Indian Rupee Could Be Girded By Reserve Bank After Surprise Inflation Pop

- Rupee under pressure from rising oil prices but could get support if RBI starts raising interest rates

- Core inflation in April rose more than expected leading to speculation interest rates could also rise

- INR's outlook mixed due to cross-currents from differing factors

© Ash T Productions, Adobe Stock

The Rupee could gain support from the Reserve Bank of India (RBI) over the coming year if it starts lifting interest rates in response to rising inflation, according to new analysts from Asia-focussed lender DBS Bank.

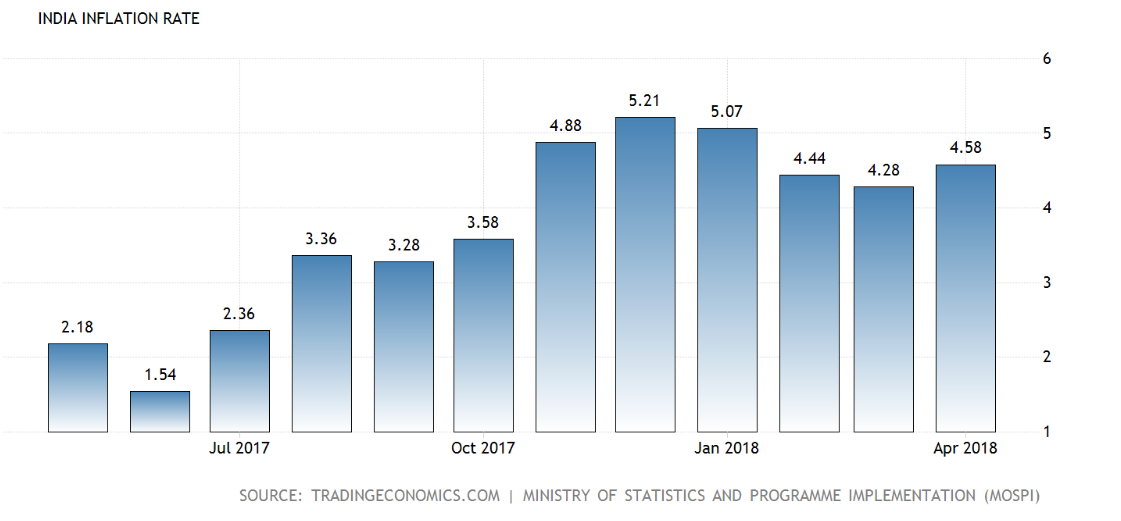

Indian inflation (CPI) increased by a higher-than-expected 4.58% in April from a March reading of 4.28%, official data showed on Monday. The result was higher than the economists' consensus forecast of 4.42%, according to data from the Ministry of Commerce and Industry.

An increase in inflation often prompts the central bank to intervene and raise interest rates in order to bring inflation back down and promote price stability.

Higher interest rates in turn usually appreciate the local currency as they attract greater inflows of foreign capital, drawn by the promise of higher returns.

As such a move by the RBI would be positive for the Rupee, all other things being equal.

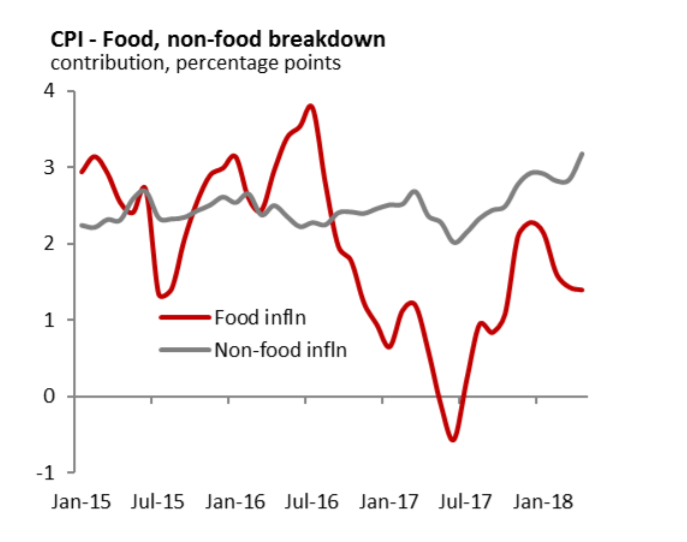

Sometimes fluctuations in CPI can be put down to short-term volatility in components such as food and petrol, but, in April food inflation remained unchanged at 3.0% and so was not responsible for the broader rise.

The headline rate rose as a result of increases in core components: house price inflation, for example, increased from 8.31% to 8.50%; clothing and footwear rose to 5.11% from 4.91%; tobacco and intoxicants increased to 7.91% from 7.79% and miscellaneous increased to 4.96% from 4.16% before.

The rise in core elements is expected to lead the RBI to raise interest rates at future policy meetings, according to Radikha Rao, an economist at DBS in Singapore.

"The Reserve Bank of India is unlikely to be comfortable with the firm core inflation amidst the higher volatility in the bond and exchange rate markets," says Rao. "These factors validate our expectations for the RBI policy committee to veer towards a hawkish stance in June (small probability of a preemptive hike) and pave the way for a +25bp increase in August. With another move likely in 4Q18, we see room for cumulative 50bp hikes in FY19," adds the economist.

(Image courtesy of DBS Bank)

Such a rise would help provide underpinning support for the Rupee, although the currency is likely to remain under pressure from other factors which are outside of the RBI's remit of control.

Watch Oil

One such factor is rising oil prices since India has to import most of its oil and the commodity accounts for a third of its total imports. Changes in the price of oil can, therefore, heavily affect the aggregate supply and demand of Rupees - impacting their value.

Currently, the consensus appears to be that the price of oil will rise to over 80 Dollars a barrel from its current level at 70.95 (WTO), and this may explain the Rupee's weakness on Monday despite the higher inflation data surprise.

A recent report from OPEC suggests supply and demand are once again close to reaching equilibrium after several years of over-supply which pushed prices to below 30 Dollar a barrel temporarily.

"Oil prices continued to be well supported. Prices lifted as OPEC said that the global oil glut had been virtually eliminated," says a note from the research team at St George Bank in Sydney. "The report also said that OPEC was cutting supply more than under the pact. Further, it was highlighted that US shale production was facing capacity constraints, even as the EIA said it expected US shale output to rise to a record."

The evidence appears to point to a continuation of the uptrend in oil prices which is likely to push the Rupee down, providing a counter-weight to the possible bullish RBI approach.

Yet if oil continues rising the RBI may increasingly seek to defend the Rupee, according to Richard Kelly, head of research at investment bank TD Securities in Toronto, as a stronger Rupee will help balance the trade budget.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.