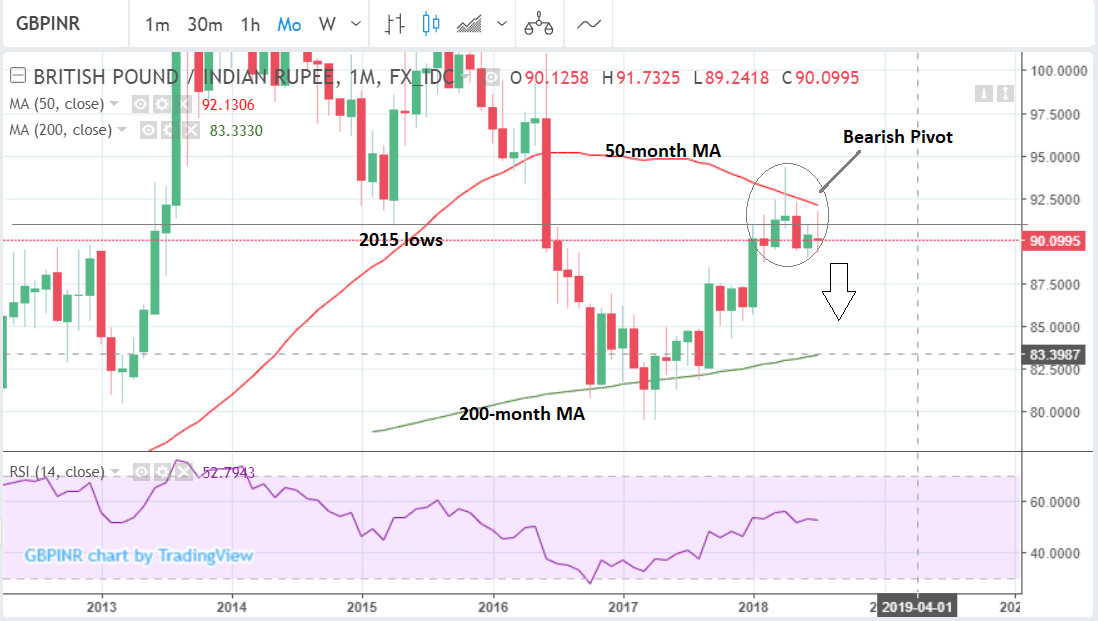

The longer-term trend is down after the pair pivoted on the monthly chart after intersecting with the 50-month MA (circled), in April, and this suggests more downside for the pair on the horizon.

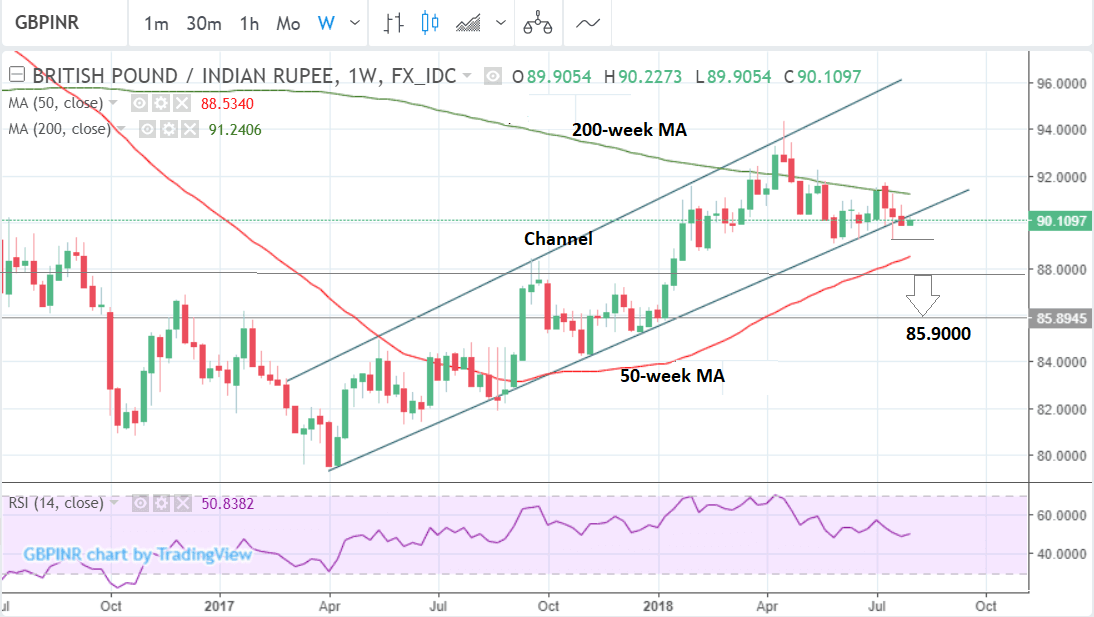

The weekly chart is showing that the pair is breaking out of a long-term bullish channel.

If it can break below the 89.24 lows it will confirm the breakdown has been successful, and this will lead to a more bearish outlook.

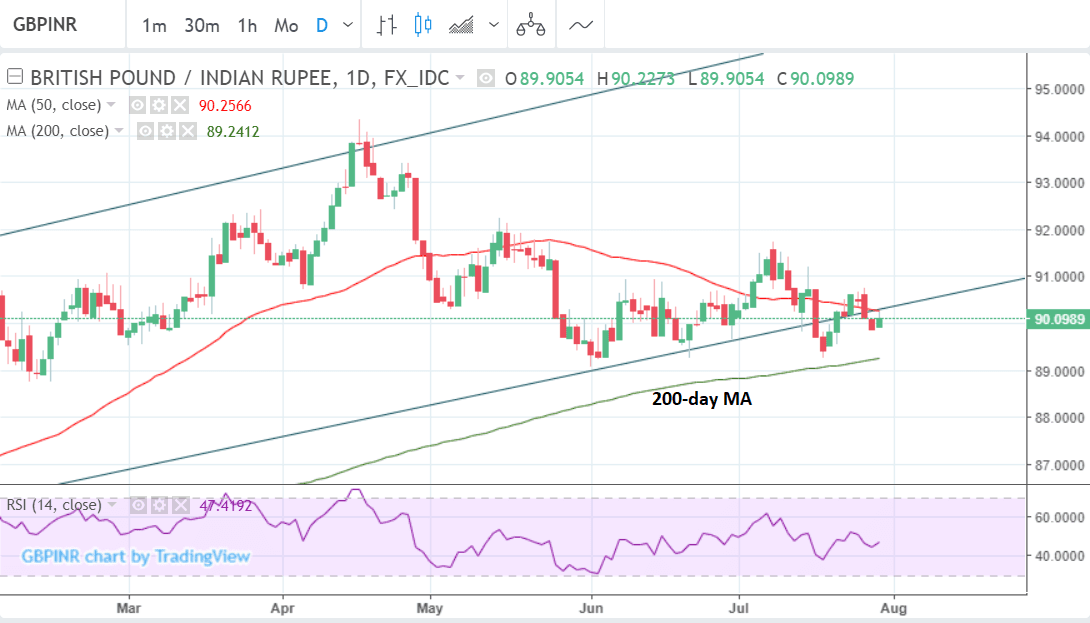

After a breakout prices usually fall a distance lower equivalent to the height of the channel, which generates a target at about 85.90, however, in this case the 200-day moving average (MA) at 89.24 and the 50-week (MA) at 88.53 are standing in the way of declines.

Large MA's often impede the trend and sometimes even lead to reversals, so although we are still bearish owing to the monthly chart, it may be tough-going chewing through these levels in the short-term.

For a really clear run lower we would be looking for these levels to be cleared with confirmation coming from a break below 87.75.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What to Watch for the Indian Rupee

The main event in the week ahead for the Indian Rupee is the meeting of the Reserve Bank of India (RBI) on Wednesday at 10.00 B.S.T.

The RBI is widely expected to raise interest rates at its meeting after inflation started surging higher in the spring.

Such a move would probably lead to a further appreciation of the Rupee.

The central bank surprised investors by hiking rates by 0.25% to 6.25% in June when everyone expected them to wait until August.

Despite the pre-emptive strike due to an acceleration of inflationary pressures many analysts still expect a hike in August as well.

"We expect 50 bps more hikes in 2018-19, with the next likely in August," says Radhika Rao, an economist with DBS.

One limit to the amount of upside expected in the event of a rate hike is the fact it is so widely expected and, therefore, probably already priced into the market.

In such a situation the greater volatility might be caused by the RBI not changing rates, which would weaken the INR.

Key Events to Watch For Sterling this Week

The main event for Sterling on the economic calendar in the week ahead, is the Bank of England policy meeting on Thursday at 11.00 GMT, followed by governor Carney's press conference at 11.30.

The BOE's quarterly inflation report will also be released at the same time.

The current consensus expectation is for the Bank to announce a rise of 0.25% in the base interest rate in the UK to 0.75%.

A hike will probably result in only limited upside for the Pound as the move is already widely telegraphed and lacks the 'element of surprise' for an explosive thrust higher.

The probability of a hike has been hovering at around circa 80%, supported most recently by last week's positive data releases.

Therefore, what will matter is whether the Bank hints at further interest rate rises in coming months. If the Bank strikes a hawkish tone on the matter then Sterling might well extend higher. If the market gets the sense that this is a 'dovish hike' i.e. one that is unlikely to be followed by another rate rise in coming months then the currency might fall.

"We fear that sterling, which has not benefited so far from prospects of tighter monetary policy at home, may suffer," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan who adds Sterling is damned if the BoE hikes, damned if it does not."

"If the BoE hikes, as we also expect, we would see this as a policy mistake hurting the economy, and thus the currency, over the medium term. If the bank leaves the rate unchanged, investors’ disappointment will likely lead to new GBP sales," says Mialich.

The one spoiler to a rate hike are Brexit risks.

EU chief negotiator Barnier's recent criticisms of key aspects of the Chequer's plan, such as goods' tracking and variable tariffing, make it possible the BOE could opt for caution and not raise rates at all.

"On data grounds a rate rise would seem justified after the weakness in Q1 proved to be temporary, however the uncertainty seen at the end of July might stay the banks hand," says Michael Hewson, analyst at CMC Markets.

Given the heightened expectations of a hike the shock of a no-change is a major risk for Sterling in the week ahead.

The other main data releases for the Pound are Purchasing Manager Survey Indices (PMIs).

The first PMI to be released is manufacturing out on Wednesday at 9.30 B.S.T, which is forecast to show a slide to 54.2 in July from 54.4 in June, although any result above 50 is indicative of growth.

Construction PMI is out on Thursday at the same time and forecast to show a fall to 52.9 from 53.1.

Services PMI is out on Friday at the same time and is expected to show a fall to 54.7 from 55.1.

PMI's are calculated using the answers from surveys of industry purchasing managers who have a pivotal view of conditions. They are seen as an important leading indicator for the economy and, therefore, impact on Sterling, to which they are positively correlated.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here