GBP/INR is Showing Early Signs of Promise But 'No Cigar' Quite Yet

- Written by: James Skinner

- GBP/INR is showing growth potential and is worth watching

- Charts are presenting 'circumstantial evidence' of more upside

- Brexit risks may be easing whilst INR could be influenced by CPI data

© Adobe Images

The Pound-to-Rupee rate, currently trading at 91.60, is showing early signs of growth potential which places it on the bullish radar.

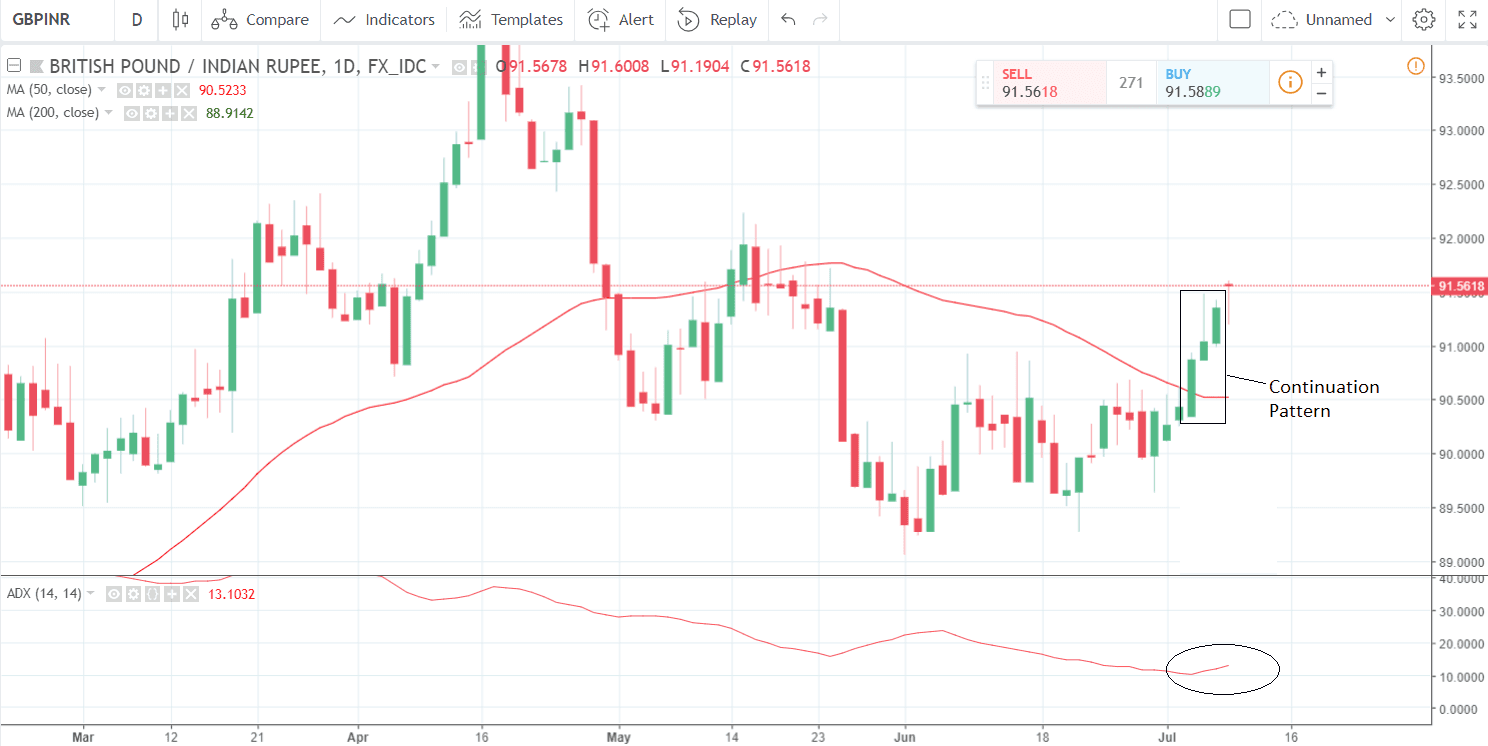

The formation of a three-bar bullish continuation pattern (boxed below) after the exchange rate broke above the 50-day moving average (MA) at the end of last week, is one such sign.

Above: GBP/INR rate shown at hourly intervals.

On its own, this pattern often successfully predicts a continuation of the uptrend. If it coincides with a certain reading on an indicator called ADX it's forecasting power is enhanced. The ADX needs to be between 20-35 and in an uptrend for this enhancement.

Sadly, on GBP/INR, ADX is not quite there yet, for although it is just starting to turn higher it is not yet above 20, sitting as it does at 13.1. So, sorry but no cigar.

Invented by the famous technician, Welles Wilder, ADX measures how strongly prices are trending - in whatever direction. The fact it is rising is good news for bulls, but it is rising from a very low base which is still indicative of a sideways market. Thus although the pair looks promising traders should act with caution.

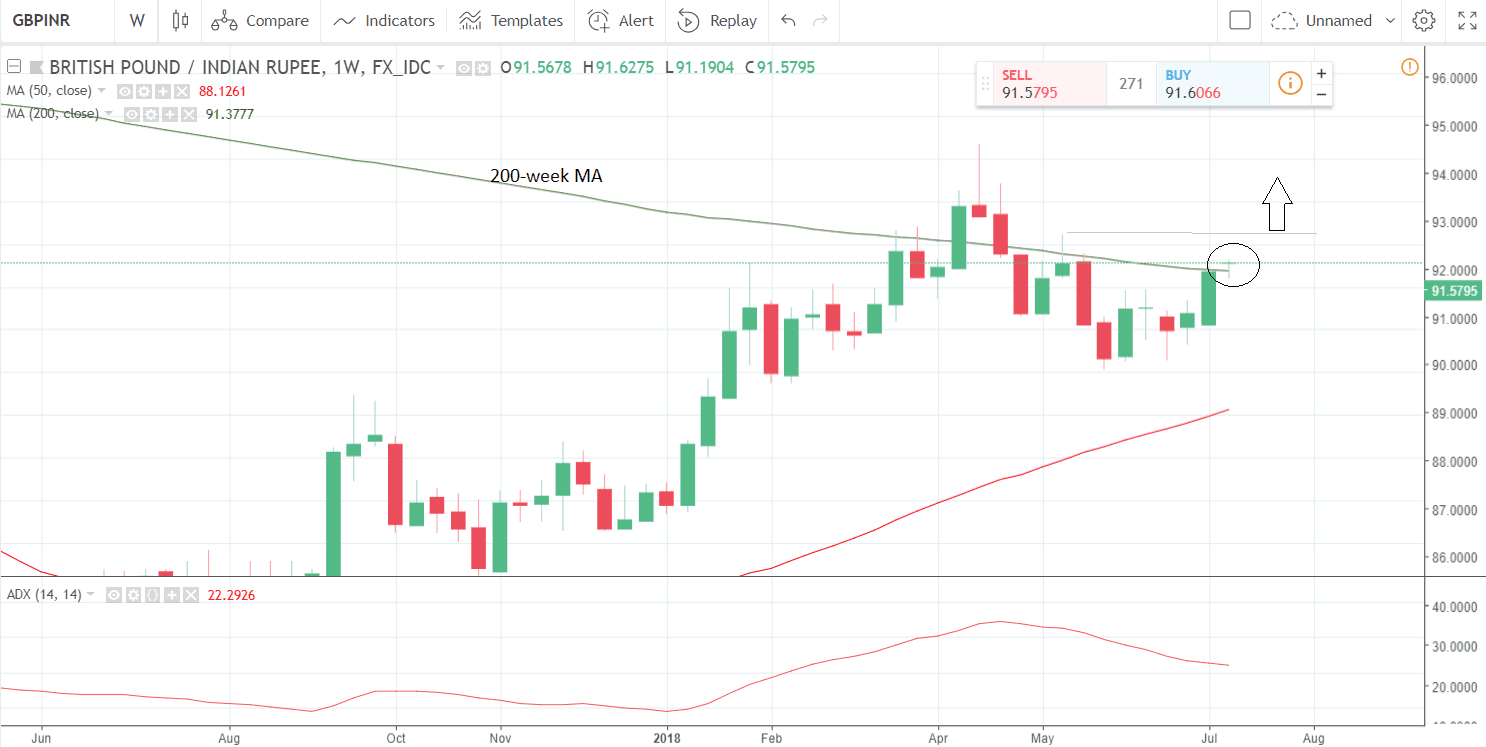

The weekly chart is also showing seeds of growth. The exchange rate is in the process of clearing the 50-week MA and if it is successful that should give it a big boost. The big question is whether the clearance is sufficient to expect a continuation higher.

Above: GBP/INR shown at weekly intervals.

Major MAs like the 50, 100 and 200-period act as obstacles to prices which often stall or even reverse after touching them. It's a phenomenon technician call 'dynamic support and resistance'.

In the case of GBP/INR, the price has now actually pushed marginally above the MA, suggesting it might be breaking above this obstacle. this is bullish, although it is still a bit too early to say for sure.

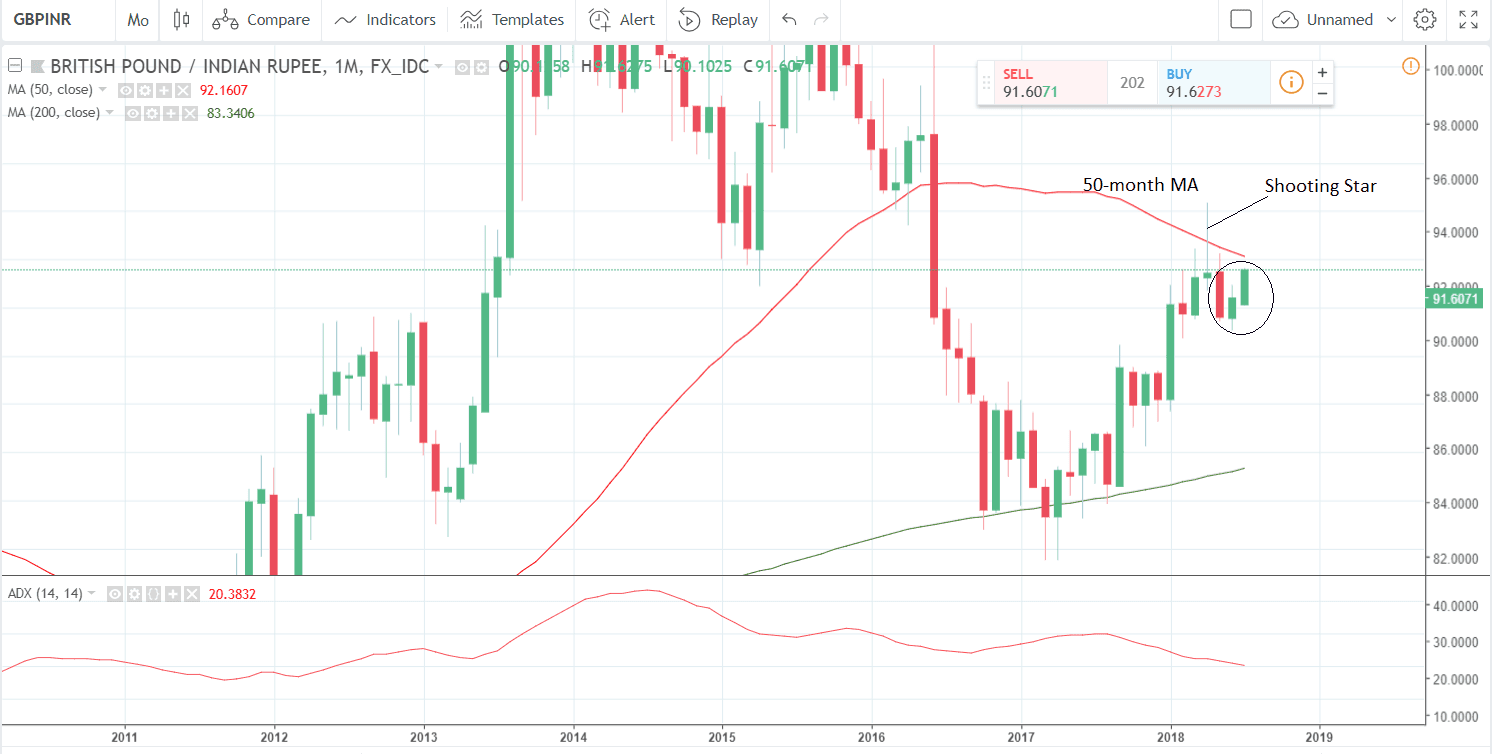

The monthly chart is the least bullish and suggests traders should act with even more caution, at least until the exchange rate has made some more progress.

Above: GBP/INR rate shown at monthly intervals.

At the start of 2018, the young uptrend stalled after meeting the 50-month MA. The Japanese shooting star candlestick pattern with a long range which formed in April is an especially bearish sign, although the lack of a follow-through takes the edge off its bearishness.

The last two months have shown a relatively robust recovery but the 50-month remains above the exchange rate at 92.16, capping gains. Ideally, we would want to see a clear break above it, confirmed by a move above 93.00, for confirmation of more upside.

From a fundamental perspective, there are a lot of events that could potentially act as a catalyst for volatility. Sterling is currently gaining tentative support from Theresa May's new softer strategy on Brexit but of more importance for Sterling is whether it is viable.

Much depends on how the EU responds to her plan. A further risk comes from inside her own party. The resignation of the Brexit minister David Davis on Monday morning has already raised concerns about whether she has enough support from her own MPs. Nevertheless, given the mood of the country appears to have shifted marginally away from Brexit she may be able to claim broader political support for her cause. If her plan holds and gets the green light from Brussels it would also signal substantially more strength for Sterling.

For the Rupee the main risk factor comes from June inflation data out later this week (Thursday 12 at 11.00 GMT) which analysts are predicting will show a further rise to 5.29%. Inflation has been rising strongly in India over recent months and this led the Reserve Bank of India (RBI) to raise interest rates at its last meeting. Clearly higher inflation would lead to further expectations of the RBI raising rates which would bolster the Rupee. Currencies tend to gain when interest rates rise as they act as a magnet to foreign capital drawn by the promise of higher returns.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here